The headline moves yesterday were seen in equity markets which plummeted (S&P down 3%) under pressure from an uptick in US yields and USD. Consequently, we saw a flight to safety which drove the bid in gold but weighed on risk currencies.

A light data calendar should see a fairly muted European morning though US CPI data due later today has the potential to further weigh on risk appetite if we see a strong number. Similarly, any US data weakness today should see some lightening up of yesterday's bearish tone.

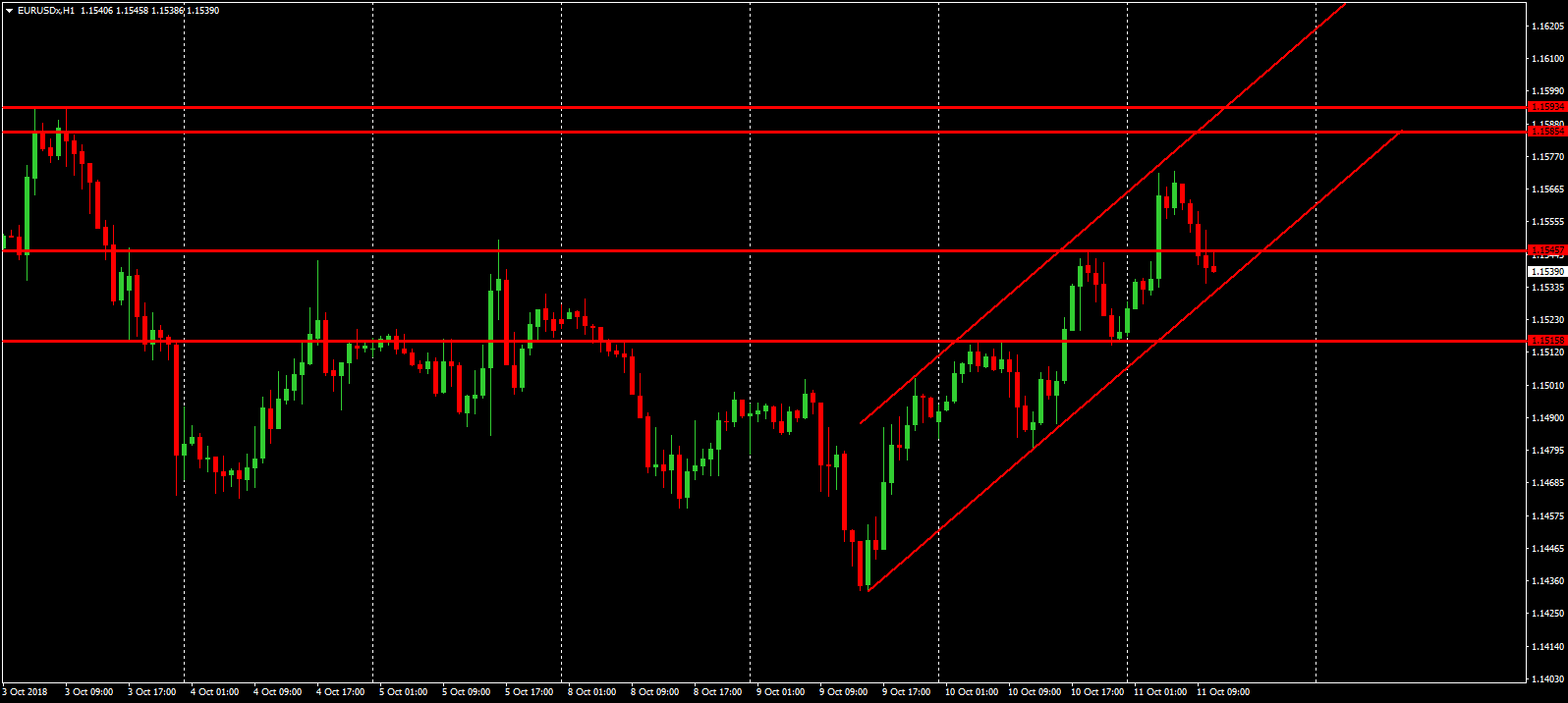

EURUSD intraday analysis

After briefly piercing above the 1.1545 area resistance, EURUSD has since slipped back below the level. For now, price action continues to move within a short term bullish channel which until broken, keeps focus on a further recovery higher. If we do see a downside break, the 1.1515 level might provide some intraday support with prior highs and lows at the level. To the topside, the 1.585 – 1.1593 is the key resistance level (last week's high) which will need to be broken to see a further topside run.

GBPUSD intraday analysis

The run above the late September high of 1.3216 eventually failed and price has since moved back below the level. While below here, focus is on a run down to deeper support at the 1.3113 region where we have a raft of prior highs and low. Alternatively, if we see a move back above 1.3216, the September high of 1.3297 will come into focus.

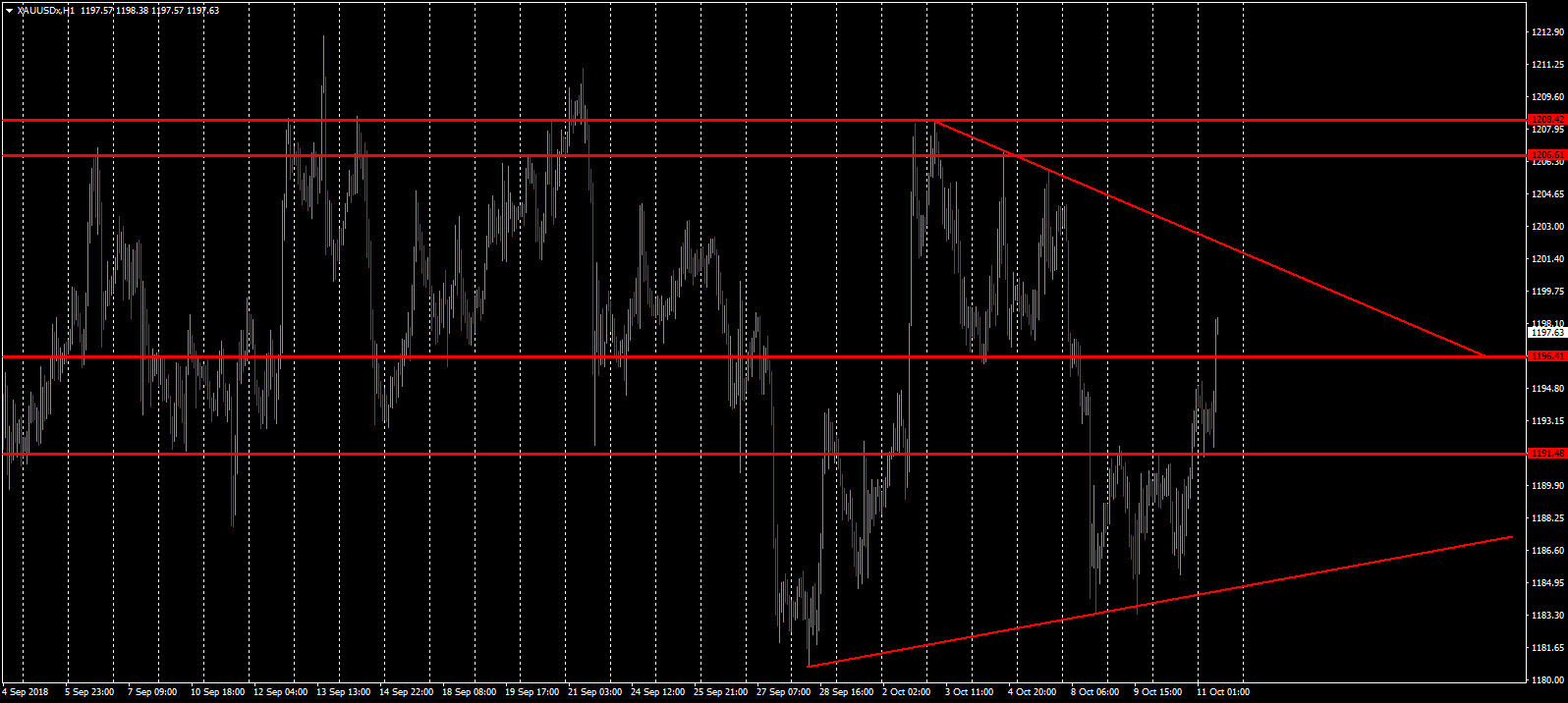

XAUUSD intraday analysis

Gold prices have now surged above the local 1196.41 region that saw key support last week. For now, price remains in the middle range of the larger contracting triangle pattern which has framed price action over the last few weeks. If the topside triangle trend line is broken, focus will turn to a test of structural resistance around the 1206.61 – 1208.42 region. To the downside, initial support is sitting at the 1191.48 region, while below there the rising triangle trend line provides support.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.