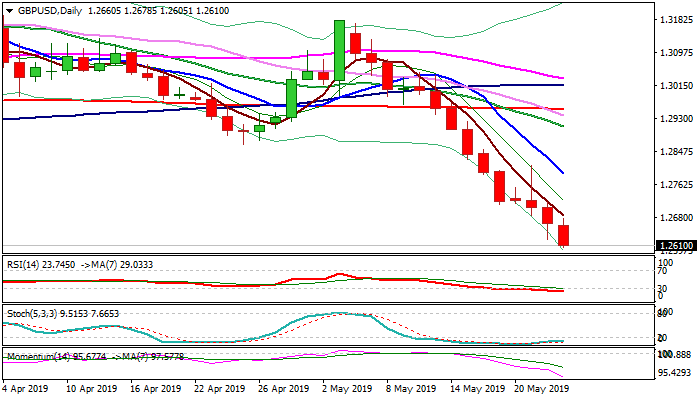

GBPUSD

Sterling continues to spiral down and hit new lowest levels since early Jan, as political turmoil in the UK intensifies and fears of no-deal Brexit rise that overshadows EU elections Prime Minister Theresa May is under strong pressure to quit and is expected to announce a date of her departure, likely on Friday. Boris Johnson is leading on the list of May's successors and markets see risk of further fall of pound if he becomes the PM. Technical studies remain firmly bearish and helped with negative sentiment, as cable holds in red for the thirteenth straight day and eyes targets at 1.2476 (2018 low) and 1.2397 (2019 low, posted on 3 Jan). Mild corrective actions are expected to offer better opportunities to re-enter bearish market, but deeply oversold daily studies so far lack any firmer signal. Falling 5SMA offers initial resistance at 1.2684, guarding more significant barrier at 1.2791 (falling 10SMA) which should limit stronger upticks and keep bears intact.

Res: 1.2650; 1.2684; 1.2719; 1.2773

Sup: 1.2600; 1.2580; 1.2528; 1.2476

Interested in GBPUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.