- The GBP/USD is trading little changed on the upside, but the highest in 8-weeks in middle of 1.2800s.

- The UK Prime Minister Theresa May is set to speak in the parliament later on Monday in an attempt to save her Brexit deal scheduled for a parliamentary vote tomorrow.

- The UK parliament is unlikely to approve May’s Brexit deal as EU’s assurances fall short of convincing lawmakers.

- With Sterling waiting for key Brexit deal vote scheduled for Tuesday, the currency pair is set to move sideways.

With 74 days left before officially exiting the European Union, the United Kingdom is still far from having a clear view of what kind of Brexit it is set to experience. Looking at the Sterling levels at the highest since November last year, it looks like currency traders are not bothered at all.

The GBP/USD is trading little changed on the upside nearing 1.2860 ahead of the pre Brtexit vote speech by the UK Prime Minister Theresa May in the House of Commons. Although Theresa May’s call on lawmakers is expectedly a bare warning that delivering Brexit means voting for her deal as there are no other options on the table, the lawmakers are set to flex their muscle and reject the deal after the parliament banned the UK government from leaving the EU with no deal last week.

Voting for a May’s Brexit deal means orderly Brexit. Ousting the Brexit deal means either re-work the deal with the EU partners, that is highly unlikely, or face other domestic consequences including calling the early elections that will probably require delayed Brexit or even no Brexit at all.

Even political partners of Theresa May in the EU now face a tough time and admit that the option of delayed Brexit might be a compromise outcome.

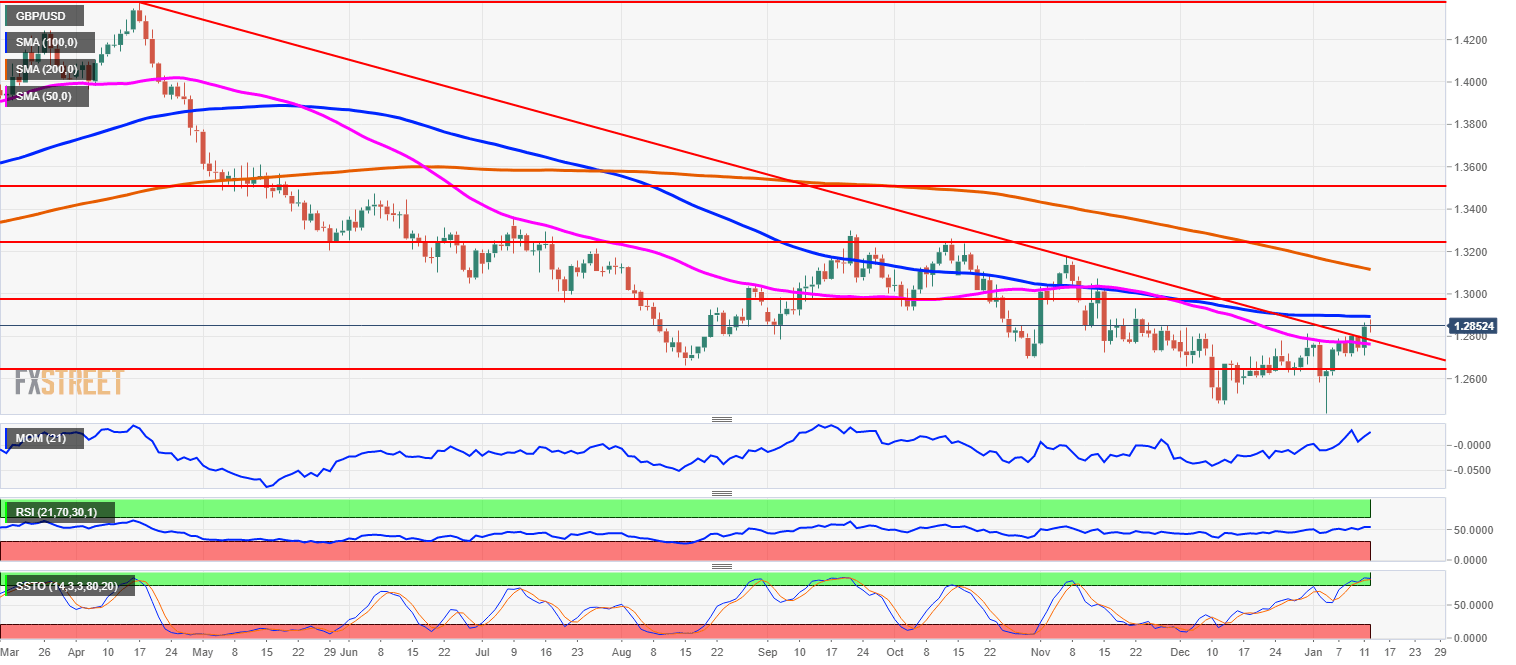

Technically the GBP/USD broke a long-term downtrend on the upside and it looks set for further gains fuelled by hopes for delayed Brexit. With the rejection of Brexit deal in the UK parliament widely expected and priced-in, the potential is building on the upside, although fundamentally rejecting Brexit deal is GBP/USD negative. The Relative Strength Index is flat in the neutral territory, but the Momentum and Slow Stochastics are elevated with Slow Stochastics set to make a bearish crossover in the Overbought territory. With Sterling waiting for key Brexit deal vote scheduled for Tuesday, the currency pair is set to move sideways. On the downside, the GBP/USD needs to break 1.2770 and below to return to the old trend low. On the upside, the 1.3000 is the next hurdle for GBP/USD.

GBP/USD daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.