The price of crude oil was relatively unchanged today as investors continued to monitor the happenings in the Middle East. The United States are blaming Iran for the attacks and the Trump administration, along with Saudi Arabia, are considering how to respond to the attacks. On Sunday, Trump said that the US was locked and loaded and ready to retaliate. However, experts believe that Trump has very little options. While the administration can easily target Iranian oil facilities, that would risk a prolonged conflict and lead to higher prices. Failure to respond will lead to more similar attacks.

The US dollar weakened slightly as the Federal Reserve officials started their meeting. The Fed meeting comes at a time when the world is facing serious challenges. Growth in the United States and in the rest of the world has weakened. This was evidenced yesterday after the release of weak industrial, capital investments, and retail sales from China. In the United States, the economy expanded slightly above 2% in the second half of the year after rising by 3.1% in the first quarter. Worse, oil prices have soared by almost 20% this week, which is not a good thing for the United States. Traders will be paying close attention to the Fed’s decision and the subsequent statement.

The euro rose slightly against the sterling and the US dollar after traders received the sentiment data. In Germany, the ZEW current conditions survey declined to -19.9 from the previous -13.5. This was worse than the consensus estimates of -15. On a positive note, the economic sentiment improved to -22.5 from the previous -44.1. This data measures the sentiment for the next six months. A reading below zero indicates pessimism on the economy. In the EU, the economic sentiment improved to -22.4 from the previous -43.6.

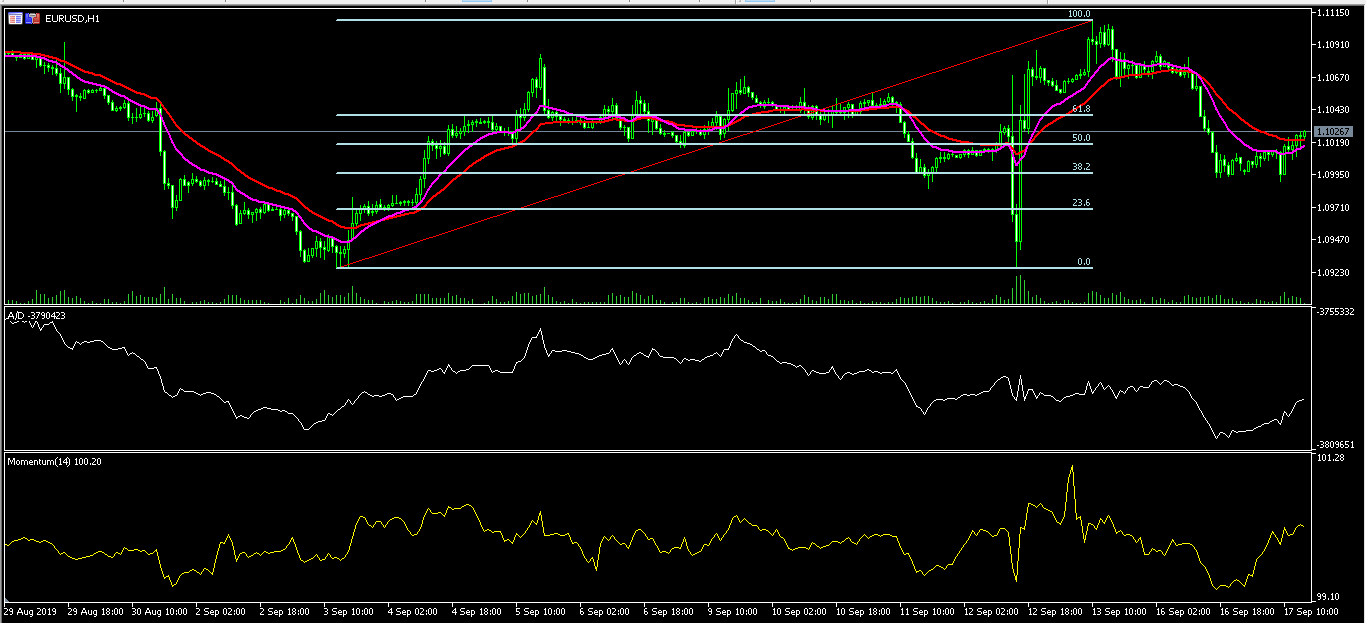

The EUR/USD pair rose to an intraday high of 1.1025 from a low of 1.0990. The price is between the 50% and 61.8% while the price is slightly above the 15-day and 25-day moving averages. The accumulation/distribution indicator has moved slightly higher. The same is true with the momentum indicator. The pair will likely remain along the current levels ahead of the Fed statement tomorrow.

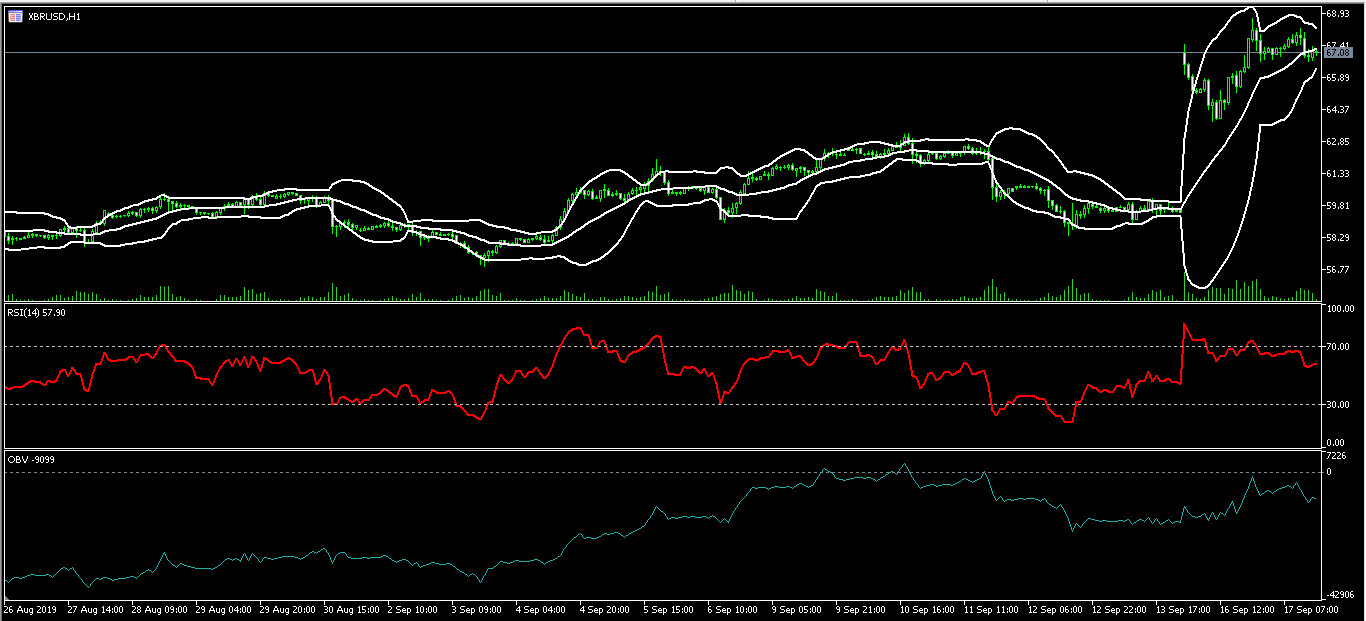

XBR/USD

The XBR/USD pair remained at elevated levels today as investors continued to wait on more news from the region. The pair is trading at 67.08, which is along the middle line of the Bollinger Bands. The RSI has moved slightly below the overbought level of 70 while the on-balance volume has also continued to rise. The pair could make some major moves in the American session if there are any statements about Iran and Saudi Arabia.

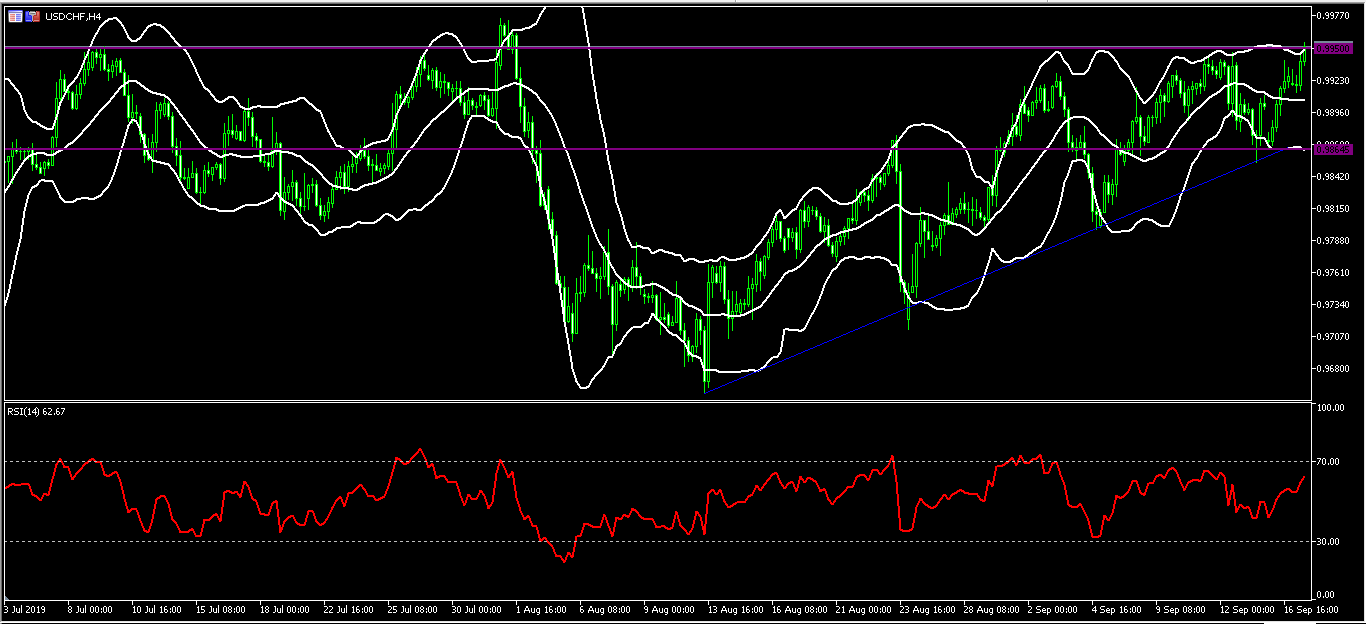

USD/CHF

The USD/CHF pair rose today after SECO released its economic projections for Switzerland. The pair reached the important resistance level of 0.9955, which is above the 14-day and 28-day moving averages. The RSI has moved close to the overbought level of 70. The pair could move lower to test the previous support of 0.9865.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.