Key takeaways

Israel has completed mass vaccination and has started the gradual re-opening of the economy. In this piece, we dive into the Israeli data, which we believe give us some insights into what we should expect for other countries as well.

Consumption swiftly recovered in a number of industries – both in services and goods. The initial rebound held through March, but has since subsided somewhat, indicating that spending patterns return to normal quickly. Unfortunately, Israeli holidays disturb the picture somewhat in April.

The reopening of the economy has propelled consumer confidence to record-highs, whereas business confidence remains subdued, with notably the tourism industry struggling despite the domestic reopening.

COVID-19: Israel leads the pack on vaccinations and reopening

Israel has more or less completed its mass vaccination program with nearly 60% of the population being fully vaccinated. This may seem low but it is important to recognise that the population is very young (the age group 0-14 constitutes roughly 28% of the total population) and the Pfizer vaccine is not yet approved for children (although it may soon be the case, as the Pfizer vaccine has showed good results in young teenagers, see press release). Given the US is likely to approve Pfizer for young teenagers next week, Israel is likely to follow suit. Additionally, there is a higher degree of vaccine scepticism among Arab-Israelis and Haredi Jews.

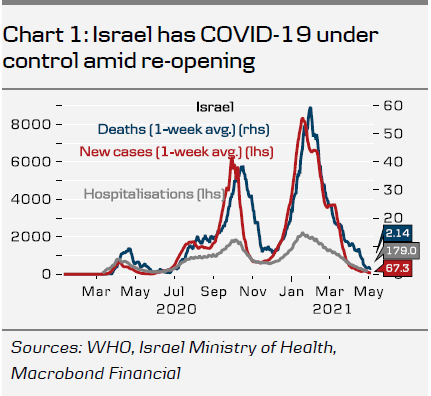

Israel permitted restaurants, cafes, and event halls to reopen on 7 March, as the country was about to hit the half way milestone with 50% of the total population being fully vaccinated against COVID-19. Restrictions have been lifted gradually since then and the gatherings are currently limited to 20 people indoors and 100 outdoors. Despite the reopening and less social distancing, the COVID-19 situation continues to improve with very few new cases, declining hospitalisations and very few deaths. This supports the findings from scientific studies that vaccines not only protect oneself but also others due to lower transmission (positive externalities), see e.g. Milman et al (2021). Despite the re-opening, new cases, hospitalisations and deaths continue to move lower and COVID-19 is under control.

We think Israel’s re-opening looks very similar to what many European economies can expect in the coming months with a gradual reopening and a “Green Pass” as a key tool. We have dived into the Israeli macro data, which we think tell us something about what to expect also in the US and in Europe.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.