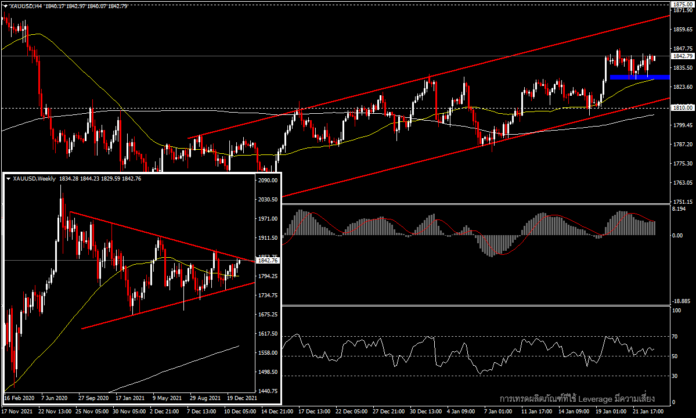

XAU/USD, H4

Concerns about inflation and the Fed’s interest rate hike have finally seen gold realize its safe haven and anti-inflation status as it moved up to a two-month high in the 1848 zone and is now holding steady at 1,840 aftermarket volatility. This volatility sent US stocks on Monday to their lowest level in months before narrowly closing positive, with the Nasdaq +0.63 from -4.9%, S&P500 +0.28% from more than -3% and the Dow back up 99 points (+0.29%) after 1,100 point loss.

During last night’s volatility, the VIX.F fear index hit a near-one-year high of 33.02 (now at 29.22), and the US 10-year Treasury yield hit a new weekly low of 1.71%, before returning to 1.77% this morning.

Interestingly, from a technical perspective, in the midst of severe volatility in the Day and Week timeframes, gold prices are testing the borders of a symmetrical triangle pattern, while in the short-term trend on the H4 timeframe the price maintains an upward outlook. With a break above the MA50 line within an uptrend channel, the MACD remains in positive territory and the RSI is at the 58 levels, with the next key resistance at the November high zone of $1,875. If the MA50 line is broken, the next support will be at the MA200 line at the $1,810 zone.

Amid the inflationary situation at the highest record in decades, this week’s PMI figures for major economies, including the United States, are indicative of a significant slowdown in growth. The concern now falls on the Fed and whether at tomorrow’s meeting it will announce measures to control inflation and simultaneously maintain market confidence. Aside from that, the data to watch for this week are the preliminary Q4 GDP projections and the US PCE inflation index.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Australian CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.