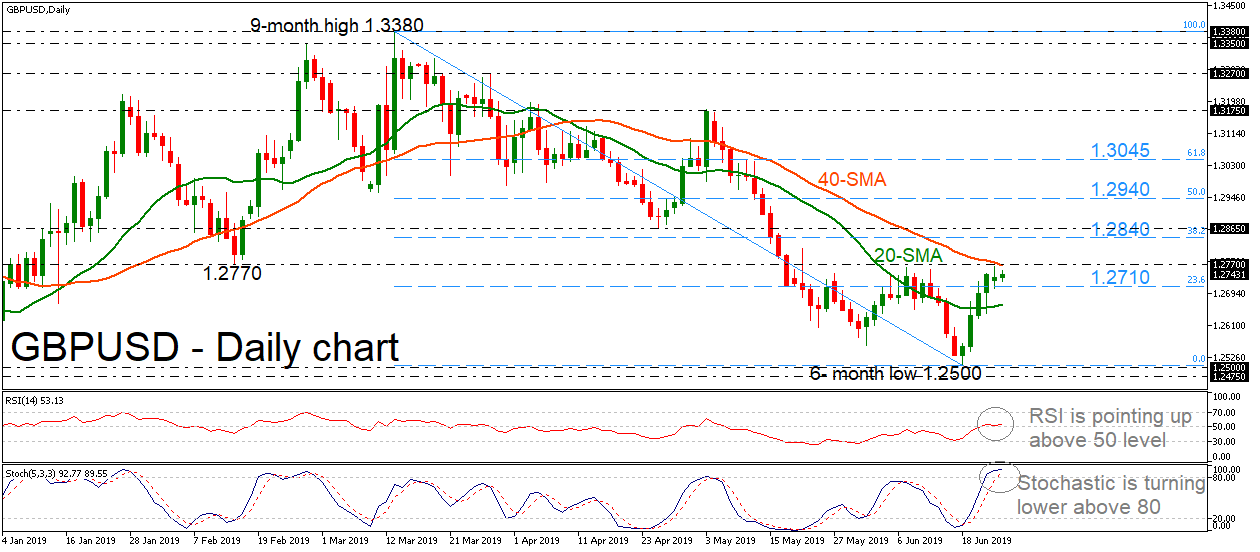

GBPUSD has been advancing over the last five days, following the rebound on the six-month low of 1.2500. Currently, the price is finding strong resistance near the 40-day simple moving average (SMA), which overlaps with the 1.2770 barrier.

Looking at the technical indicators the stochastic seems to be overstretched as it is turning lower above the 80 level. However, the RSI is pointing slightly up while in the positive territory, suggesting more gains in the near term.

If the price continues the strong bullish movement and surpasses the 40-SMA, it could find immediate resistance at the 38.2% Fibonacci retracement level of the downleg from 1.3380 to 1.2500 near 1.2840, before touching the 1.2865 barrier. Even higher, the 50.0% Fibonacci of 1.2940 could provide resistance as well.

On the other side, if the pair retreats and slips beneath the 23.6% Fibonacci region of 1.2710, it could meet support at the 1.2660 level. More losses could drive cable at the 1.2500 handle and the 1.2475 area, taken from the low on December 2018.

Overall, GBPUSD looks to be bullish in the near term and a daily close above 1.2770 could endorse traders’ bullish positions.

In the long-term picture, the pair has been remaining negative since the downfall from 1.3380.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.