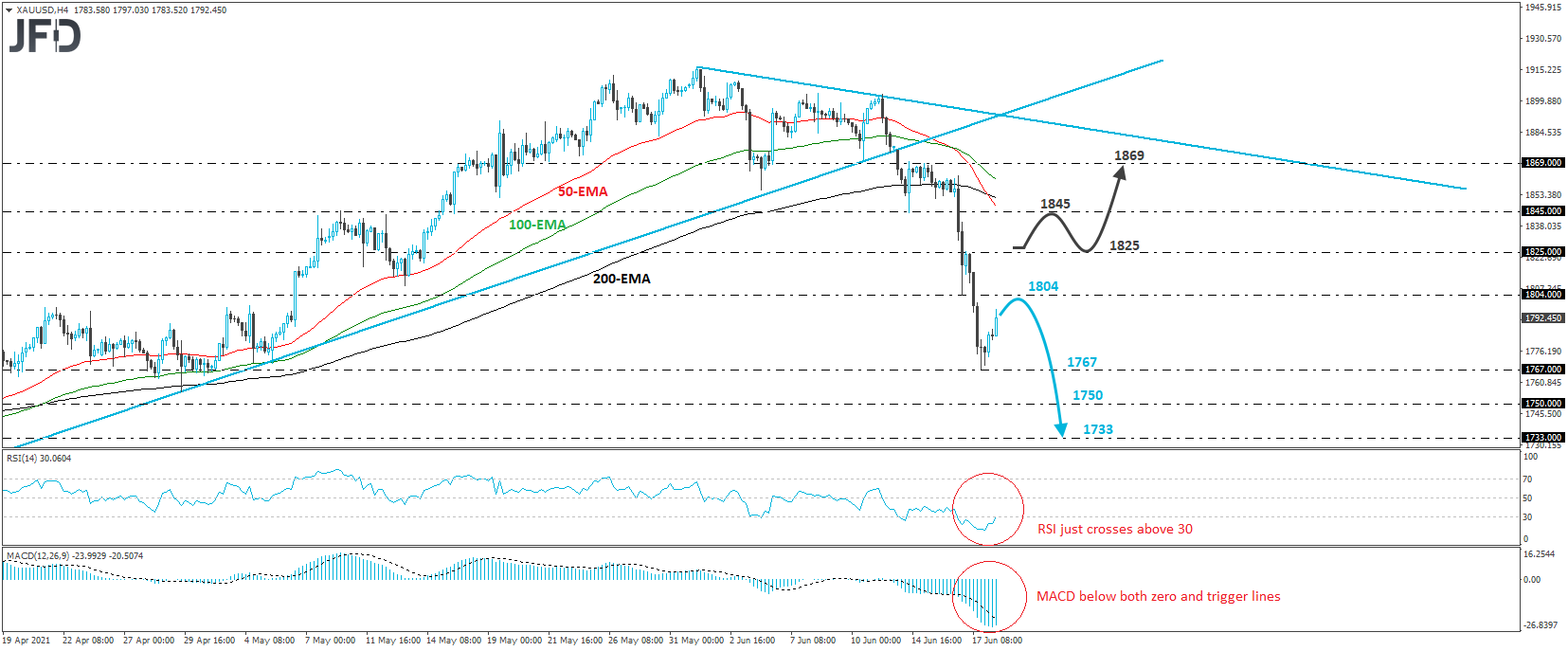

XAU/USD tumbled on Wednesday after the Fed signaled that interest rates in the US could start rising in 2023. The free fall continued yesterday as well, with the metal hitting support at 1767, a territory that offered strong support between April 19th and May 3rd. Thereafter, gold rebounded and today it looks to be headed towards Wednesday’s low of 1804. Overall, the metal is trading well below the prior upside support line drawn from the low of March 31st, and also well below a newly established downside line, taken from the high of June 1st. Therefore, we would consider the near-term outlook to be bearish.

If the bears are strong enough to take charge again from near the 1804 area, we could see another leg south towards the 1767 support zone. That said, we would like to see a move below that key obstacle before we get confident on more declines. Such a move would confirm a forthcoming lower low and may initially target the inside swing high of April 14th at 1750. Another dip, below 1750, could extend the slide towards the low of that day, at 1733.

Looking at our short-term oscillators, we see that the RSI rebounded and just poked its nose above its 30 line, while the MACD, although below both its zero and trigger lines, shows signs of turning up as well. Both indicators detect slowing downside speed and support the case for some further recovery before the next leg south, perhaps for a test near 1804.

Now, in order to start examining whether the upside correction will last longer, we would like to see a move above 1825, a resistance marked by yesterday’s high. The next hurdle may be the inside swing low of June 14th, at 1825, the break of which could pave the way towards the peak of the day after, at around 1869.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.