Cable traded within narrow consolidation range in Asia on Thursday, following strong fall in past two days and awaiting the third key release this week, UK retail sales.

Pound was hit by weak data in past two days, as downbeat UK wages and inflation sparked strong pullback from new post-Brexit recovery high at 1.4376.

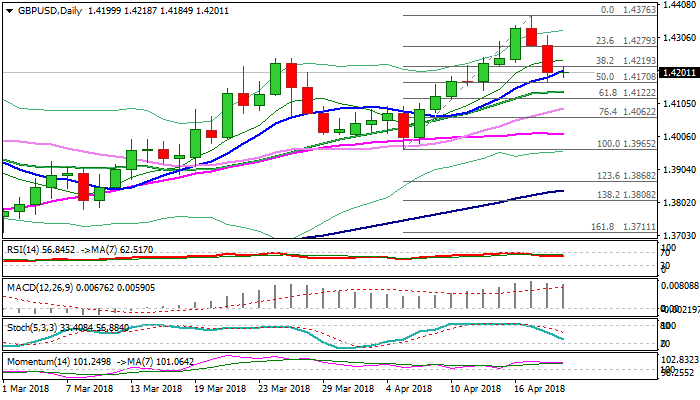

Pullback dented solid support at 1.4185 (rising 10SMA) but managed to close above on Wednesday, while today’s repeated probes below 10SMA (currently at 1.4207) were so far short-lived. Two-day pullback on Tue/Wed generated bearish signal on close below 1.4219 (Fibo 38.2% of 1.3965/1.4376 upleg) which needs confirmation on repeated close below and also close below rising 10SMA.

Reversal pattern is forming on daily chart and sees risk of deeper pullback towards 1.4243/22 (rising 20SMA/Fibo 61.8% of 1.3965/1.4376).

Pullback has dented bulls on daily chart, however, daily indicators are still in bullish setup and require repeated close above 10SMA to generate initial signal of correction end and formation of higher low, with confirmation on recovery extension and close above 1.4250 (Fibo 38.2% of 1.4376/1.4172 pullback).

Forecast for UK retail sales is negative (Mar -0.5% f/c vs 0.8% in Feb/core -0.4% f/c Mar vs 0.6% in Feb) and release in line with expectations or below would put sterling under fresh pressure.

Positive sentiment among investors over strong expectations for BoE rate hike next month faded after disappointing wages and CPI and picture could be soured further on retail sales miss.

Res: 1.4220; 1.4250; 1.4274; 1.4298

Sup: 1.4185; 1.4170; 1.4143; 1.4122

Interested in GBPUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.