- Gold benefitted from the spillover effect of a short-squeeze in silver.

- A strong rebound in the US equity futures capped gains for the metal.

- Investors now eye the US ISM Manufacturing PMI for some impetus.

Gold opened with a bullish gap on the first day of a new trading week, albeit lacked any strong follow-through and remained below three-week tops touched on Friday. The precious metal benefitted from the spillover effect of a short-squeeze in silver – similar to what was seen in GameStop shares during the previous week. However, a combination of factors held bulls from placing aggressive bets and kept a lid on any further gains for the commodity.

A solid rebound in the US equity markets was seen as one of the key factors capping gains for the safe-haven XAU/USD. Apart from this, reports that ten Republican senators urged the US President Joe Biden to cut the $1.9 trillion price tag on his proposed COVID-19 stimulus package further weighed on the non-yielding yellow metal. In fact, Republican pitched plan with a reported $600bn to garner bipartisan support. More details are due to be released later this Monday.

Meanwhile, fading hopes for rapid approval of additional US economic stimulus measures was evident from the ongoing decline in the US Treasury bond yields. This, in turn, undermined the US dollar and might help limit any meaningful slide for the dollar-denominated commodity. Market participants now look forward to the US ISM Manufacturing PMI for some trading impetus. The key focus, however, will remain on the broader market risk sentiment and the US stimulus headlines.

Short-term technical outlook

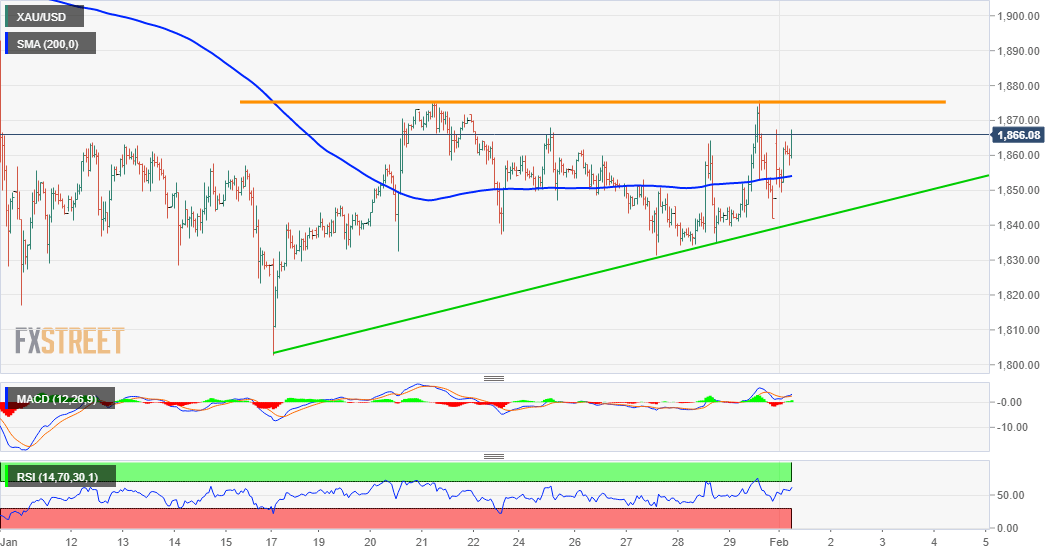

From a technical perspective, the recent recovery from the vicinity of the $1800 mark has been along upward-sloping trend-line support. This, along with a strong horizontal resistance near the $1875-76 region, constitutes the formation of an ascending triangle on hourly charts. Ascending triangles have a bullish bias and are typically seen as a continuation pattern, though sometimes mark a reversal.

A sustained strength beyond the triangle resistance will suggest that the commodity has bottomed out in the near-term and set the stage for a further near-term appreciating move. Bulls might then aim to reclaim the $1900 mark before pushing the XAU/USD further towards the $1922-24 supply zone.

On the flip side, any meaningful slide might continue to attract some buying near the triangle support, currently near the $1842 region. Failure to defend the mentioned support level will negate the constructive outlook and prompt some technical selling. The precious metal might then accelerate the fall further towards intermediate support near the $1830 region before eventually sliding back to challenge the $1800 round-figure mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.