GBP/USD

Cable holds in red and extends steep fall into fourth straight day, on track for the biggest weekly fall since the second week of June 2020.

Sterling weakened on Brexit tensions and delayed lift of Covid restrictive measure and came under increased pressure on hawkish Fed that lifted dollar, while today’s weaker than expected UK retail sales data added to negative signal.

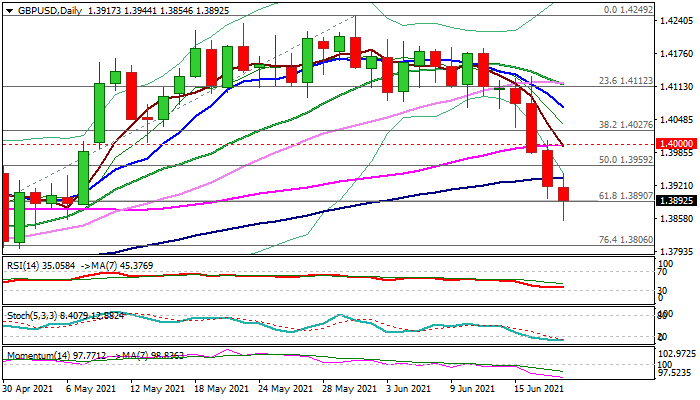

The pair fell to new six-week low (1.3854) in early European trading on Friday, with Thursday’s close below 100DMA (1.3936) and today’s break through pivotal Fibo support at 1.3890 (61.8% of 1.3669/1.4249), generating fresh bearish signals which look for confirmation on weekly close below 1.3890 Fibo level.

Bears eye 1.3800 (May low / near Fibo 76.4%), which guards weekly higher base at 1.3690 zone.

Oversold conditions and week-end profit-taking after strong fall may slow bears, with upticks under broken psychological 1.40 barrier to provide better selling opportunities.

Res: 1.3936; 1.3950; 1.4000; 1.4021.

Sup: 1.3854; 1.3800; 1.3715; 1.3690.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.