- XAU/USD lost its traction following Monday's sharp upsurge.

- 10-year US T-bond yield turned south in early American session.

- Near-term outlook remains bullish but a daily close above $1,800 is required for additional gains.

The XAU/USD pair started the week on a firm footing and gains more than 1% on Monday. However, gold struggled to break above $1,800 and staged a technical correction toward $1,780 on Tuesday before beginning to erase its losses. As of writing, gold was down 0.22% on a daily basis at $1,790.

The broad-based selling pressure and falling US Treasury bond yields on Monday helped XAU/USD gather bullish momentum. The benchmark 10-year US T-bond yield lost nearly 2% and helped gold find demand. Furthermore, the risk-positive market environment made it difficult for the greenback to attract investors.

The sharp decline witnessed in the S&P 500 Futures during the European trading hours on Tuesday provided a boost to the USD and weighed on XAU/USD. Additionally, rising T-bond yields forced gold price to continue to push lower.

However, the 10-year US T-bond yield reversed its direction during the early trading hours of the session and allowed gold to edge higher. Nevertheless, with Wall Street's main indexes opening the day deep in the red, the USD preserved its strength and kept XAU/USD's rebound limited.

Earlier in the session, the data published by the US Census Bureau showed that the goods and services deficit of the US widened by $3.9 billion to $74.4 billion in March. This reading was largely in line with the market expectation and failed to trigger a significant market reaction.

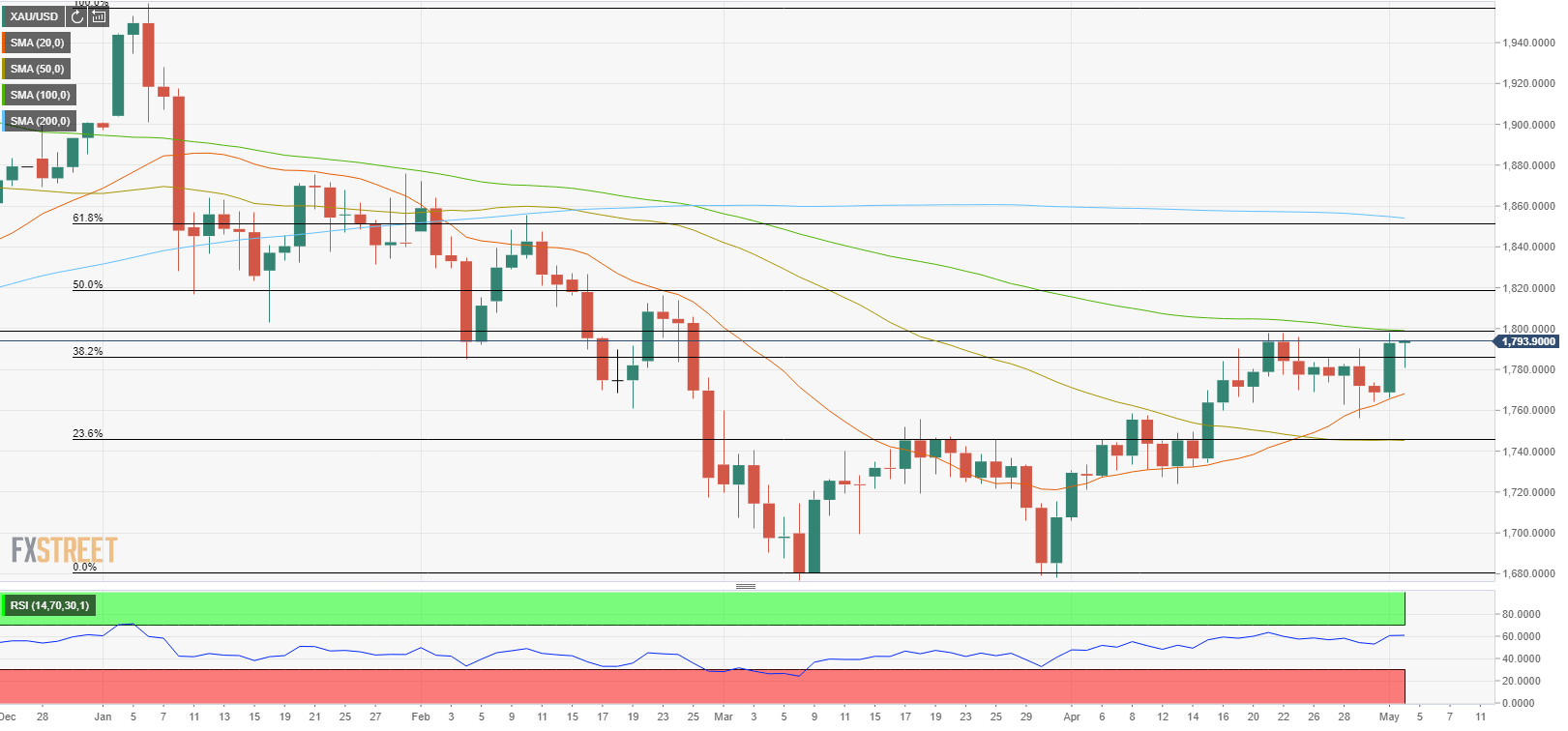

Gold technical outlook

On the daily chart, the Relative Strength Index (RSI) indicator stays near 60, suggesting that buyers remain in control of gold prices. However, only a daily close above $1,800 (psychological level, 100-day SMA) is likely to trigger another leg up as sellers managed to defend this level numerous times. The next target on the upside aligns at $1,820 (Fibonacci 50% retracement of the January-March downtrend).

On the other hand, additional losses are likely if gold closes below $1,785 (Fibonacci 38.2% retracement). $1,768 (20-day SMA) could be seen as the next support before $1,740 (50-day SMA/Fibonacci 23.6% retracement).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.