GBP/USD

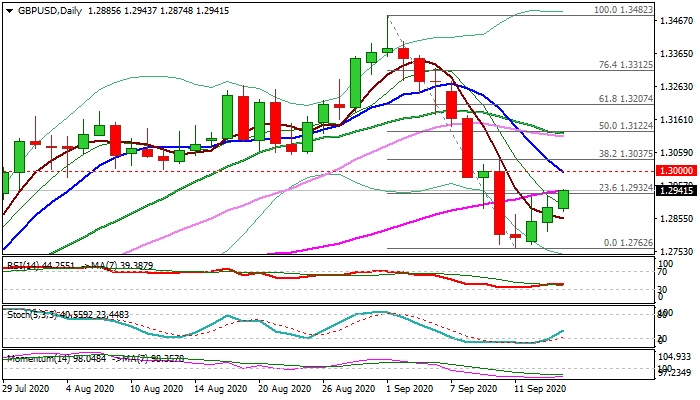

Cable edges higher on Wednesday, looking for another attempt at daily cloud top (1.2944) after the action in past two days was capped by rising cloud top.

The pair holds in green for the third straight day, with series of higher lows pointing to bullish near-term bias.

UK inflation fell to the lowest in almost five years in August, but release had a minor impact on sterling, inflated by weaker dollar and signals that the government might have a way through parliamentary labyrinth for PM Johnson’s bill which breaches existing Brexit agreement.

Daily techs show 14-d momentum rising from deep negative territory and RSI/Stochastic also heading north, but initial bullish signal could be expected only on firm break of daily cloud top, while rise above next pivotal barriers at 1.3000/37 (psychological / Fibo 38.2% of 1.3482/1.2762) is required to generate reversal signal.

Fed policy statement and remarks from chief Powell are key events today and expected to provide fresh direction signals.

The dollar may come under fresh pressure on dovish stance from Fed (expected scenario) on extension of ultra-accommodative policy and promise for further stimulus that would further boost pound’s recovery

Res: 1.2944; 1.3000; 1.3037; 1.3053

Sup: 1.2900; 1.2874; 1.2814; 1.2762

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.