The GBP/USD pair met with some fresh supply on Thursday and extended previous session's retracement slide from three-week high level of 1.3175. With investors looking past the latest Brexit optimism, a report, via the Sun, saying that the UK PM May could ask for more time to cut a Brexit deal with Cabinet, exerted some fresh downward pressure on the British Pound.

The selling pressure aggravated further on the back of resurgent US Dollar demand, which got an additional boost after the Fed maintained its hawkish stance with an upbeat assessment of the economy and indicated further gradual rate hikes in the future.

The downfall seemed rather unaffected by some optimistic comments from the UK Foreign Minister Jeremy Hunt, saying that Brexit negotiation is in the final stage and that I am confident that we will reach an agreement. Bearish traders even shrugged off reports saying that a full withdrawal agreement could be published as early as next Tuesday, while other headlines suggested that a deal will be reached within three weeks.

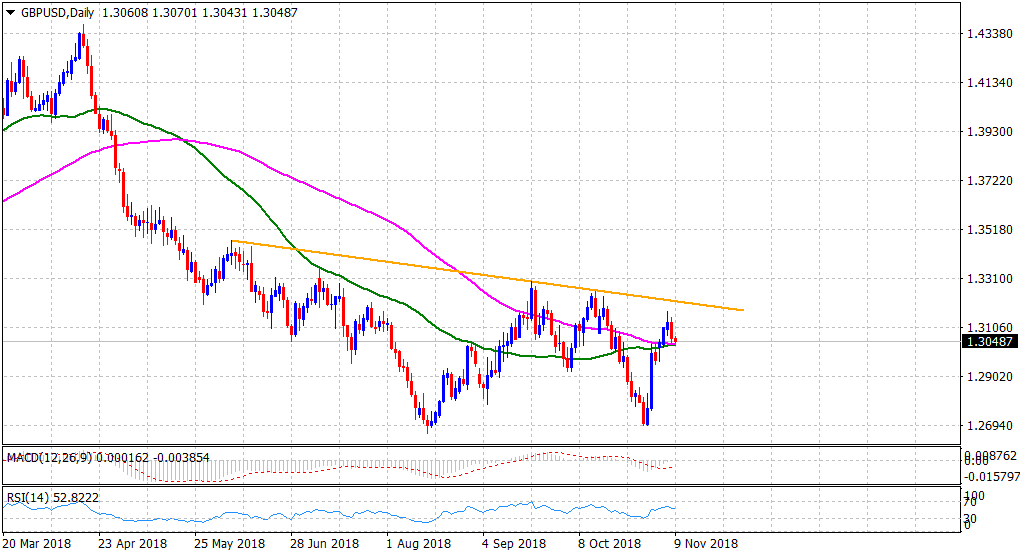

The pair tumbled over 100-pips intraday and the selling remained unabated through the Asian session on Friday. Currently holding just above 50/100-day SMA confluence support, market participants now look forward to the release of prelim UK Q3 GDP growth figures, along with industrial/manufacturing production and trade balance data for some fresh impetus. This coupled with any fresh Brexit-related headlines and the scheduled release of prelim Michigan Consumer Sentiment Index for November from the US might further assist traders to grab some short-term opportunities.

From a technical perspective, the pair's recent up-move stalled ahead of an important descending trend-line resistance, extending through monthly highs set in June, Sept. and October. A follow-through weakness below the mentioned confluence support, currently near the 1.3030 region, might negate prospects for any further near-term positive move. The slide might turn the pair vulnerable to break through the key 1.30 psychological mark and head towards testing weekly lows support near the 1.2965 level.

On the flip side, the 1.3100 handle now becomes immediate strong resistance and is followed by the 1.3125-30 supply zone. A follow-through buying interest might now help the pair to surpass the 1.3175-80 intermediate resistance, and the 1.3200 handle, towards testing the trend-line resistance, currently near the 1.3220-25 region.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.