- Boris Johnson wins the first round of UK leadership contest.

- No-deal Brexit fears hold investors from placing bullish bets.

- Likelihood of a Fed rate cut weighs on the USD and lend some support.

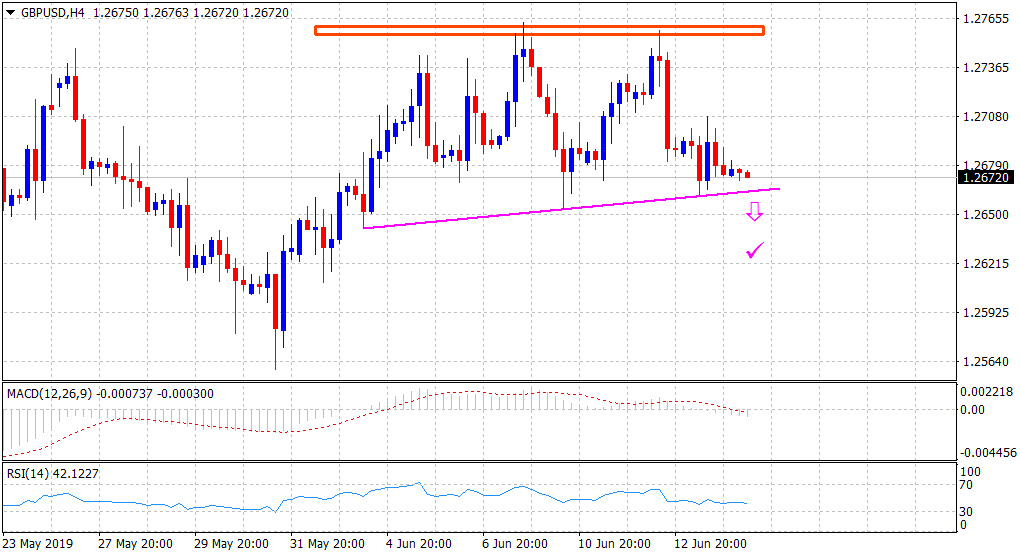

The GBP/USD pair remained depressed through Thursday's trading session and extended the previous session's rejection slide from the 1.2750-60 supply zone, albeit remained well within this week's broader trading range. The pair did tick higher but struggled to sustain above the 1.2700 handle after the results of the first ballot for Tory leadership contest showed that the leading candidate Boris Johnson received the highest - 114 votes. However, given that Johnson is not looking to extend Article 50 and is also ready to leave the EU on October 31st with or without a deal, fears of a no-deal split held investors from placing any aggressive bullish bets and capped any meaningful up-move.

On the other hand, the US Dollar continues to benefit from safe-haven flows amid concerns over a further escalation in trade tensions between the world's two largest economies. Meanwhile, market participants remained convinced that the Fed will eventually move to cut interest rates by the end of this year, further reinforced by the recent disappointment from the latest US monthly jobs report and softer US consumer inflation figures. Increasing Fed rate cut bets kept a lid on a modest USD strength and turned out to be one of the key factors that helped limit any deeper losses, at least for the time being.

The pair extended its sideways consolidative price action through the Asian session on Friday, awaiting fresh catalyst before traders start positioning for the next leg of a directional move. In absence of any major market moving economic releases from the UK, traders on Friday will take cues from the release of US monthly jobs report - due later during the early North-American session. This coupled with a scheduled speech by the BoE Governor Mark Carney might influence the sentiment surrounding the British Pound and further contribute towards producing some meaningful trading opportunities on the last trading day of the week.

From a technical perspective, the pair's repeated failures near the 1.2750-60 region clearly suggest that the near-term selling pressure might still be far from over. A follow-through weakness below weekly lows support near mid-1.2600s will reinforce the bearish outlook and turn the pair vulnerable to accelerate the slide further towards the 1.2600 round figure mark en-route multi-month lows support near the 1.2560 region.

On the flip side, the 1.2700 handle now seems to have emerged as an immediate support, which if conquered might assist the pair to make a fresh attempt towards challenging the 1.2750-60 important barrier. Only a sustained move beyond the mentioned hurdle might prompt some near-term short-covering move and lift the pair even beyond the 1.2800 mark towards testing the next major hurdle near the 1.2860-65 region.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.