GBP/USD

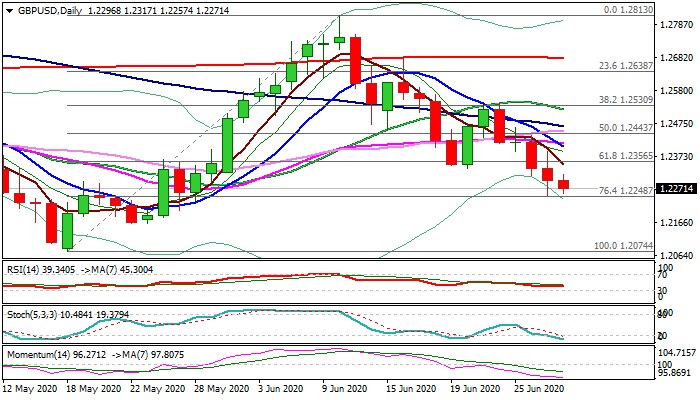

Cable remains firmly in red for the third straight day and pressures pivotal support at 1.2250 (Fibo 76.4% of 1.2074/1.2813/Monday's low, the lowest in one month).

Fresh weakness probes again into thick daily cloud after Monday's dip failed to register daily close in the cloud.

Fading risk sentiment keeps sterling under pressure which increases on expectations of the UK re-opening the most of the economy and further spending on infrastructure that the government is preparing for.

Weak economic data released today added to negative stance as the UK economy contracted 1.7% in Q1, more than 1.6% expected and UK current account deficit widened to 21.1 billion pounds, well above expected 15.6 billion gap.

Initial bearish signal could be expected on close within the cloud and confirmed on close below 1.2250 that would signal further weakness and expose support at 1.2161 (22 May trough). Solid supports at 1.2335 (22 June former low) and 1.2356 (broken Fibo 61.8% support) are expected to limit stronger upticks and keep bears in play.

Res: 1.2317; 1.2335; 1.2356; 1.2389

Sup: 1.2250; 1.2204; 1.2161; 1.2100

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.