GBP/USD

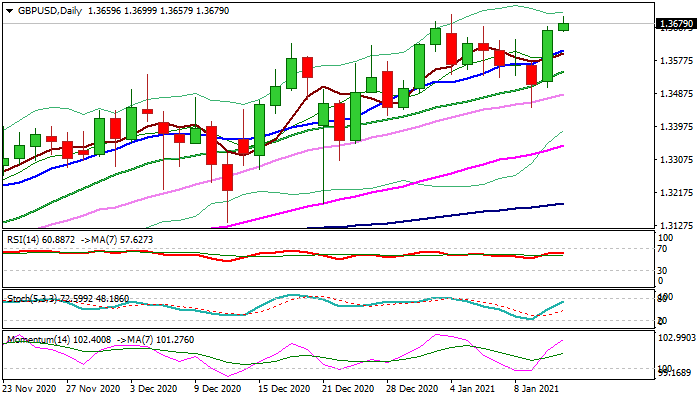

Cable keeps firm bullish tone in early Wednesday’s trading and extends strong rally from the previous day (the pair was up 1.04% for the day in the biggest one-day rally since Nov 5), pressuring key barriers at 1.3700 zone (new multi-month high / upper 20-d Bollinger band).

Full retracement of 1.3700/1.3451 pullback suggests that corrective phase is over and larger bulls are ready to resume.

Fibo projections at 1.3763 (123.6%) and 1.3800 (138.2%) mark immediate targets, with stronger acceleration to threaten psychological 1.40 barrier.

Rising stocks and weaker dollar underpin fresh risk appetite and lift sterling, as Brexit story is currently sidelined, but worries about pandemic remain and could deflate pound.

Failure to clear 1.37 pivot would signal prolonged consolidation, with dip-buying to remain preferred scenario while the price action stays above rising 10DMA (1.3607).

Dip and close below 20 DMA would increase downside risk.

Res: 1.3703; 1.3763; 1.3800; 1.3860.

Sup: 1.3657; 1.3607; 1.3577; 1.3547.

Interested in GBP/USD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.