Having witnessed some extreme volatility since the beginning of this week, the GBP/USD pair now seems to have stabilized a bit and has been oscillating in a narrow trading band over the past 12-hours or so. The pair remained well below nine-month tops set on Wednesday despite the fact that the UK PM Theresa May, after suffering two key defeats this week, finally got a win on Thursday, wherein the parliament voted to pass the motion to request the EU for a delay of the looming Brexit deadline on March 29.

The lawmakers approved a short delay until June 30 if a deal is approved by March 20, which means we're headed for yet another meaningful vote next Wednesday. The key focal point for GBP traders will be on whether May will be able to gather enough support for the meaningful vote this time around. If not, a longer extension will further prolong Brexit uncertainties and trigger some choppy trading in the Sterling.

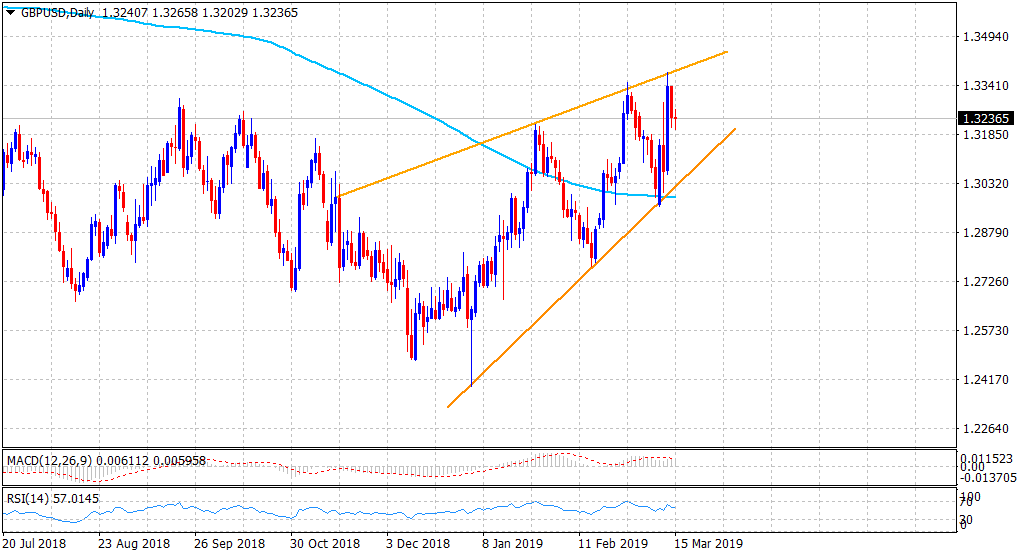

But unless we get more clarity on the matter, the pair seems more likely to swing around within a broader trading range, though a sustained break below the 1.3200 handle might accelerate the slide further towards the 1.3165-60 support area. A subsequent weakness might negate prospects for further near-term up-move and drag the pair back towards testing the 1.3100 round figure mark en-route the 1.3070 horizontal level. On the flip side, the 1.3300 handle now becomes an immediate strong hurdle, which if conquered might push the pair back towards challenging multi-month tops, around the 1.3380 region.

Looking at a slightly broader picture, the pair now seems to be forming a bearish rising wedge chart pattern, though will be confirmed only after a sustained break below a confluence region near the 1.30 psychological mark - comprising of the very important 200-day SMA and pattern support.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD faces decent contention around 1.0600

The knee-jerk in the Greenback reignited some buying interest in the risk complex and pushed EUR/USD to three-day highs near 1.0680, rapidly leaving behind the recent yearly low around 1.0600.

Gold dips on falling US yields as traders shrug off hawkish Fed remarks

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.