Gold market analysis: XAU/USD holds support as bulls eye the ATH again

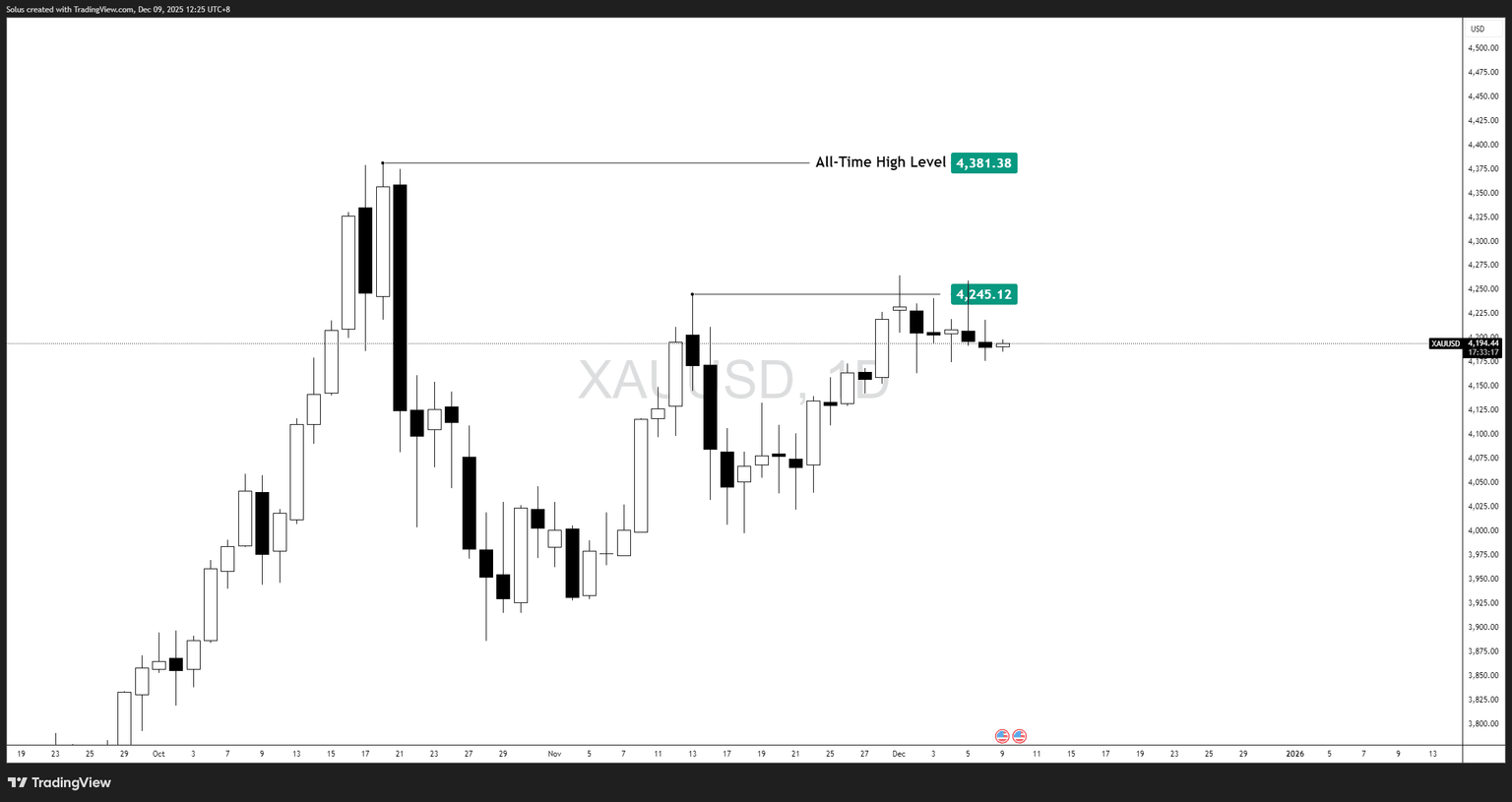

- Gold is consolidating just beneath the $4,245 resistance, forming a tight structure that signals compression ahead of a potential breakout.

- Rate-cut expectations continue to support the metal, as lower yields and a softer US Dollar maintain a bullish macro environment.

- The all-time high at $4,381 remains the key upside magnet, with price repeatedly defending the recent order-block region below $4,200.

Gold remains one of the strongest-performing macro assets of Q4, holding elevated levels despite short-term volatility and repeated retests of intraday support. The charts show a market that refuses to break down, even as price stalls beneath the $4,245 pivot. Each dip toward the mid-$4,100s is met with renewed buying interest, signaling that the structural bid beneath gold remains intact.

This is typical behavior for a market preparing for a larger move. Gold is not distributing — it is coiling.

Gold’s strength is still driven by rate-cut expectations

As the Federal Reserve leans back toward a December rate cut, gold continues to benefit:

- Rate cuts weaken the US Dollar, giving gold room to appreciate.

- Lower yields decrease the opportunity cost of holding a non-yielding asset.

- Investors tend to rotate toward defensive assets during policy-transition periods.

The market is not pricing an aggressive easing cycle — but the expectation of even a single cut is enough to keep gold supported near highs.

Geopolitical uncertainty and the resilience of commodity demand add to this underlying bid.

Compression below resistance

Your charts show a few important structural points:

- The all-time high is fixed at $4,381, a clear external liquidity pool.

- Gold is repeatedly testing the $4,245 short-term high, yet refuses to break down.

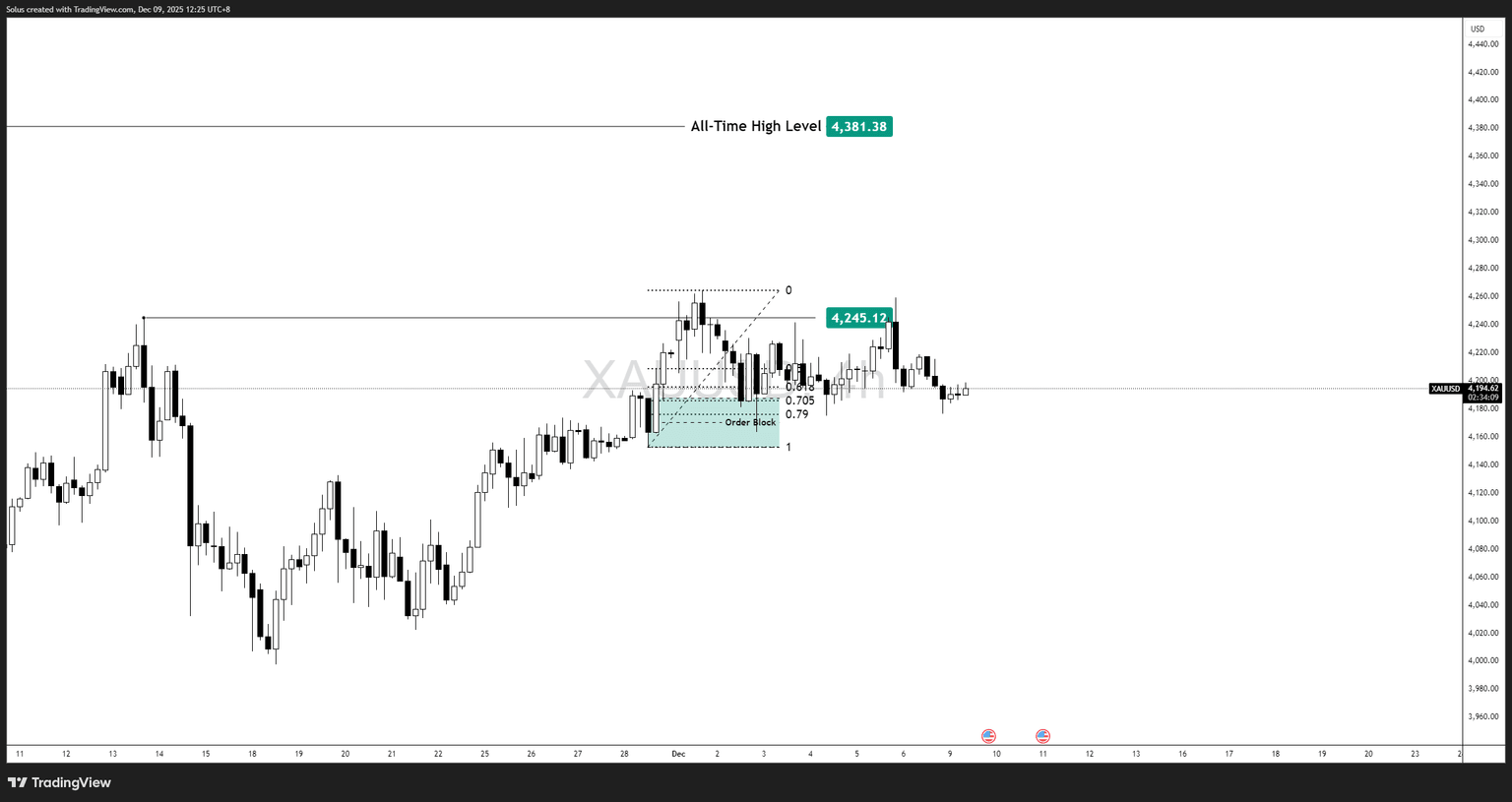

- The recent pullback into the order block near $4,170–$4,190 formed a clean reaction.

- Price is now hovering beneath resistance, forming higher-timeframe acceptance.

This zone — between the order block and $4,245 — is acting as gold’s “reloading range.”

The market is waiting for clarity, but buyers remain in control.

Technical outlook

- Price is hovering around the $4,200 handle, moving sideways rather than forming a downtrend.

- The order block at the 0.705–0.79 retracement continues to hold as a foundation.

- Wicks show absorption on the downside; rallies show controlled momentum, not distribution.

- Gold is forming a higher-timeframe coil, often a precursor to directional expansion.

If the structure was weak, gold would have already broken below the order block. Instead, it stabilizes.

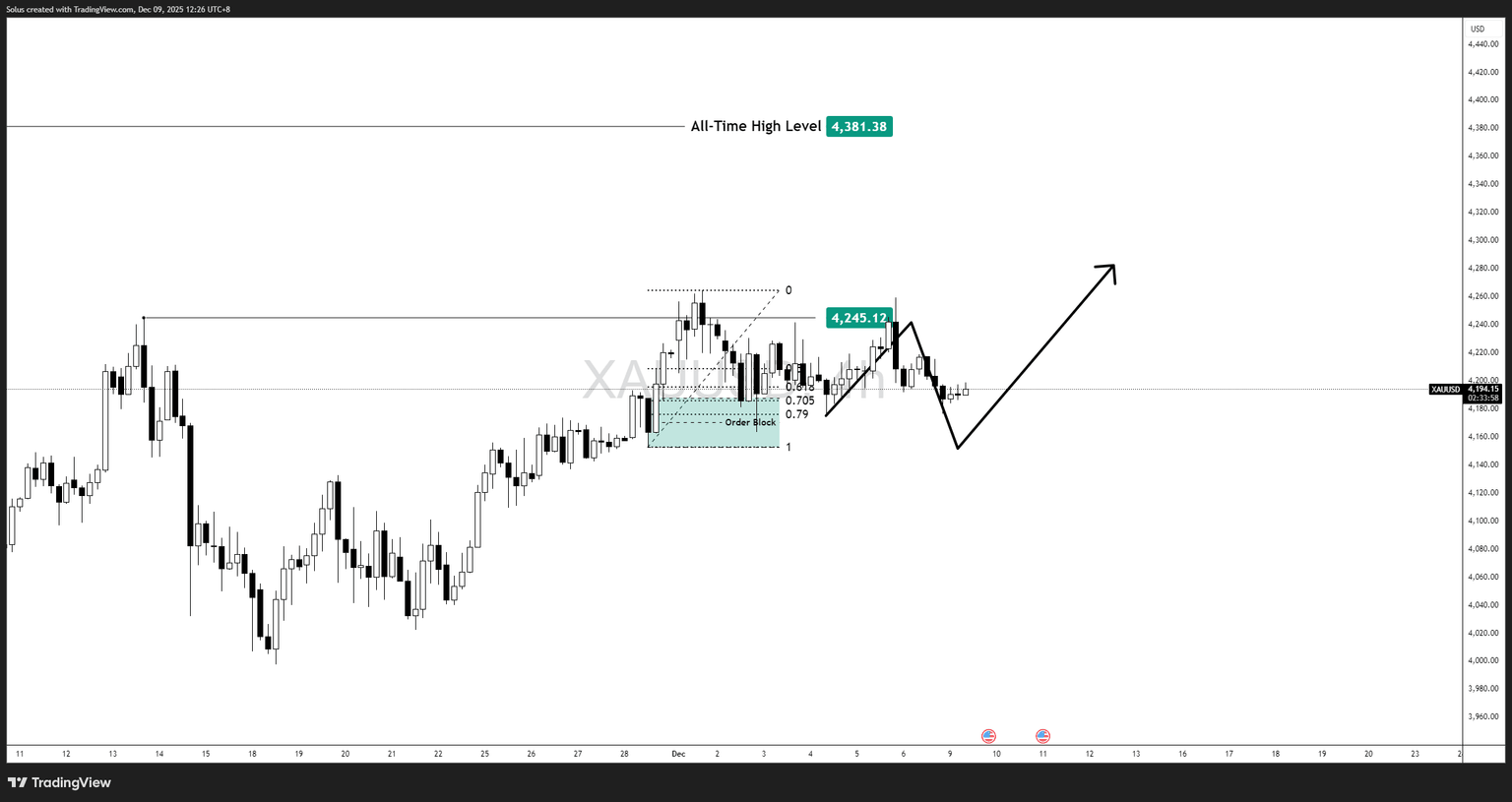

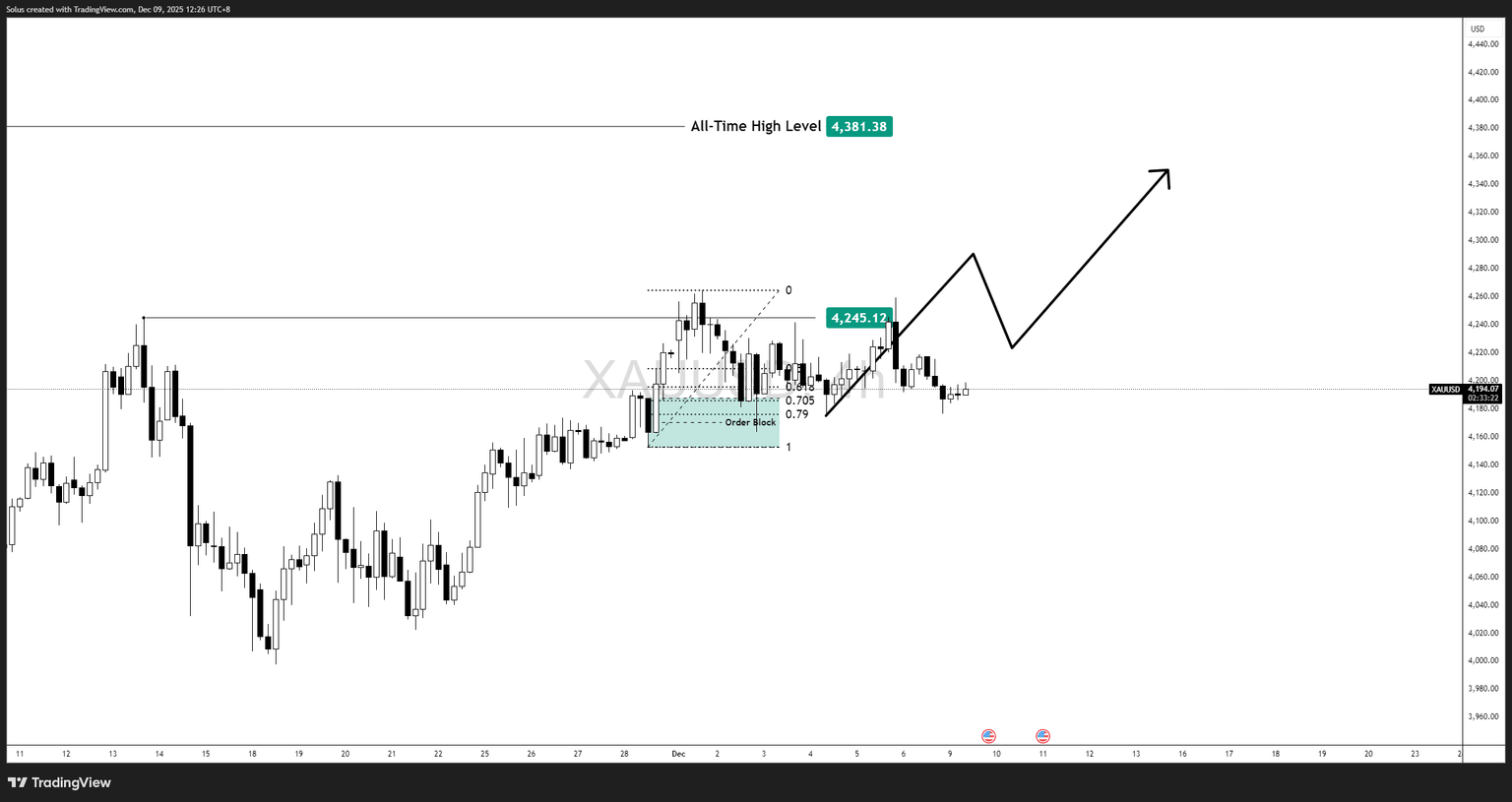

Bullish scenario

A bullish continuation will unfold if:

- Gold holds above the $4,170–$4,190 order block.

- Price reclaims the $4,245 short-term high with conviction.

- DXY continues to stall inside its compression range.

- The Fed reinforces dovish expectations in December.

Under this scenario, gold likely attacks:

- $4,300 (round-number magnet).

- $4,350 (continuation target).

- $4,381 all-time high (liquidity draw).

A breakout above $4,381 opens a path toward $4,450–$4,500 later in the month if momentum persists.

Bearish scenario

A deeper pullback emerges only if:

- Gold loses the order-block region ($4,170–$4,190).

- US Dollar strength returns on reduced rate-cut odds.

- Yields bounce sharply and remove gold’s defensive bid.

Downside levels to watch:

- $4,130.

- $4,080.

- $3,980 (major daily imbalance fill).

However, the current structure does not yet indicate distribution — dips remain corrective, not trend-shifting.

Final thoughts

Gold remains fundamentally and technically supported as December progresses. With the Fed leaning toward a rate cut, the US Dollar trapped in range, and geopolitical tension sustaining safe-haven flows, the path of least resistance for gold still leans higher.

As long as gold continues to defend the $4,170–$4,190 zone, the market maintains a clear upside bias.

This is a textbook bullish consolidation beneath a major high — the kind of structure that often precedes expansion, not reversal.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.