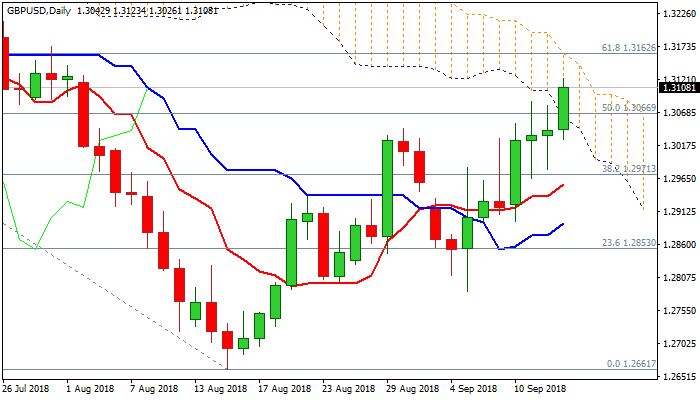

GBPUSD

Cable rallied into falling daily cloud, pulled higher by weaker dollar on disappointing US data. Fresh bullish acceleration neutralized downside risk seen after double long-legged Doji candles on Tue/Wed, keeping in play broader bulls from 15 Aug low at 1.2661. The Bank of England kept rates unchanged at 0.75% in widely expected action after the central bank raised interest rates in August and now leaving markets to digest the decision. The central bank is widely expected not to take any rate decision until Brexit divorce process is completed, but indicated further rate hikes at a gradual pace and according to the evidence from the economy. Daily tech show bullish momentum building and supporting further advance, as bulls look to generate fresh positive signal on break and close above daily cloud top (1.3162), also Fibo 61.8% of 1.3472/1.2661 fall. Meanwhile, bulls might be delayed as daily slow stochastic turned sideways in overbought territory and on track to generate bearish signal for consolidative / corrective action. Broken cloud base marks solid support at 1.3060, which should ideally contain corrective action and keep bulls intact. Only return and close below 55SMA (1.3013) would sideline bulls for deeper correction.

Res: 1.3123; 1.3162; 1.3185; 1.3213

Sup: 1.3066; 1.3026; 1.3013; 1.2963

Interested in GBPUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD tests the major level of 1.0650; followed by the nine-day EMA

EUR/USD remains lackluster during the early Tuesday, hovering near 1.0650. From a technical perspective, analysis suggests a bearish sentiment for the pair as it struggles below the pullback resistance at the 1.0695 level.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.