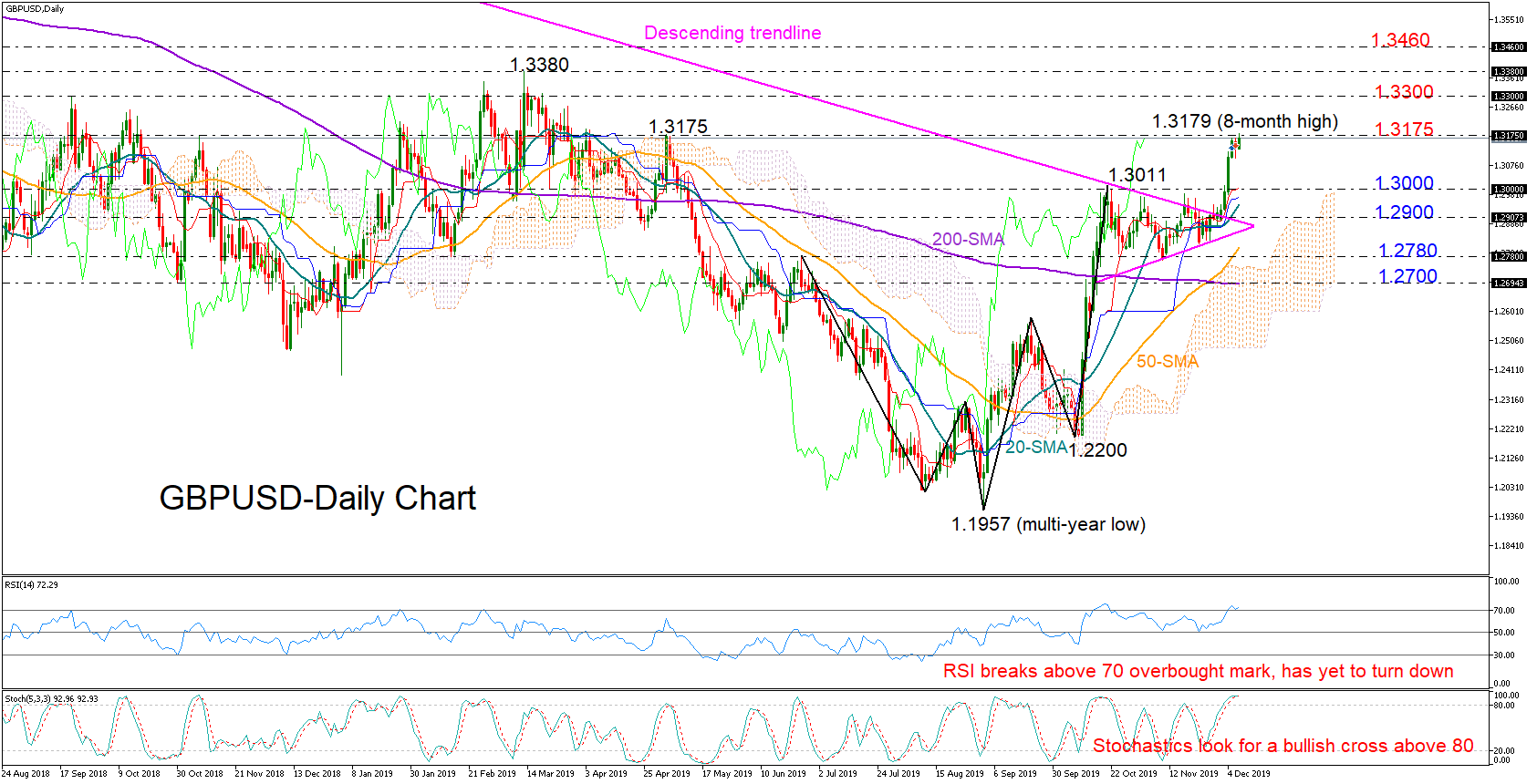

GBPUSD closed significantly above the tentative descending trendline stretched from the 2018 high of 1.4375 that looked to be part of a bullish pennant formation.

The price inched up to an eight-month high of 1.3179 on Monday but remained close to the key 1.3175 resistance mark, with the RSI and the Stochastics hinting that buying pressure is overloaded and downside corrections are likely in the short-term. Still, overbought signals would only be confirmed if the indicators show a clear downside reversal.

In case sellers return to the market, only a strong decline below the previous peak of 1.3011 would raise questions about the market’s strength, with traders probably searching for support around the descending trendline and the 1.2900 level. Moving lower, the pair could see a retest of the 1.2780 barrier, where another failure would bring the 1.2700 obstacle into review.

In the positive scenario, the rally could gain additional legs and touch 1.3300 if buyers manage to close clearly above 1.3175. Surpassing the 2019 top of 1.3380, the next stop could be somewhere near 1.3460 where the market action has been restricted several times in 2018.

Meanwhile in the medium-term picture, the positive sentiment has grown following the break above 1.3000, with the bullish cross between the 50- and 200-day simple moving averages (SMAs) increasing hopes that the bulls are likely to stay active. The higher highs and higher lows since the rebound off 1.1957 are another encouraging signal.

In brief, GBPUSD is looking cautiously bullish in the short-term as the market seems to be trading in an overbought area. In the medium-term, the positive outlook is likely to remain intact.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.