Gold, silver, WTI crude

Gold Spot crashed again through 1800/1795 for an important sell signal initially targeting 1785 & 1770/67.

A potential 20 points profit on shorts if you managed to sell. We bottomed exactly at the lower target.

Silver Spot broke best support at the 100 day moving average at 2670/60 this time for a sell signal targeting 2625, 2605/00 & the 200 day moving average at 2580/70.

Almost 100 ticks profit if you managed to short & we bottomed exactly at 2580/70.

WTI Crude JULY Future broke support at 7145/35 to target strong support at 7050/30. 100 ticks profit if you managed to sell. Longs needed stops below 7000 but unfortunately we over ran by 23 ticks before the bounce.

Daily analysis

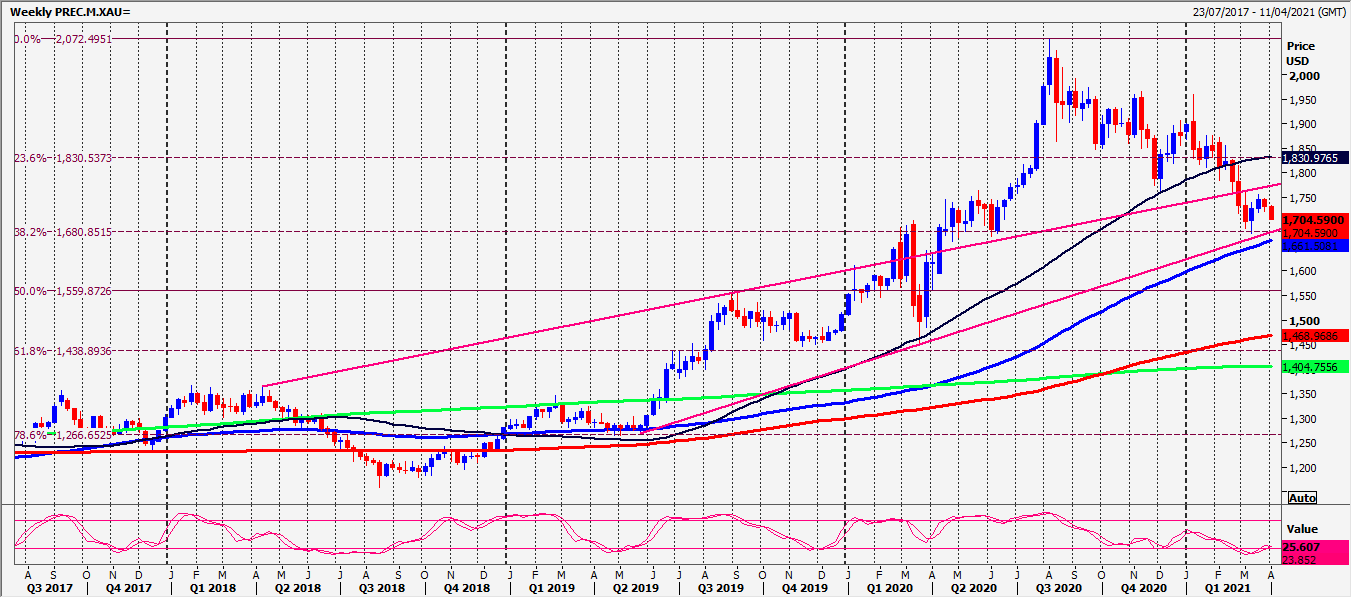

Gold managing a bounce over night after an important sell signal, towards strong resistance at 1795/1800. A high for the day is expected but shorts need stops above 1805. A break higher can target 1815/19.

Shorts at 1795/1800 target 1785 & minor support at 1770/67. I doubt this will hold again for too long. A break lower targets 1762/60 & 1755.

Gains are likely to be limited with first resistance at 1825/30. Unlikely but if we continue higher look for strong resistance at 1846/50.

Silver break below 2750 was a sell signal targeting 2625, 2605/00 & 200 dma at 2580/70. We bottomed exactly here & obviously this is key to direction this morning. However, gains are likely to be limited with first resistance at 2630/40. A high for the day certainly possible. Above 2650 allows a recovery to strong resistance at 2665/75.

Shorts need stops above 2685.

200 dma support at 2580/70. A break below 2560 is another sell signal targeting 2525 & 2505/2500.

WTI Crude first resistance at 7135/55. A break higher is a buy signal targeting 7195/7200 Above 7230 allows a retest of 7280/99.

Minor support at 7050/30 but below here can target 6980/7 & support at 6940/20. Longs need stops below 6900. Support at 6965/45 but a weekly close below here leaves a bearish engulfing candle for a sell signal next week.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.