Manufacturing Goes Deeper Into Recession, Yet Gold Remains Muted. Why?

What does it all mean for the gold market? From the fundamental point of view, weaker industrial production should support gold prices. This is because the manufacturing sector’ problems could not only translate into slower economic growth, but also force the Fed to adopt again a more dovish stance and cut interest rates further in 2020.

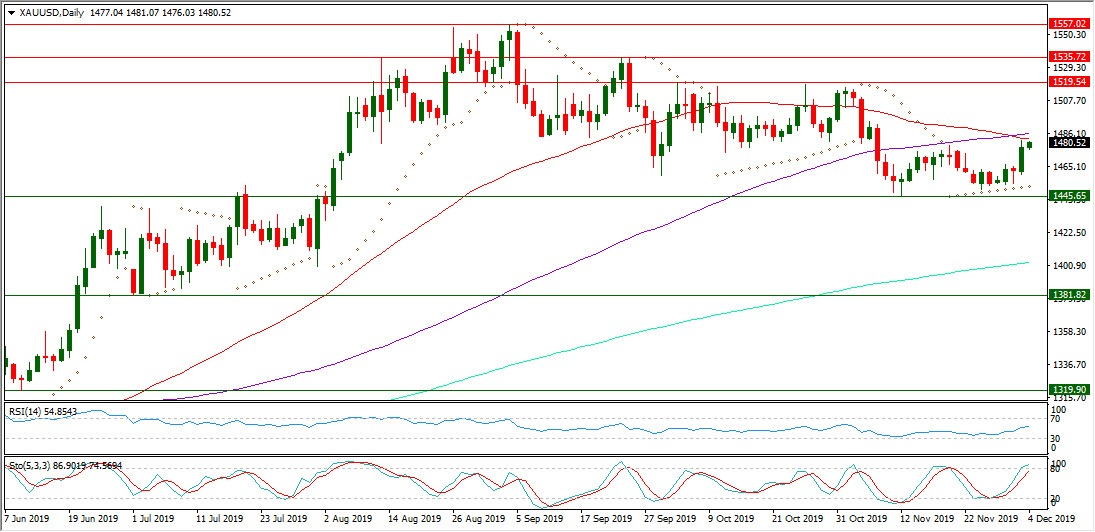

But the manufacturing recession failed to spur rally in gold in the fourth quarter of 2019, as the chart below shows. The gold prices are clearly struggling to find momentum, even in the face of disturbing data on the U.S. manufacturing sector. Read more...

The fear of Sino-American trade dispute escalation revived the demand for gold

The investors' worries about the trade negotiations future between US and China increased significantly containing the market sentiment, following the U.S. House members voting to impose sanction against Chinese officials for their human rights abuse, after the US Senate unanimously passed a bill aimed at protecting human rights in Hong Kong.

Trump's administration has previously put visa bans on Chinese officials linked to the mass detention of Muslims in Xinjiang province, Trump has actually warned that he is to impose more tariffs on China if talks failed.

The demand for safe haven increased sending UST prices higher, as Beijing is expected to take action soon and retaliate against this resolution, especially, if there could escalating by raising U.S. tariff on Chinese goods on Dec. 15 as scheduled previously, before the trade talks advance to form a phase-one trade deal containing all what the 2 side reached. Read more...

Gold hits fresh monthly tops near $ 1485 amid mounting US-China risks

The bulls regain poise in early European trading, offering a fresh lift to Gold, as it now flirts with four-week highs of 1482.81 amid a risk-off market profile.

The demand for the safe-haven gold has returned, as the European traders hit their desks and react negatively to the latest US-China developments on the political front after the US House approved the Xinjiang human rights bill.

The Chinese officials immediately condemned the US’ interference and threatened retaliation. The escalating US-China political tensions combined with looming trade uncertainty kept the investors unnerved, as they sought safety in the traditional safe-haven, gold. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

-637110359178557124.png)