- Junior coalition Unionist party said it will not support a Brexit deal leaving Northern Ireland separated from the rest of the UK.

- Earlier this week the UK Cabinet was invited to study the Brexit agreement without the crucial part on the Irish border that is being negotiated in Brussels.

- The UK third-quarter GDP rose 0.6% over the quarter meeting the market expectations.

- Fed paved the way for the December rate hike in support of the US Dollar. For more details read Joseph's Analysis here.

The GBP/USD is trading down 0.3% at around 1.3000 on Friday as a combination of hawkish Fed paving the way for the December rate hike, the Unionist party refusing to accept the Brexit deal leaving Northern Ireland separated and the lower than expected UK GDP growth weigh on the currency.

The UK Cabinet was invited by the Prime Minister Theresa May to study the Brexit agreement that misses the crucial part on the Irish border on Thursday while Brexit negative headlines about the timing of possible Brexit deal for three weeks at the earliest saw Sterling sell-off from a 3-week high of 1.3175. The GBP/USD has also been buoyed by weakness in the US dollar following the Democrats snapping the victory in the House while Republicans retained the Senate majority after the US mid-term elections.

With the Irish border issue being negotiated in Brussels, chances are that the UK Prime Minister could visit Brussels as well to finalize the deal before approval at the European Council meeting. Such a scenario should be treated with caution as the parliamentary approval remains a potential risk.

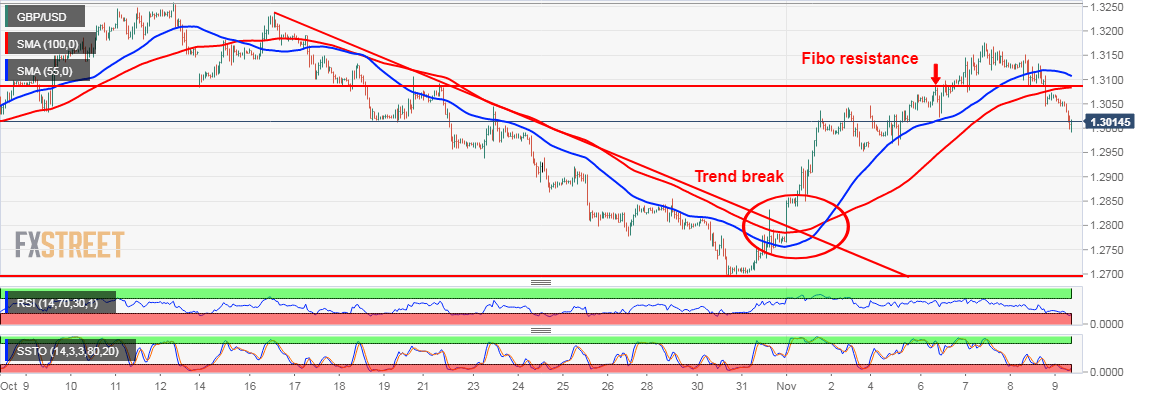

The GBP/USD broke the 26.3% Fibonacci retracement level of 1.3085 to the downside as hawkish Fed and Brexit pessimism pushed the currency pair past key support level. The Relative Strength Index and Slow Stochastics made a bearish turn moving into the oversold territory. The key area of support at 1.3085 was broken and the currency pair is now in the run to close the Monday morning gap at 1.2960 next.

GBPUSD 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.