Giving Everyone a Fair Shot

The IMF wants to Give Everyone a Fair Shot.

The COVID-19 pandemic is intensifying the vicious circle of inequality. To break this pattern and give everyone a fair shot at prosperity, governments need to improve access to basic public services—such as health care (including vaccination) and education—and strengthen redistributive policies.

For most countries, this would require raising additional revenue and improving the efficiency of spending.

Holistic Approach

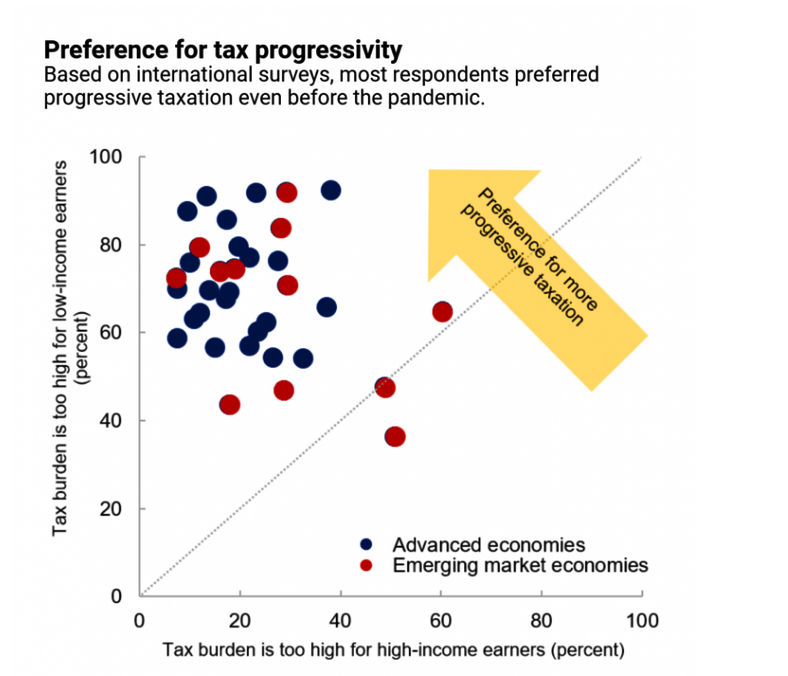

Enhancing access to basic public services will require additional resources, which can be mobilized, depending on country circumstances, by strengthening overall tax capacity. Many countries could rely more on property and inheritance taxes. Countries could also raise tax progressivity as some governments have room to increase top marginal personal income tax rates, whereas others could focus on eliminating loopholes in capital income taxation. Moreover, governments could consider levying temporary COVID-19 recovery contributions as supplements to personal income taxes for high-income households and modernizing corporate income taxation. In emerging market economies and low-income countries in particular, additional revenues could also be raised through consumption taxes to finance social spending. Further, low-income countries will need support from the international community to help with financing and implementing home-grown taxation and spending reforms.

In some countries, public support for better access to basic services, financed through higher taxes, has been strong and is likely increasing with the pandemic. A recent survey in the United States shows that those who had personally experienced the impact of COVID-19, either through illness or unemployment, have developed a stronger preference for more progressive taxation.

Robinhood Politics

These schemes always start out by promising to "tax the rich". In practice, it never stops there.

To support socialist redistribution schemes, taxation inevitably dives further and further into the middle class.

You can see it coming with more "guaranteed income" proposals.

And the ideas get crazier and crazier like AOCs and Al Gore's plan to spend $90 trillion to save the earth from oceans rising three inches over the next 50 years.

I assure you $90 trillion will not come from the wealthy or corporations.

The ultimate goal is to fund environmental nonsense and ensure that Jeff Bezos does not make more than the bottom 200 workers at Amazon.

Massive Tax Hikes

Yesterday, I commented Prepare for 3 Things: Big Government, Huge Boondoggles, Massive Taxes

Several readers wanted me do define massive taxes in the erroneous belief the proposals will only impact millionaires.

It won't stop there because it never does. And look at the gigantic basket: Wealth taxes, corporate taxes, capital gains taxes, death taxes, consumption taxes, value added taxes (VAT), property taxes.

Spotlight Illinois

Illinois has 6,963 Taxing Bodies yet the state is broke with pension plans that are bankrupt.

Nothing is ever fixed in Illinois. But guess what the alleged fix is.

The governor wants higher taxes. Yet high taxes are the reason people escape Illinois.

On Oct 5, 2019, I wrote Escape Illinois: Get The Hell Out Now, We Are.

I am pleased to say that I am out of Illinois.

Exit Taxes

California progressives have their eyes on an exit tax, They want to go after anyone who lived in California and moved.

For discussion, please see California Seeks Wealth Tax to Soak the Rich, Even Those Leaving.

Don't tell me these tax hikes will just be on the rich because they won't.

It will never stop because politicians will dream up an endless parade of projects that can be funded by higher taxes.

To give everyone a "fair shot", the IMF wants government to be Robinhood deciding who is rich, who is poor, and who needs to be made more equal. Inevitably the middle class suffers.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.