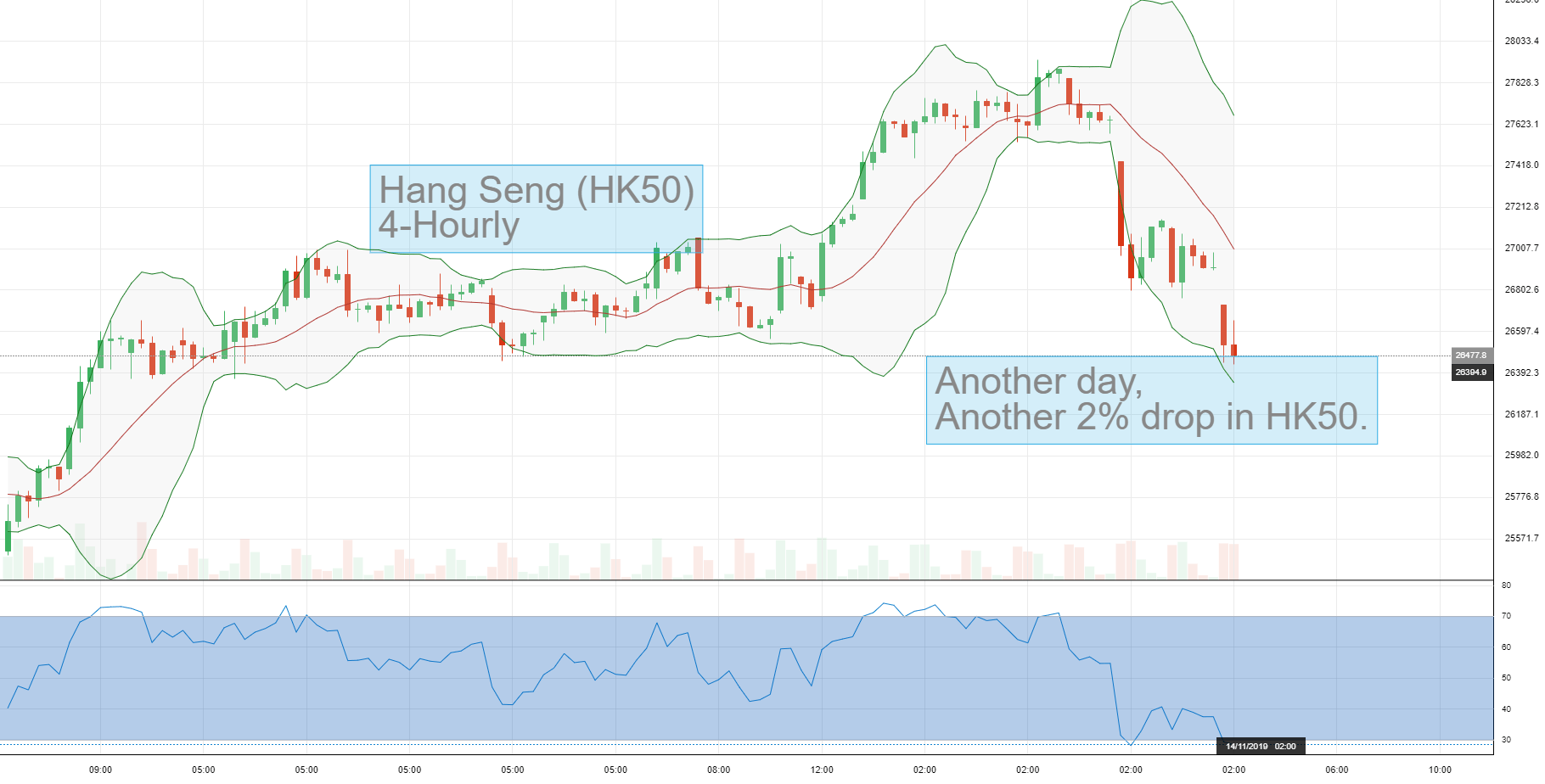

Another day of clashes, another drop of 2% on the HK share benchmark.

There is no doubt that the HK protests have reached a boiling point and that steam is coming out of the 2019 rally in the Hang Seng level, very quickly.

The HK trading day approaches close with another 2% bleed in HK50 levels, amid ongoing escalation of tensions.

- Can this spill over into a whole-of-market ‘Risk-Off’ theme?

I don’t think so, I think that the risk sentiment is desensitised to the tensions because they have dragged on for so many weeks now.

- Nevertheless, I am a serious SELLER from this level 26,500, aiming at the 25,500 October low, for a target of 1,000 points.

-

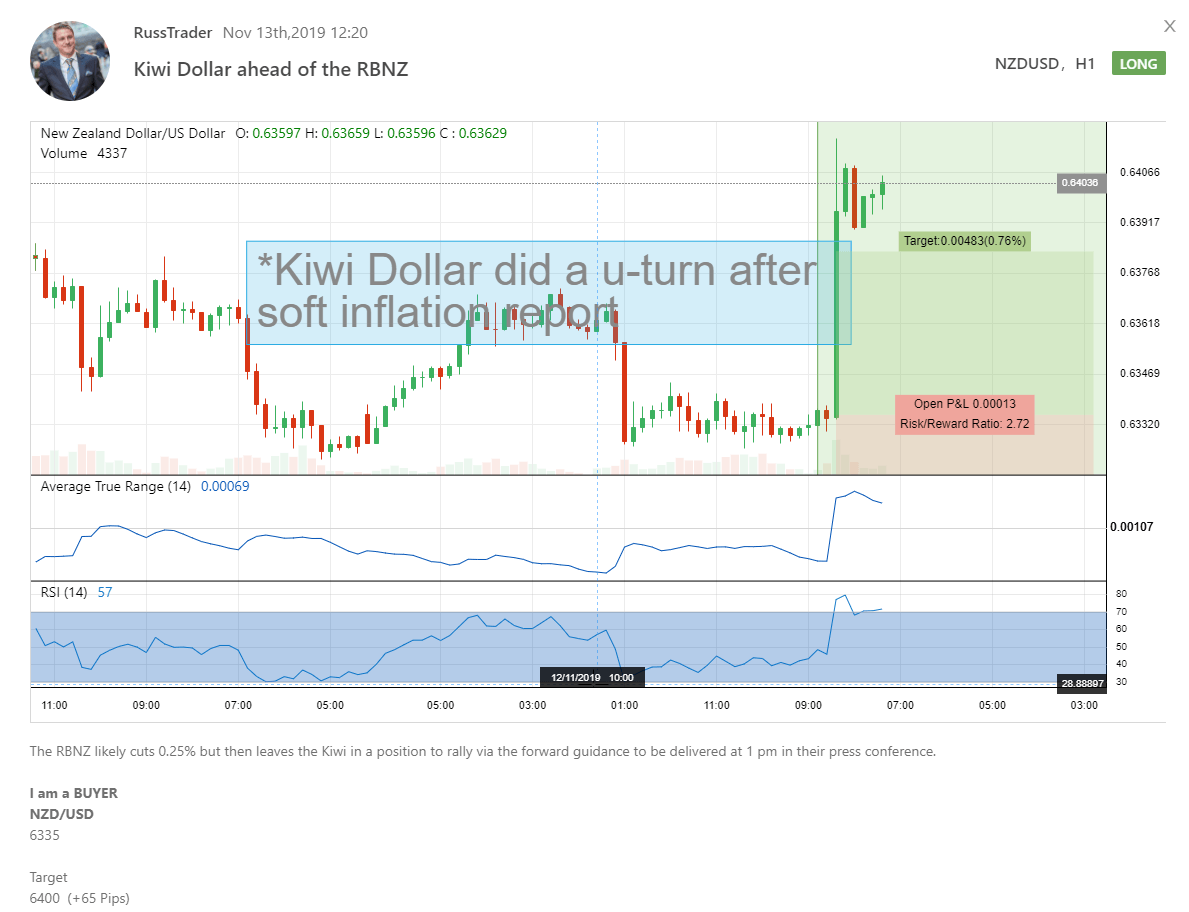

All eyes are on the NZD/USD looking for a follow through of Bidding, UK & US inflation data

-

The wording from US Fed Jerome Powell testimony – is also critical for the sentiment strength for the USD.

RBNZ and NZD/USD:

The RBNZ held the benchmark New Zealand interest rates helping see a sharp jump above 0.6400 versus the Greenback as the pricing was skewered toward a cut leading into this meeting.

More unwinding in Short NZD/USD positions should be almost certain now that we have the clear forward guidance from the RBNZ Governor Orr.

- I expect the Kiwi Dollar price to form a base above 64c, and to move to 2nd Target at 0.6450.

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing substantially more than your initial investment). ‘Reiwa-Capital’ is a brand of Reiwa-Capital Pty Ltd (ACN 640 117 942) of Level 35, Tower One, Barangaroo Avenue, Barangaroo NSW 2000. The information on this website is of a general nature only and is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Reiwa-Capital does not provide or issue financial advice, recommendations, or opinion in relation to acquiring, holding or disposing of a margined transaction.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.