Gold

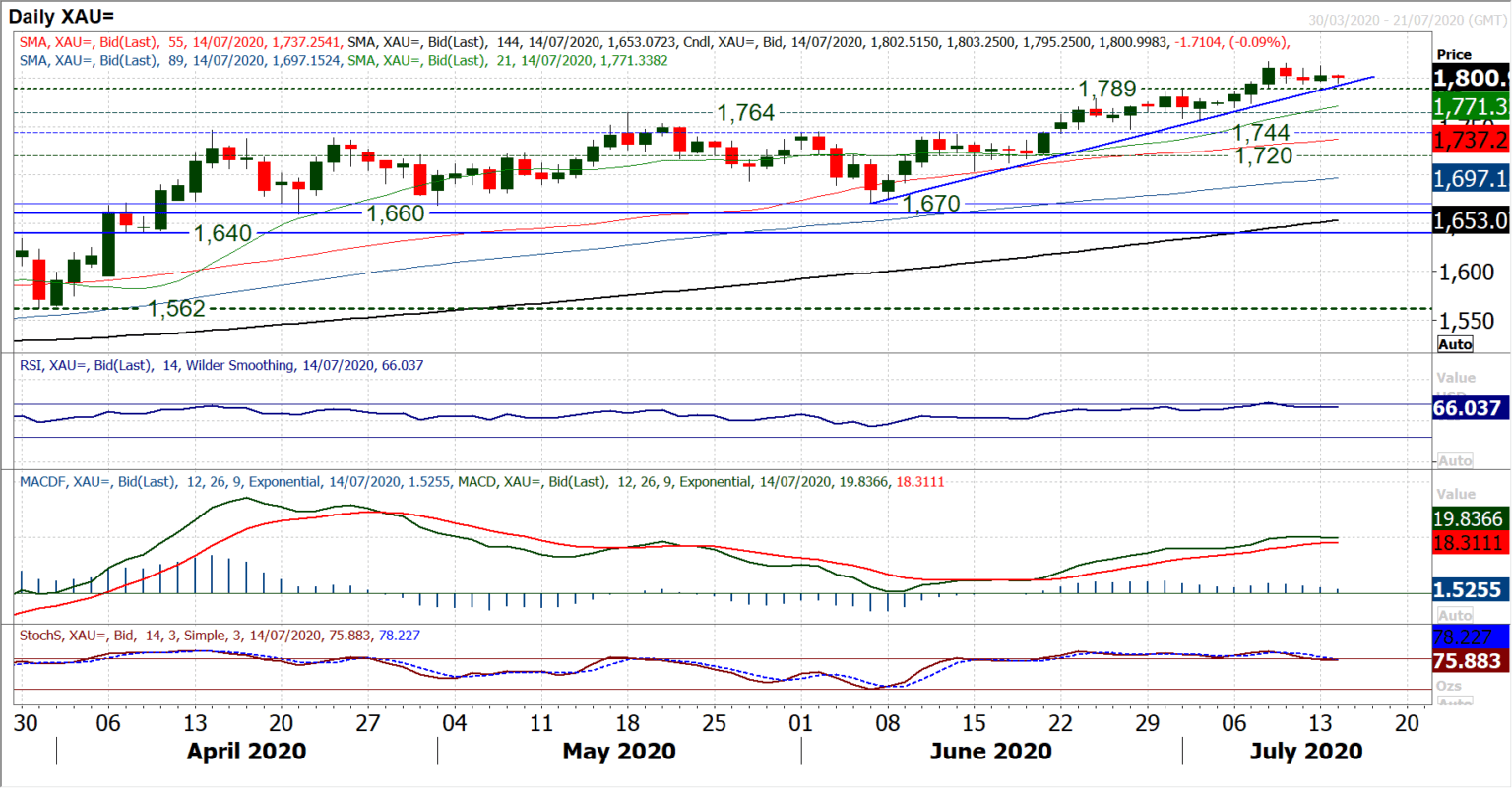

Gold continues to consolidate the latest breakout to new multi-year highs. We have backed the gold run higher, and so far we continue to do so. However, with a balance of small bodied and mild negative candlesticks in recent sessions, there is a sense that there is a little caution creeping in. Technically the set up is still bullish, as momentum indicators remains positively configured with RSI and Stochastics holding in strong positions. The support of a five week uptrend which is still intact and comes in today at $1792 (which is above the $1789 latest breakout) will become a key early warning sign now. A breach of this trend could begin to reflect a near term tiring of the move higher and potential correction. Moving under $1789 would add to this potential. However, we would still view weakness as another chance to buy into what is still a very strong medium to longer term bull trend. Any corrective move that finds support between $1789 and $1764 would be another good chance to buy. We still expect $1818 will not be a key high for long, as the two month consolidation range breakout implies a target range of $1820/$1858. Given the bull market outlook, we would expect a good chunk of this implied target to be achieved in the coming weeks. A move below $1744 would be our signal to shift from our bullish stance and turn neutral now.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.