Gold continues being traded on the sell-side for a second consecutive week. The reduction in the trade tensions between China and the United States are increasing the investor's confidence. The two biggest world's economies are preparing for the early October meeting, which will take place in Washington.

During this week, the risk-of commodity eases 0.52% falling below the $1,500 per ounce. The risk appetite is driving the stocks market to advance for its third consecutive week. Dow Jones Industrial Average soars by third consecutive week climbing over the 27,250 pts, the highest level since July 31. The S&P 500 is being traded in the bull-side reaching the 3,021.75 pts, erasing the August's loses.

Technical overview

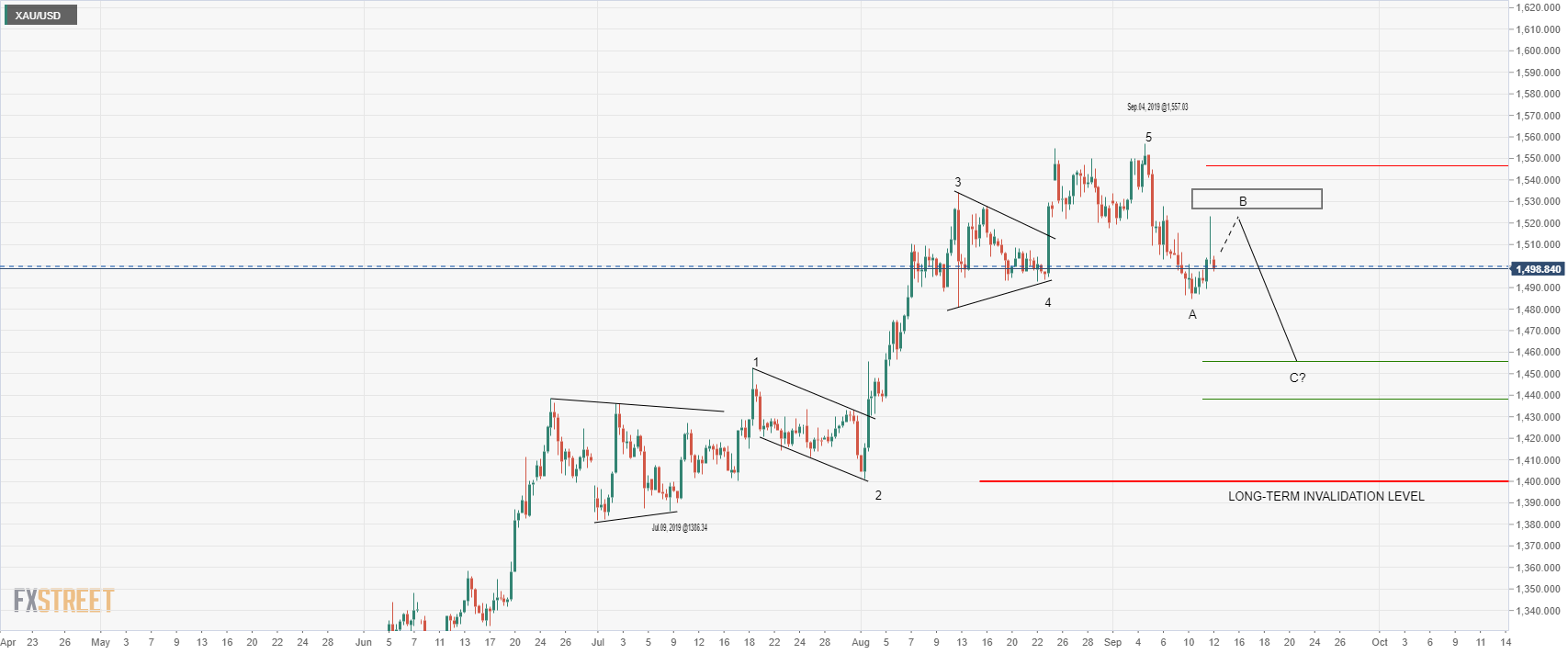

Gold in its 8-hour chart shows a first bearish leg from the September 04 high at 1,557,03. Currently, the golden metal is running in a corrective sequence. The price action suggests that Gold is moving in an incomplete wave B.

The current formation could drive the price to seek sellers in the area between $1,530 to $1,535 from where the wave B should be ended.

After this movement, we anticipate a new decline in five waves corresponding to a wave C. The potential bearish target of this decline is the area between $1,455 and $1,438. The invalidation level for the corrective scenario is at $1,546.

In the long-term picture, the primary trend is bullish. In this sense, we consider the possibility of a new bounce in five waves.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.