The gold price dropped below $1,900 amidst Covid-19 cases increases in the West and the US dollar appreciation. So, what happens next with the yellow metal?

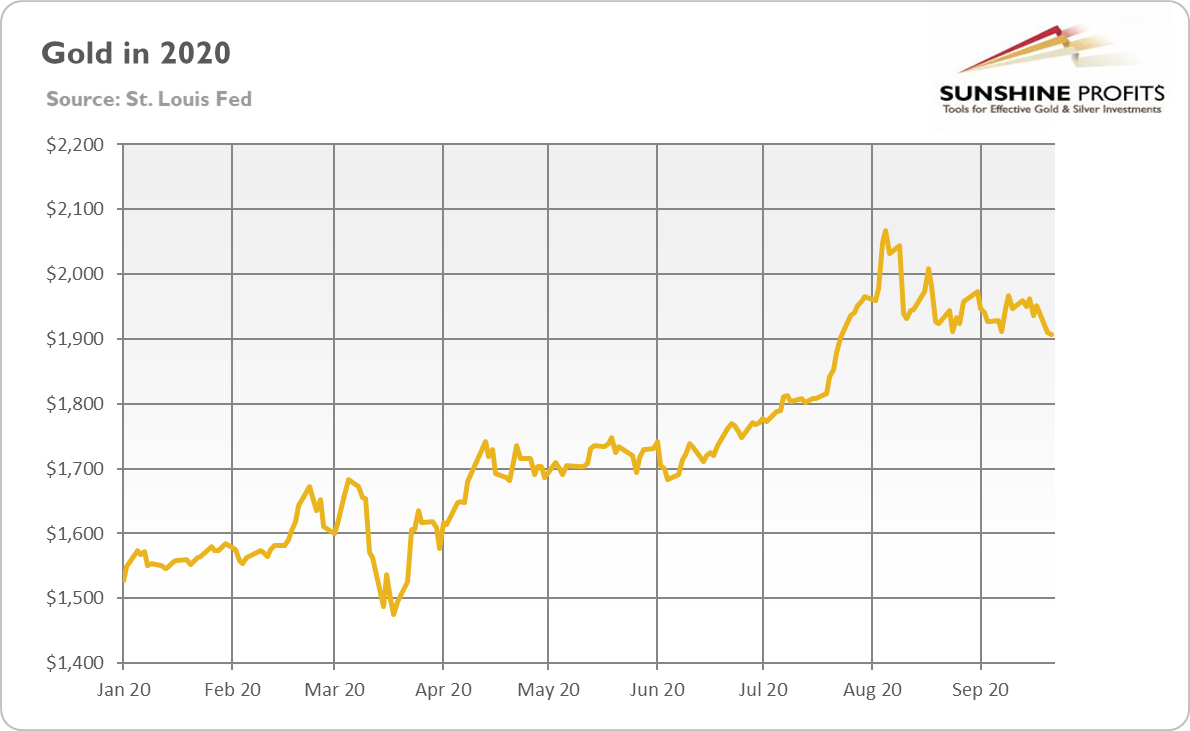

For the time being, things are not looking good, my bull friends. The bearish trend in the gold market continues. As the chart below shows, we saw a significant selloff on Monday with gold prices decreasing from above $1,950 to $1,909. To make matters worse, the decline continued on Tuesday and Wednesday, with the price of gold dropping below the critical level of $1,900, for the first time since the end of July.

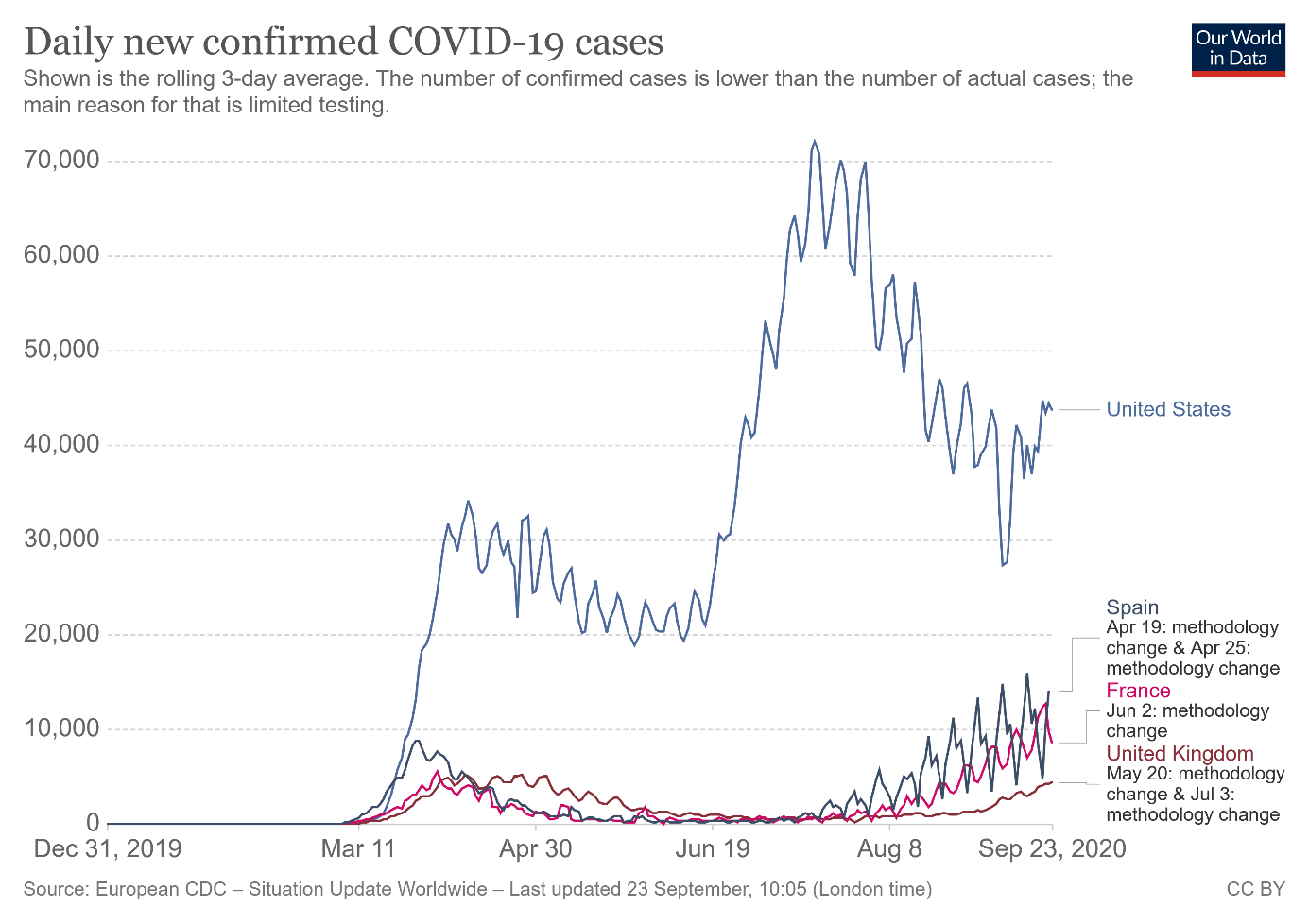

So, what exactly happened here? Well, as we wrote in Tuesday's Fundamental Gold Report, the coronavirus just came back with another wave. As pointed out in the chart below, the daily new confirmed Covid-19 cases are increasing again in several European countries, and the United States.

Yes, even the U.K. Prime Minister Boris Johnson has already introduced some new restrictions, including 10 p.m. curfews for pubs and restaurants in England. Can you imagine pubs in England opened only until 10 p.m. – that's not just a crisis, it's a disaster!

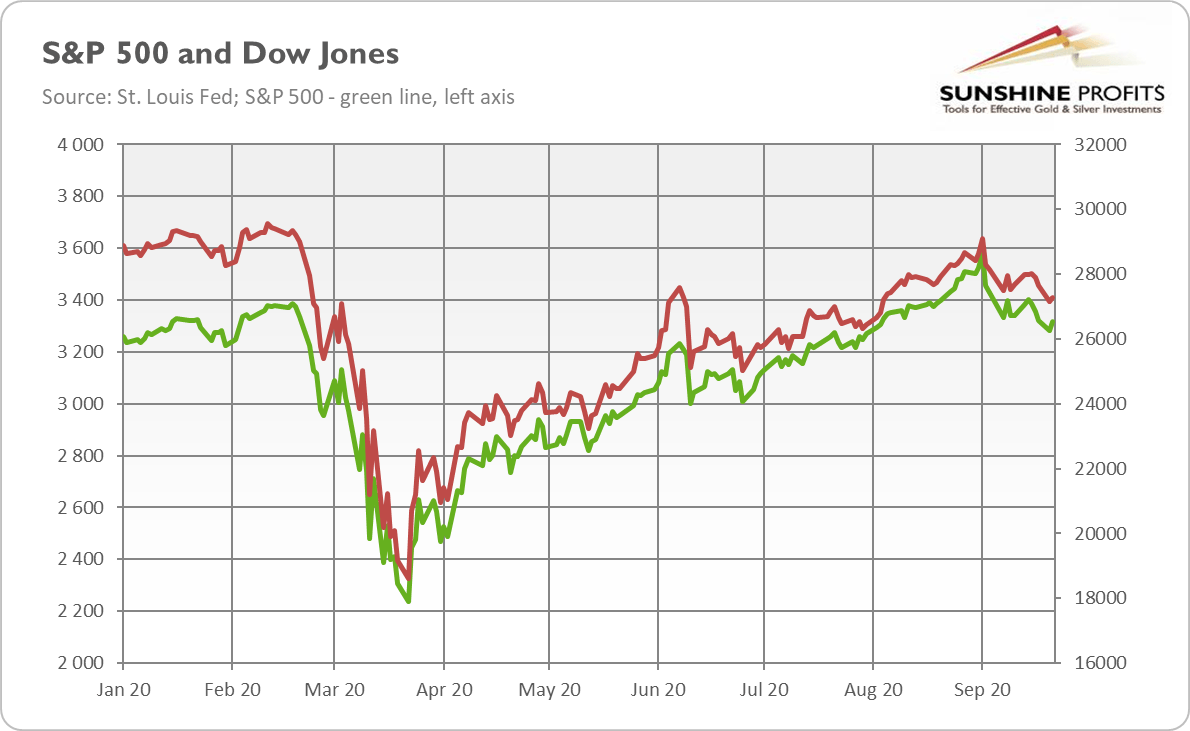

As a result, the recent Covid-19 cases resurgence renewed the global concerns about the reinstatement of lockdowns or other constraining measurements that can hamper the pace of the economic recovery (I warned you that there is no point in expecting a V-shaped rebound). This anxiety caused was the main reason behind the recent stock market declines, pushing down the S&P 500 and Dow Jones from 3319 and 27657 to 3281 and 27148, respectively (see the chart below).

Moreover, the negative market sentiment intensified U.S. dollar's safe-haven demand, which rose to the two-months high. Consequently, the EUR/USD exchange rate dropped to a two- months low of $1.1671 on Wednesday morning.

Although the new cases are increasing in America, infections are spreading incredibly rapidly in Europe, strengthening the greenback‘s position against the euro. The recent cases resurgence across Europe have coincided with the weak economic Eurozone indicators: for example, the business growth ground to a halt in September.

Implications for Gold

So, what does the above mean for the gold market? Well, the renewed global concerns about the second Covid-19 wave of infections, primarily in Europe, along with its economic implications, pushed investors toward the US dollar. It is all normal – in every crisis, cash is always the king. But in a global or European crisis such as the current one, the greenback is the tsar.

Several other risks have accumulated recently. Let's not forget that the U.S. presidential elections are quickly approaching. It is likely that the elections' results will be disputed, as Trump already suggested that mail-in voting could be rigged. Moreover, the fight over Supreme Court Justice Ruth Bader Ginsburg's successor adds up another volatile element, as it decreases the chances of a quick deal on the new stimulus measurements. You see, if Trump manages to install a conservative replacement in time, the new judge could help resolve any dispute in his favor. These risks supported the US dollar, which put downward pressure on the gold prices as a result.

Therefore, the market sentiment is clearly bearish right now, and it appears that the yellow metal needs a real spark to reenter a bullish trend. Indeed, it seems that both the stock and gold market await patiently for the upcoming fiscal and monetary stimuli. Unfortunately for the gold bulls, the market expectations for a new Congress or the Fed support have declined in recent days. That is why the fears about the second wave of infections and the renewed sanitary restrictions are so acute – there is no government or central bank's help on the horizon that can protect and solidify the economy.

But still, gold bulls shouldn't give up. Remember the first wave of the pandemic? Gold also plunged, only to soar afterward, resulting in a record high. The fundamental outlook for gold is still bullish: the real interest rates are negative, the public debt is ballooning, while the Fed's monetary policy is very dovish. Although right now, both the Congress and the central bank could potentially disappoint investors, they will have no choice but to provide additional support as they always do indulge the Wall Street – and, although somewhat unintentionally, gold bulls.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.