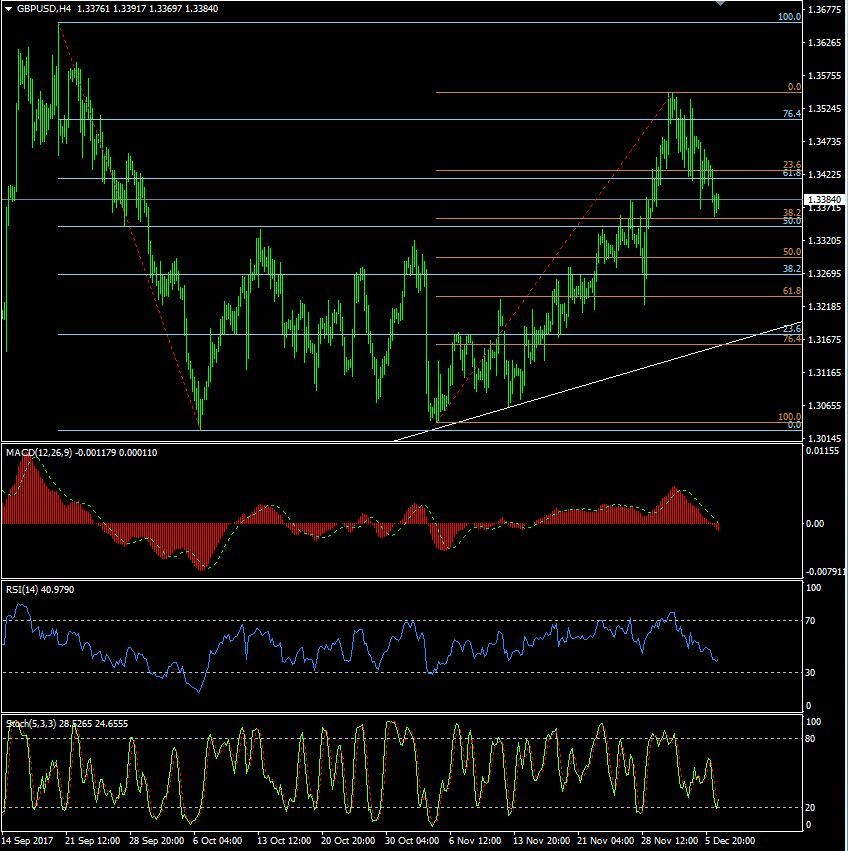

GBPUSD: 1.3470

After a quick dip to 1.3319, Cable rallied strongly on the positive Brexit headlines regarding the Irish border, and if further progress is made then we may see a test of 1.3550 or even 1.3650.

1 hour/4 hour indicators: Up

Daily Indicators: Turning higher?

Cable fell to a 1-wk low at 1.3358 amid Brexit uncertainty, ending NY 1.3375

Weekly Indicators: Turning higher?

Preferred Strategy: It looks set to remain choppy for Sterling, with Brexit headlines likely to guide the direction, although right now it all looks quite positive so I prefer to trade from the long side, particularly in the crosses, i.e. long GbpAud, short EurGbp. Watch for the UK data later today…it could be a busy session for Cable.

| Resistance | Support | ||

| 1.3595 | 22 Sept high | 1.3430 | Minor |

| 1.3549 | 1 Dec high | 1.3380 | Minor |

| 1.3538 | 4 Dec high | 1.3319 | Session low |

| 1.3500 | Minor | 1.3295 | (50% of 1.3038/1.3549) |

| 1.3484 | Session high | 1.3280 | Minor |

Economic data highlights will include:

Manufacturing/Industrial Production, Trade Balance, NIESR GDP Estimate

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.