Global stocks declined today as traders focused on corporate earnings from some of the biggest companies in the world. In Europe, the DAX index declined by 2.80% while the FTSE 100 and Stoxx 50 are down by 1.85% and 2%, respectively. In the United States, futures tied to the Dow Jones and the S&P have fallen by almost 1%. Earlier today, Royal Dutch Shell announced a multibillion-dollar loss while Credit Suisse profit rose by 24%. In Germany, Volkswagen made a loss of almost $1 billion forcing the company to cut its dividends. Later today, Apple, Alphabet, and Amazon, which have a combined market cap of more than $3 trillion will release their earnings.

The euro declined slightly as traders reflected on the mixed economic data from Europe. In a report earlier today, the German statistics office said that the country’s economy contracted by 11.7% in the second quarter, in what was the worst quarter in decades. The economy contracted by 10.1% on a QoQ basis. The country’s unemployment rate remained unchanged at 6.4%. Meanwhile, the industrial sentiment in Europe improved slightly to -16.2 while sentiment in the services industry improved to -26.1.

The US dollar gained against most currencies as traders reflected on the Fed interest rate decision. In its July meeting, the bank left interest rates unchanged in the range of 0% and 0.25%. It also left the open-ended quantitative easing policy in place and pledged to do more. The currency also reacted to the first preliminary Q2 GDP data from the US. The data from BLS showed that the economy contracted by 32.9% in the quarter. That was better than the 34.1 that analysts polled by Reuters were expecting. Meanwhile, data showed that initial jobless claims rose to 1.43 million as more states put brakes on their reopening process. This was higher than the 1.42 million that was reported last week.

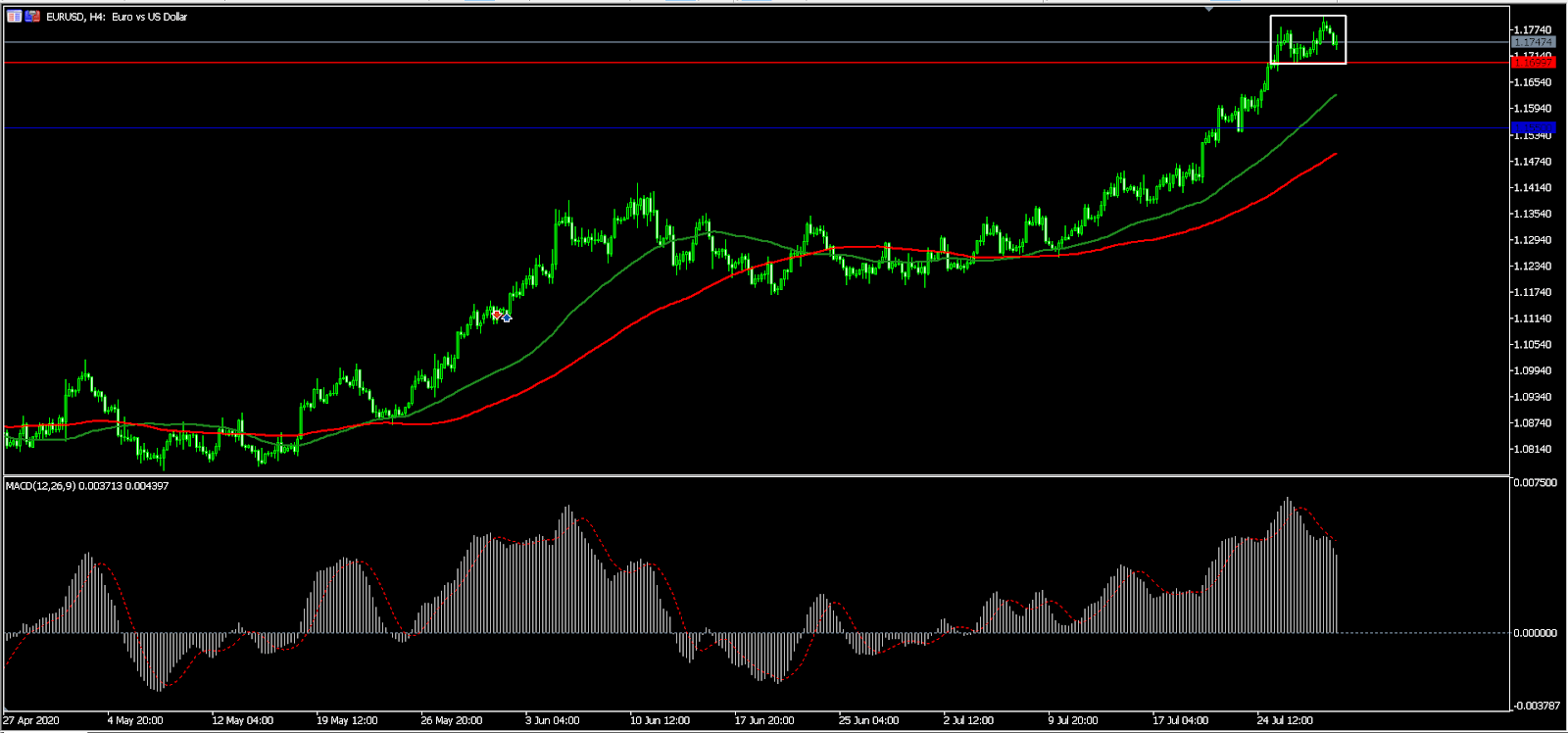

EUR/USD

The EUR/USD pair is trading at 1.1747, which is lower than this week’s high of 1.1805. On the four-hour chart, the price is above the 50-day and 100-day exponential moving averages. The signal line of the MACD has formed a crossover with the main line, which is a bearish signal. However, it is also forming a bullish pennant pattern. Therefore, the pair is likely to continue rising as bulls aim to move above the 1.1800 resistance.

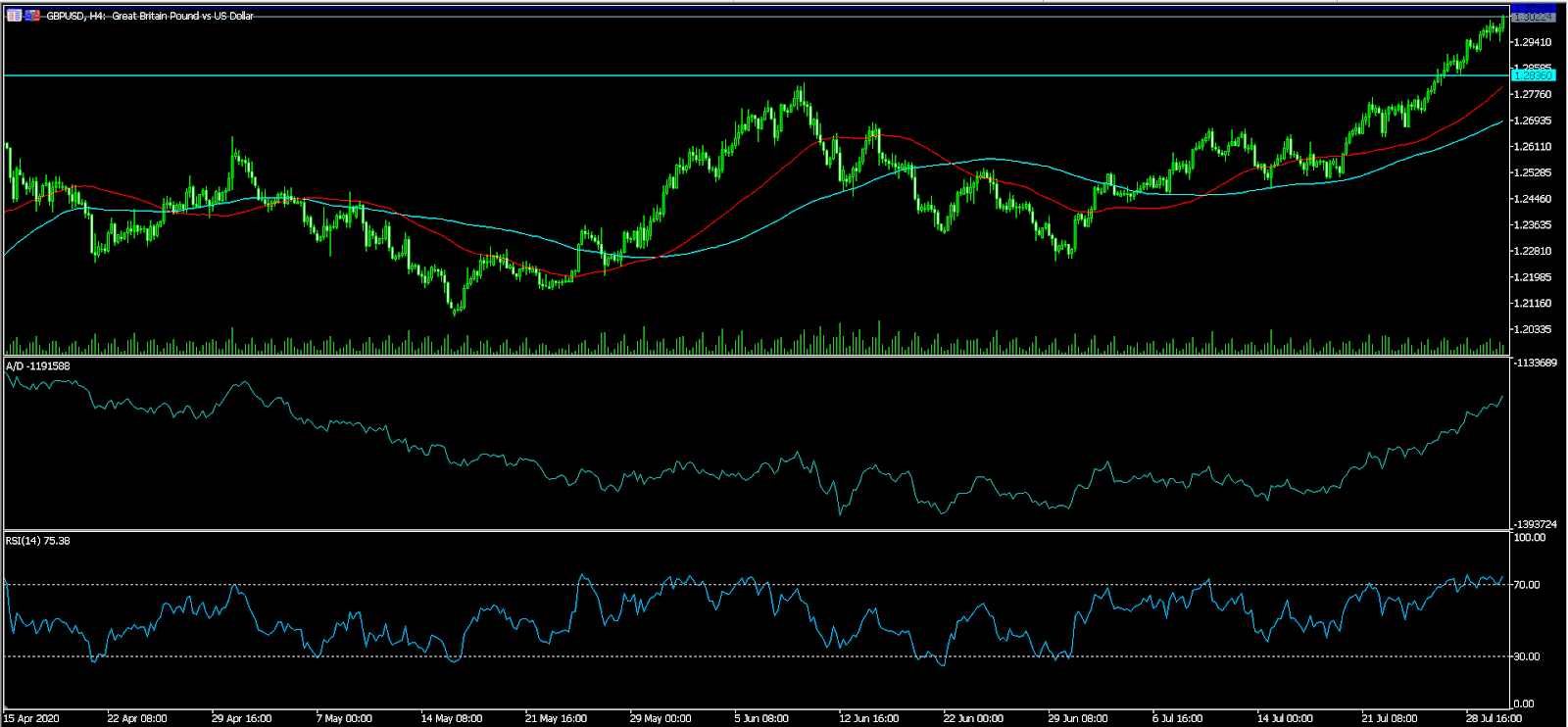

GBP/USD

The GBP/USD pair spiked to an intraday high of 1.3015, which is the highest it has been since March this year. On the four-hour chart, the price is significantly higher than the 50-day and 100-day exponential moving averages. Also, the accumulation and distribution indicator has moved to the highest level since April. The RSI has remained above the overbought level of 70. Therefore, it seems like bears are in total control, which means that the price will continue to move higher. Still, there is a possibility of a pullback happening.

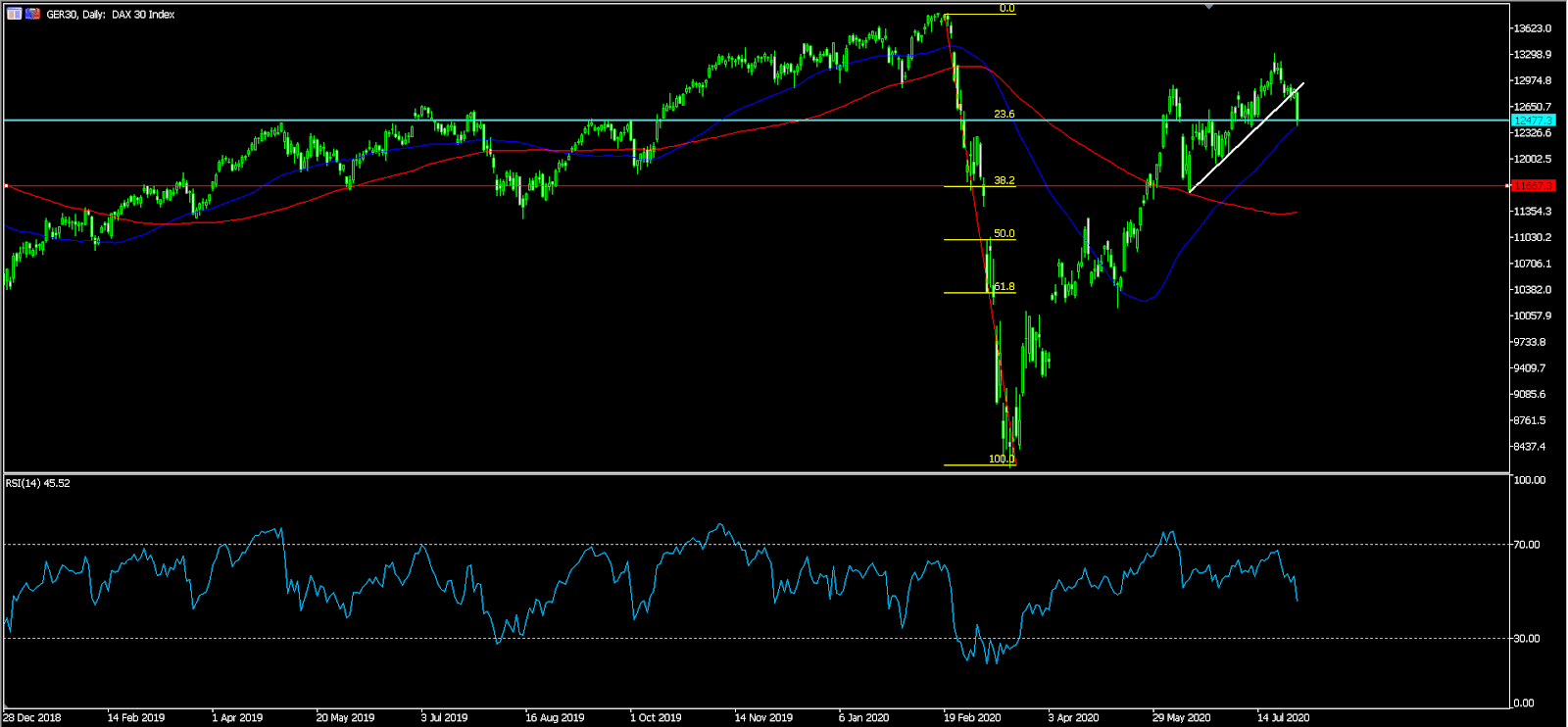

GER30

The DAX index declined sharply today as traders reacted to weak earnings from Germany. The index is trading at €12,477, which is the lowest it has been since July 10. The price is along the 50-day EMA but is also slightly above the 100-day EMA. More importantly, the index moved below the ascending trend line that is shown in white. Therefore, it seems like bears are now in charge, which will see the index continue falling to the 38.2% retracement level at €11,667.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.