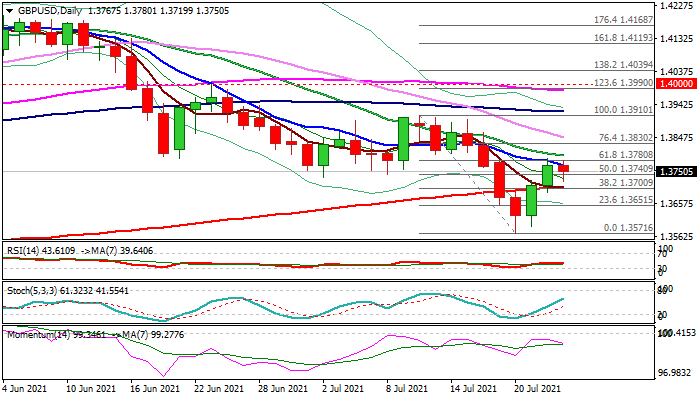

Cable eased on Friday after strong rally in past two days failed to clear pivotal barrier at 1.3780 (falling 10DMA / Fibo 61.8% of 1.3910/1.3571 downleg).

Conflicting signals from solid economic indicators and fears of stronger spread of the Delta variant of coronavirus, keep the pound without clear direction, with mixed technical studies contributing.

This week’s break above 200DMA (also Fibo 38.2% of 1.3910/1.3571) was strong bullish signal, which was partially offset by failure to resume recovery through next important barriers (10/20DMA’s).

Current easing so far looks like positioning for fresh push higher, with near-term action required to remain above broken 200DMA to keep bullish bias.

Formation of long-tailed Hammer candle on weekly chart adds to positive signals.

On the other side, rising negative momentum on daily and weekly chart warns of recovery stall.

Look for clearer direction signals on break of either 200DMA (1.3705) of 20DMA (1.3795).

Res: 1.3766; 1.3780; 1.3795; 1.3830

Sup: 1.3719; 1.3705; 1.3651; 1.3591

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.