Cryptocurrency prices rallied as Bitcoin crossed the important resistance at $57,000 for the first time since May this year. The rally pushed its total market capitalization to more than $1 trillion. The combined market cap of all digital currencies rallied to more than $2.3 trillion. There were several reasons why these currencies rallied. First, there are signs that the Securities and Exchange Commission (SEC) will allow Bitcoin futures to be listed. Analysts believe that this will lead to more demand for Bitcoin. Also, they cited its role as a hedge against inflation and the fact that hash rates have been on a bullish trend.

The price of crude oil rallied as the ongoing supply and demand imbalance continued. With the global economy recovering, analysts expect that demand will keep rising in the coming year. At the same time, OPEC and its allies are not boosting production as fast as they should. In a meeting last week, the cartel agreed to continue increasing supplies gradually in a bid to boost prices. The next key mover for oil prices will be the latest monthly report by OPEC. The report is expected to show that demand remains steady and is expected to keep rising.

The British pound declined slightly ahead of the latest UK employment numbers that will come out in the morning session. The numbers are expected to show that the country’s labour market remained steady in August as the reopening continued. Economists polled by Reuters expect the data to show that the economy created more than 243k jobs in the three months to August. At the same time, wages are expected to have risen to 7.0% while the number of people filing for claims declined.

GBP/USD

The GBPUSD retreated slightly in the overnight session. It is trading at 1.3600, which is slightly below this week’s high of 1.3670. The pair has formed a bullish flag pattern, which is a positive sign. It has also formed an inverted head and shoulders pattern. It is being supported by the 25-day moving average. Therefore, the pair will likely break out higher later today.

EUR/USD

The EURUSD pair was little changed as traders wait for upcoming US inflation data. The pair is trading at 1.1557, which was slightly below this week’s high at 1.1585. On the four-hour chart, the pair has formed a bearish flag pattern and is also below the 25-day moving average. The Williams %R has also declined sharply. Therefore, the pair will likely break out lower in the next few trading sessions.

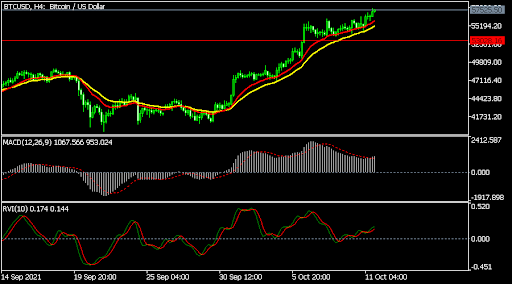

BTC/USD

The BTCUSD pair rallied sharply overnight. It rose to a high of 57,500, which was its highest level since May this year. The pair also rose above all moving averages while the MACD and the Relative Vigor Index (RVI) are above the neutral level. The pair has also formed a bullish flag pattern. Therefore, the pair will likely keep rising in the near term.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.