Are gold lease rates (GLR) really one of the major drivers of the price of gold, as is often cited? A lease rateisthe market price for borrowing or lending the particular asset. Obviously, the gold lease rate is the cost of borrowing gold. In much the same way that individuals borrow dollars, pay interest, and then return dollars to the lender, gold bullion participants borrow gold, pay a borrowing cost, and return the gold to the lender. So much for the Buffet’s claim that gold has no yield. Surely, gold stored in a vault does not yield, but when it is lent, it accrues interest. No matter how counterintuitive it may sound, some gold owners (the lending and borrowing of gold is generally reserved for the entities operating in the wholesale market, such as bullion bankers, mining companies, jewelry producers, etc.) do earn interest on gold. This proves that gold is more like currency rather than other commodities, because just like any currency, it can be lent and earn interest. Such lending transactions in the gold market are often referred to as lease transactions and interest rate applied to such lending is called gold lease rate (GLR).

The GLR is derived as Libor minus gold forward offered rates (GOFO). The former is considered as the interest on the U.S. dollars, while the latter as the interest paid on a swap of gold for greenbacks, i.e. the interest paid if one lends gold and borrows U.S. dollars. If we subtract the GOFO from the LIBOR, we will get the GLR, i.e. the interest received if one lends gold, but does not borrow greenbacks at the same time.

Let’s assume that central bank holds 100 ounces of gold and enters a swap with a dealer at a 0.5 percent (GOFO rate) and the gold price at $1200 per ounce. Therefore, the central bank receives $120,000 and the dealer gets 100 ounces of gold. Then, the central bank invests $120,000 in the market at the 2 percent (LIBOR), so it will get $122,400. After paying the GOFO rate, the central bank receives the net profit $1,800 that equals the 1.5 percent (the GLR) multiplied by the gold value at that time. Unfortunately, since the GOFO is no longer published by the London Bullion Market Association (LBMA), it is impossible to derive the gold lease rates in that way. Nevertheless, GLR is worth understanding, since it is a crucial element of the gold wholesale market.

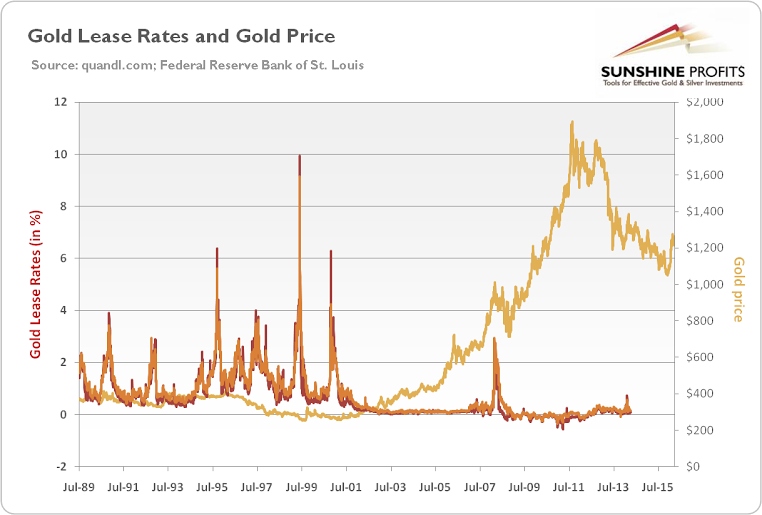

Let’s analyze the chart below which shows the historical gold lease rates and gold prices. As one can see, there is no reliable link between the price of gold and the gold lease rates in the long-term. Indeed, when the GLR shot up during the Lehman crisis, which, theoretically, should have been bullish for gold, gold actually was traded lower. Conversely, in 2009-2011, the gold price more than doubled, while the GLR were negative. Therefore, investors should remember that an oversupplied (under supplied) gold spot market does not necessarily mean that the gold lending market is also oversupplied (under supplied).

Chart 1: The price of gold (yellow line, right axis, London P.M Fix), 1-month GLR (red line, left axis, in %) and 3-months GLR (orange line, left axis, in %) from July 1989 to January 2015.

What caused the spikes in the GLR? The spikes tended either to occur for some peculiar (idiosyncratic) reasons within the gold lending market or during broader market turmoil. For example, the jump in GLR in 1999 was a result of an announcement of theWashington Agreement on Gold and fears of diminished liquidity in the gold lending market that followed.The spike in 2008, on the other hand, was caused by the surge in LIBOR (due to global turmoil and the jump in risk premium) and negative GOFO (backwardation in the gold market) as investors happily lent cash at negative rates to hold a safe-haven gold.

The key takeaway is that the GLR –the cost of borrowing gold–isone of the most important gold market-related interest rates. In February 2015, the LBMA stopped publishing the benchmark for the GOFO, so the GLR cannot be easily derived as the difference between LIBOR and GOFO any longer. However, the GLR, asa component of the gold swaps, remainscrucial to understanding the gold lending and swap market. Its existence is also the best proof that gold can earn interest, just like other currencies. In the past, the level of GLR could be used as a useful indicator of the gold market (although there was no clear long-term statistical relationship between the GLR and the price of gold), but the introduction of the zerointerest-rate policy (ZIRP) disturbed the normal functioning of the gold lending market.

If you enjoyed the above analysis and would you like to know more about the gold lending and swap market, we invite you to read the May Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.