GBP/USD

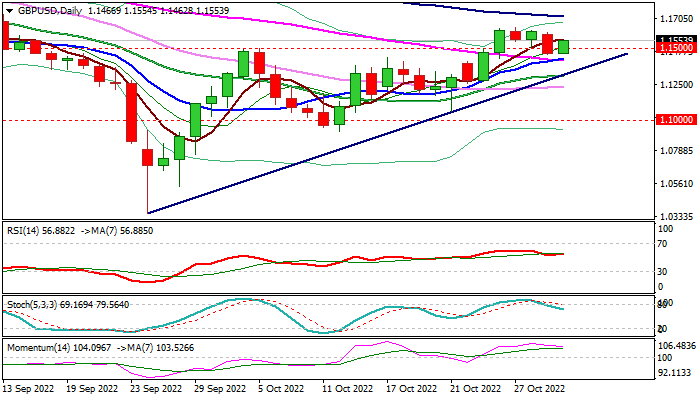

Cable regained traction on Tuesday on renewed risk appetite and returned back above 1.15 handle, signaling that a shallow pullback from new multi-week high (1.1645) might be over.

Quick changes in a view of Fed’s near-future actions, continues to move markets in opposite directions, as Monday’s optimism that the US central bank will stick to its aggressive mode, started to fade on Tuesday.

Markets are quite sure that the Fed will raise its interest rate by 75 basis points on Wednesday, but again see risk of softer approach in meetings in coming months, with prevailing expectations for 50 basis points hike in December that would be negative signal for dollar.

Cable is firmer on Tuesday, but still without significant change in near-term direction, as the downside is for now protected and the action underpinned by 10/55DMA bull-cross.

However, daily studies are mixed, as bullish momentum is weakening and stochastic is heading south, but MA’s (10/20/30/55) are in bullish configuration.

Expect initial bullish signal on close above 1.15 which would require confirmation on lift above 5DMA (1.1563) though a minimum requirement to signal bullish continuation will be sustained break above recent tops at 1.1645 that would expose next pivot at 1.1721 (100DMA).

Conversely, failure to hold gains above 1.15 would soften near-term structure and risk attack at converged 10/55DMA’s.

Market will focus on signals from Fed which is likely going to be a key driver in coming sessions.

Res: 1.1613; 1.1645; 1.1732; 1.1752.

Sup: 1.1459; 1.1429; 1.1339; 1.1308.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.