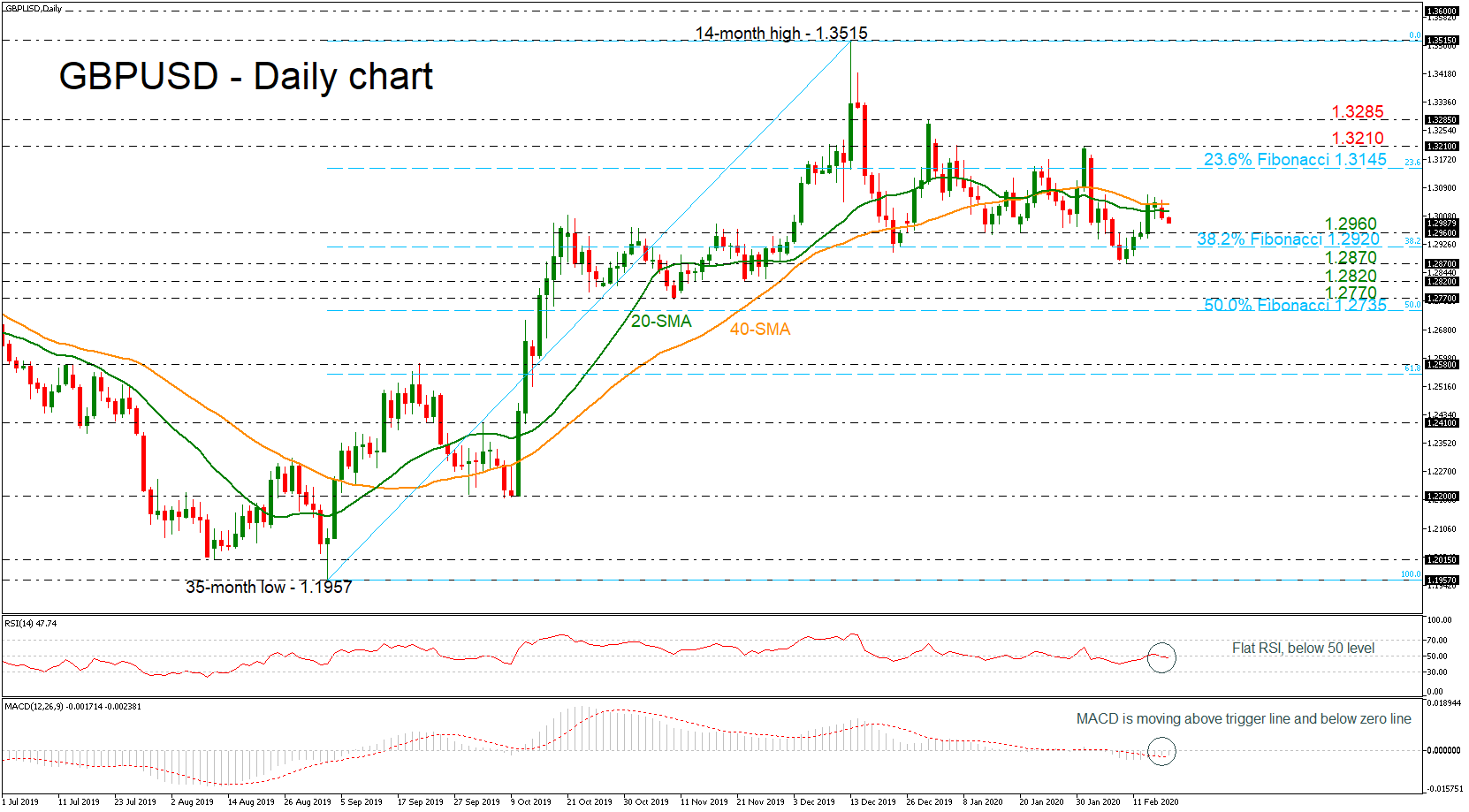

GBPUSD is losing momentum below 1.3000, within a range that has been holding since the jump to a 14-month high of 1.3515 on December 13.

Currently, the cable is developing beneath the 20- and 40-day simple moving averages (SMAs) confirming the weakening move in the market. The RSI indicator is marginally below the 50 level, while the MACD, having posted a bullish cross with its trigger line, keeps fluctuating in the bearish territory.

More downside pressure could drive the pair towards the immediate support of 1.2960 and the 38.2% Fibonacci retracement level of the upward wave from 1.1957 to 1.3515 near 1.2920. Steeper declines could challenge the next key levels of 1.2870, 1.2820 and 1.2770. Below these, the 50.0% Fibo of 1.2735 could attract traders’ attention as well.

In the positive scenario, a successful attempt above the moving averages, the price could meet resistance at the 23.6% Fibo of 1.3145 and before the 1.3210 hurdle registered on January 31 comes into view. If bulls prove stronger, the rally could continue until 1.3285, where any break higher could turn attention towards the 14-month peak of 1.3515, shifting the short-term bias to bullish again.

In the long-term timeframe, the pair retains a bullish structure and only a drop beneath the 50.0% Fibonacci could change it to bearish.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD flirts with 1.0700 post-US PMIs

EUR/USD maintains its daily gains and climbs to fresh highs near the 1.0700 mark against the backdrop of the resumption of the selling pressure in the Greenback, in the wake of weaker-than-expected flash US PMIs for the month of April.

GBP/USD surpasses 1.2400 on further Dollar selling

Persistent bearish tone in the US Dollar lends support to the broad risk complex and bolsters the recovery in GBP/USD, which manages well to rise to fresh highs north of 1.2400 the figure post-US PMIs.

Gold trims losses on disappointing US PMIs

Gold (XAU/USD) reclaims part of the ground lost and pares initial losses on the back of further weakness in the Greenback following disheartening US PMIs prints.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.