With a set of Brexit and politics related risk factors weighing on Sterling at the beginning of the week, better-than-expected economic fundamentals provided solid support for GBPUSD to end the week little changed, but on the upside.

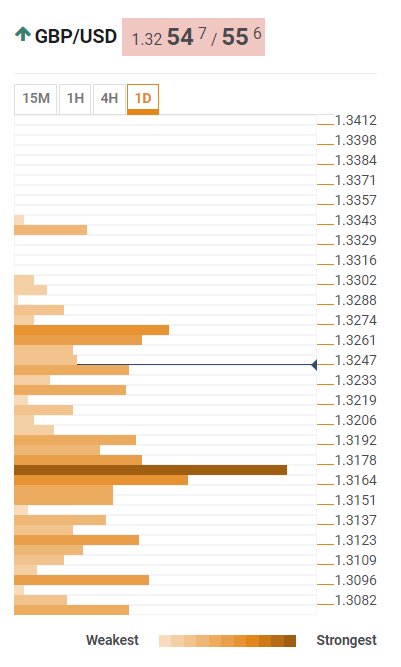

The GBPUSD is approaching the triangle formed by long-term support line starting on January 12 and connecting the cyclical bottoms that currently lies at $1.3100 level. On the upside, the 23.6% Fibonacci retracement of this year’s uptrend serves as a key resistance at $1.3265 level.

The $1.3265 level is also very strong resistance level in the Confluence indicator study representing a heavyweight cluster of indicators.

With Sterling approaching the triangle corner, the breakthrough is expected in either direction as Brexit related topics weigh on Sterling, while hard data from the economy keep surprising on the upside.

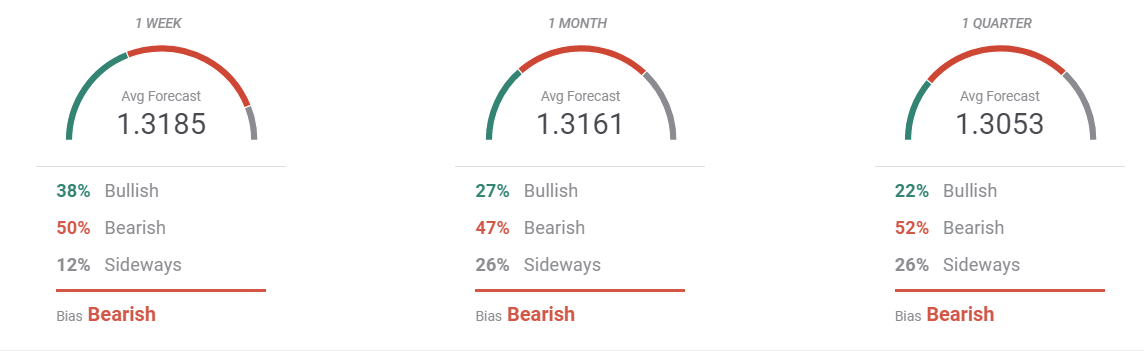

The FXStreet Forecast Poll is indicating that the majority of 34 analyst and FX forecasters participating in the survey see GBP/USD rather bearish on all of the time frames.

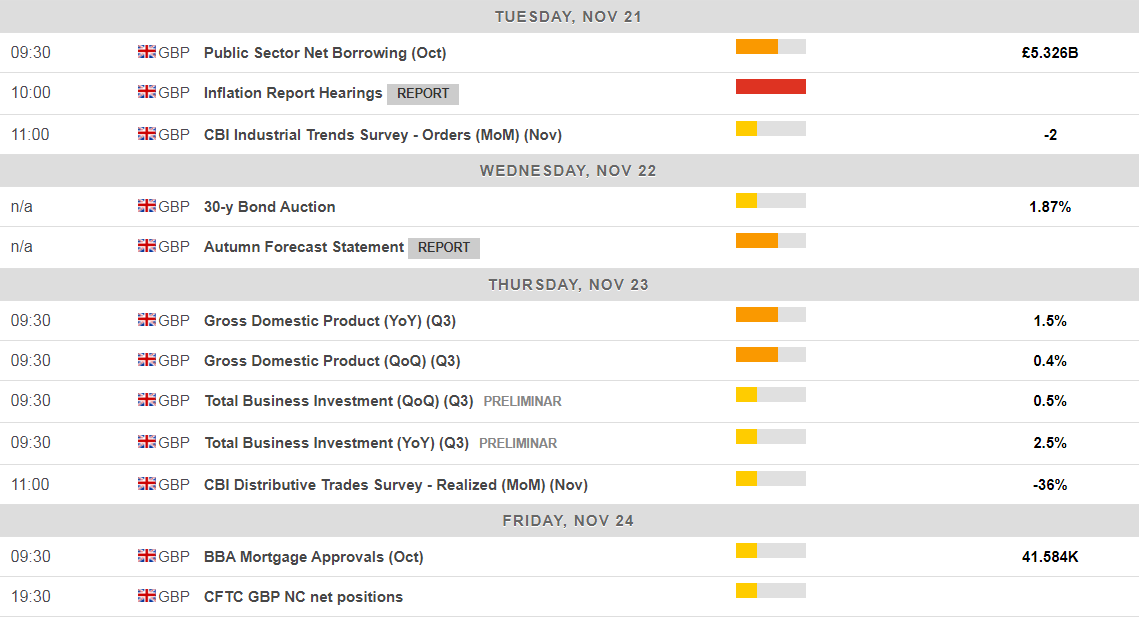

The Inflation report parliamentary hearing, the Autumn Forecast Statement from the Chancellor of Exchequer and second reading of third-quarter GDP are set to headline the week ahead.

The Inflation report hearing due on Tuesday is expected to summarise the aspects behind the Bank of England’s decision to hike the Bank rate for the first time in a decade at the beginning of this November. The BoE’s Governor Carney though is expected to stand firmly behind the decision justifying the rate rise by higher inflation pushes household incomes into negative territory and lowers the aggregate demand, factors weighing on the economic outlook.

The Autumn Forecast Statement scheduled for Wednesday is providing the update of the economic outlook and previews of the UK government's budget for the coming year, including expected spending and income levels, borrowing levels, and financial objectives. Philip Hammond will also comment on the latest independent economic forecasts prepared by the Office of Budgetary Responsibility and most likely also comment the Brexit negotiations.

The forecast from both the Bank of England and the European Commision on the UK economy showed the economic slowdown as the main scenario for three years ahead, the Autumn Statement is expected to see the UK economy decelerating as well.

The first estimate for the UK third-quarter GDP surprised on the upside with 0.4% q/q growth and the 0.4% increase is set to be confirmed also with the second estimate due next Thursday. The Office for National Statistics will enrich the GDP report by the index of investment that is expected to rise 0.5% q/q and 2.5% y/y.

Last week’s summary

Sterling opened the third week of November with the gap on the downside after the reports from British newspapers showed growing dissent within the ruling Conservative party with Prime Minister Theresa May’s leadership. Up to 40 members of the parliament from the Tory party signed the letter calling for the resignation of Theresa May with no apparent result of ongoing UK-EU Brexit negotiations.

Under the heavy weight of political uncertainty GBPUSD fell as low as $1.3076, about 100 pips lower compared to previous Friday close. Later during the week, the data showed that the inflation edged lower, while the labor market remained robust with the unemployment rate at 42-year low and retail sales rising above expectations in October. All fundamental factors gave Sterling a helping hand to recover back above $1.3200 area.

The UK CPI remained unchanged from the previous month in September while consumer prices rose 3.0% y/y. The inflation rate in October pared September’s reading and remained at the highest level since April 2012.

The unemployment rate dwelled at a 42-year low in September, the nominal weekly earnings rose 2.2% over the year with and without bonuses and the number of people claiming unemployment benefits rose 1.1K in September only. At the same time, the UK economy has shed 225K jobs just over the past two months. Falling compared to previous months, but still better than a year ago means that the momentum the economy received in late 2016 is fizzling out of the UK labor market

The UK retail sales increased 0.3% m/m beating the forecast of 0.1% m/m while core retail sales excluding motor fuel fell -0.3% m/m in October in a sign of recovering demand.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.

-636465133097386582.png)