- Risk-off action in global stocks boosts the dollar’s haven demand.

- Coronavirus fears and US-China woes cushion gold’s downside.

- Bearish bias to persist ahead of the US CPI, COVID-19 stats.

Gold (XAU/USD) closed below $1800 mark for the second straight day on Monday following a wild ride witnessed in the US last session. The bright metal fell under the latter from as high as $1813 levels after the US dollar bounced-back across the board amid a flight to safety. The US stocks were sold-off into the growing coronavirus risks after California reimposed on businesses and public spaces amid a spike of coronavirus infections. Further, souring diplomatic US-China ties over the Hong Kong and South China sea issues also weighed on the risk appetite and boosted the haven demand for the US currency. This, in turn, made the USD-denominated gold expensive in other currencies.

Gold is likely to remain pressured in the day ahead, as the greenback will continue to benefit from broad risk aversion. The focus shifts towards the critical US Consumer Price Index (CPI) release, due later today at 1230 GMT. The US CPI is seen higher at 0.6% in June YoY vs. 0.1% last while the core figure is seen a tad lower at 1.1% last month. The monthly rate is expected to rebound 0.5% in June while the core inflation is seen at +0.1%. Any disappointment in the US inflation numbers combined with fresh COVID-19 stats could help cushion the downside in gold. All eyes will also remain on the US corporate earnings for fresh cues on the global market sentiment.

Short-term technical outlook

Gold: Four-hour chart

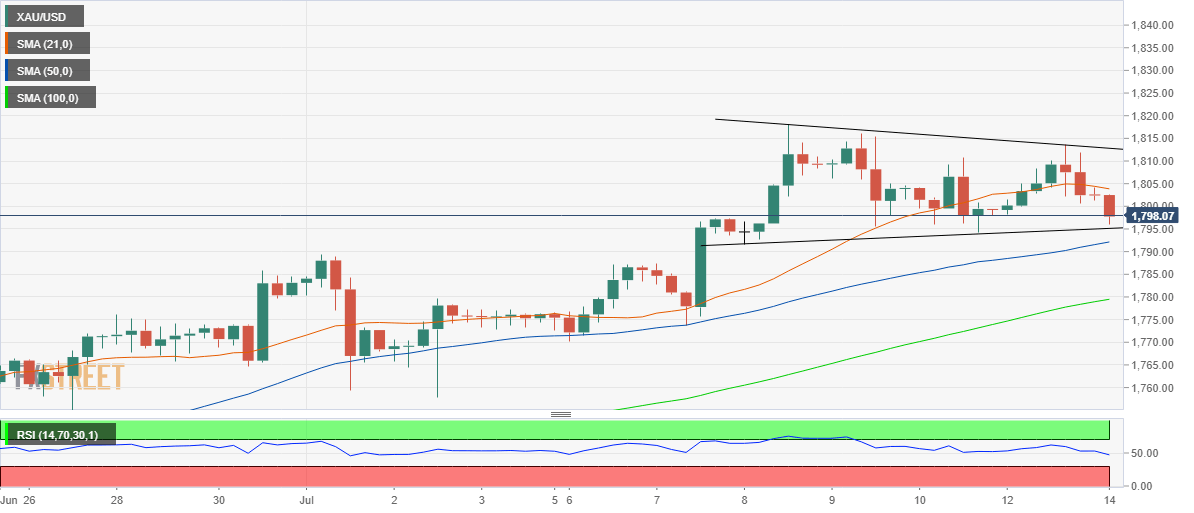

On the four-hour chart, the sentiment has turned bearish for the bright metal, after the price slipped back below the 21-4H Simple Moving Average (SMA) at $1803.87 while trading within a symmetrical triangle formation. The 4H Relative Strength Index (RSI) has pierced through the midline from above, backing the near-term downside bias.

The immediate support is seen at the rising trendline support at $1795.13, below which the pattern will get validated. The next support is aligned at the upward sloping 50-4H SMA at $1792.15.

Acceptance below the latter will open floors towards the 100-4H SMA support at $1779.50. The pattern target is seen at $1769, which will be on the sellers’ radars in the coming days.

Alternatively, only a break above the aforesaid 21-4H SMA support-turned-resistance will revive the recent bullish momentum, which could see the bulls test the falling trendline resistance near $1813. That level coincides with Monday’s high.

Gold: Additional levels to consider

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.