GBPUSD

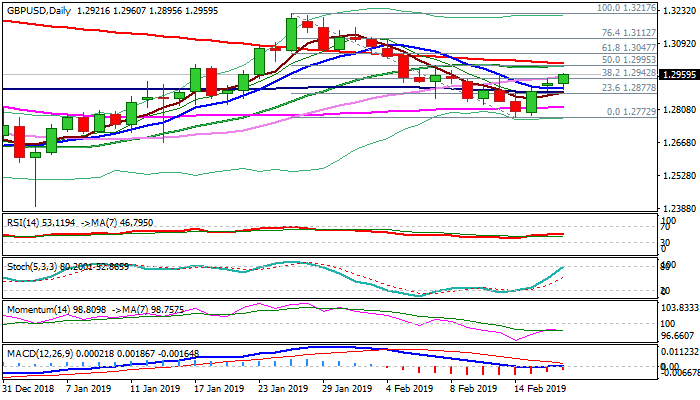

Cable enters American session on Tuesday firmly in green and above pivotal barrier at 1.2942 (Fibo 38.2% of 1.3217/1.2772 / daily Kijun-sen). The pair ticked lower after release of UK jobs data, as markets were initially disappointed after earnings came at 3.4% in three months to December, missing 3.5% forecast, however, data were solid, as pay growth remained at its fastest pace in a decade. Adding to positive tone was strong increase in job creation, which rose 167K in three month to December, beating 152K forecast and 141K in the previous period. Unemployment in UK remains at the lowest in over 40 years at 4%, completing the picture of strong UK labor sector ahead of Brexit. Fresh extension of recovery leg from 1.2772 low (14 Feb) looks for bullish signal on daily close above 1.2942 pivot, to confirm reversal and open way for test next strong resistance zone between 1.2990 and 1.3007 (converged 20/200SMA's / 50% retracement of 1.3217/1.2772). Sideways-moving 10SMA (1.2897) holds the action of Mon/today and is expected to keep the downside protected.

Res: 1.2990; 1.3007; 1.3047; 1.3102

Sup: 1.2942; 1.2897; 1.2879; 1.2819

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.