- GBP/USD witnesses a modest pullback from two-week tops on Thursday.

- The intraday downtick was led by reviving safe-haven demand for the USD.

- Investors look forward to flash UK PMI prints for some meaningful impetus.

The GBP/USD pair edged lower on Thursday and eroded a part of the previous session's goodish positive move to two-week tops. As investors assessed the possibility of a BoE rate cut at its upcoming meeting on January 30, a modest pickup in the US dollar demand prompted some long-unwinding trade on Thursday. Concerns over China's coronavirus outbreak turned out to be one of the key factors that benefitted the greenback's perceived safe-haven status against its British pound.

Apart from a modest USD uptick, the pullback lacked any obvious fundamental catalyst and thus, lacked any strong follow-through. The pair quickly reversed an intraday dip to sub-1.3100 levels, albeit ended the day with modest losses and snapped three consecutive days of winning streak. The pair held steady above the mentioned handle through the Asian session on Friday. Heading into next week's BoE policy decision, the flash version of the UK Manufacturing and Services PMI prints for January will play a key role in influencing the pair's momentum on the last trading day of the week.

Short-term technical outlook

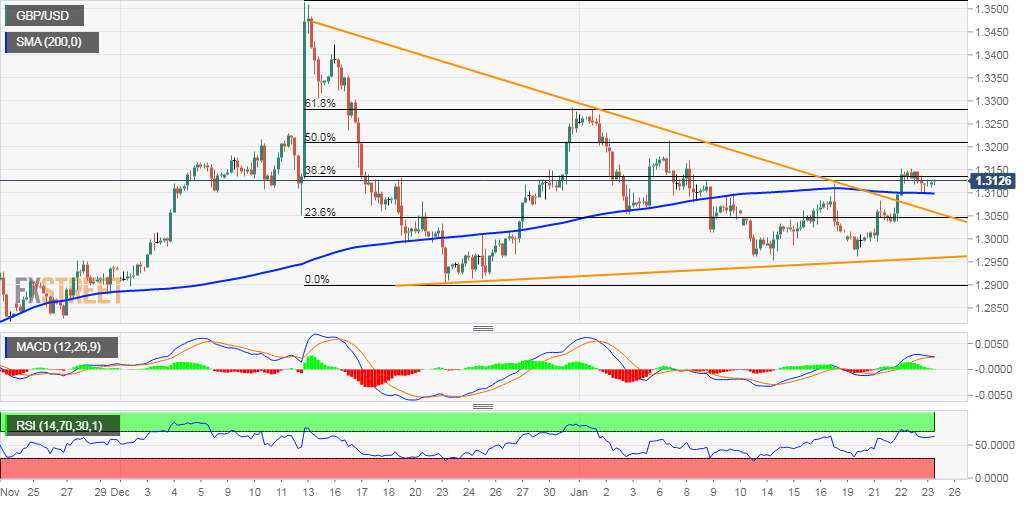

Looking at the technical picture, the pair stalled its recent positive momentum near a resistance marked by 38.2% Fibonacci level of the 1.3515-1.2905 recent pullback. However, the fact that the pair has already confirmed a near-term break through a descending triangle, the near-term technical set-up seems tilted in favour of bullish traders. A sustained move beyond the weekly swing highs, around mid-1.3100s, will reaffirm the constructive outlook and set the stage for a move back towards reclaiming the 1.3200 round-figure mark. The momentum could further get extended towards mid-1.3200s and late December/early January swing high resistance near the 1.3285 region.

On the flip side, any pullback might continue to attract some dip-buying near the 1.3100 round-figure mark, which coincides with 200-period SMA on the 4-hourly chart and should help limit the downside. The triangle resistance breakpoint, currently near the 1.3070-65 region, now seems to act as strong support, which if broken might prompt some near-term weakness. The pair then might turn vulnerable to accelerate the slide back towards challenging the key 1.30 psychological mark with some intermediate support near mid-1.3000s (23.6% Fibo. level).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.