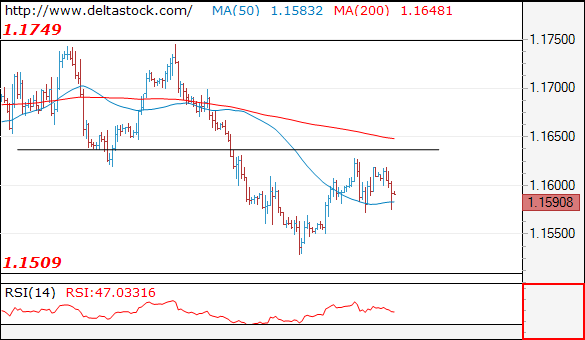

EUR/USD Current level - 1.1590

The pair failed to break through 1.1640 hurdle and currently the bias is neutral, within the 1.1570-1640 range. My outlook is rather bearish below 1.1640, for a slide towards 1.1509.

|

|

||||||||||||||||

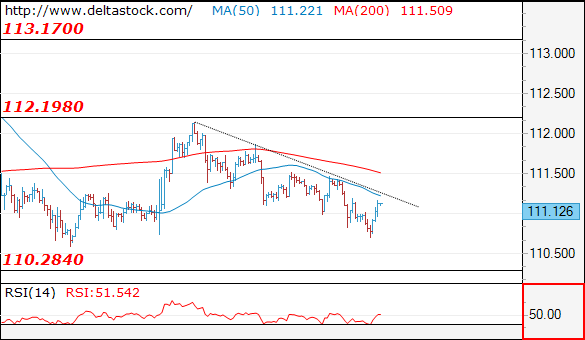

USD/JPY Current level - 111.12

I favor a break through 111.50 key level, towards 112.80 zone.

|

|

||||||||||||||||

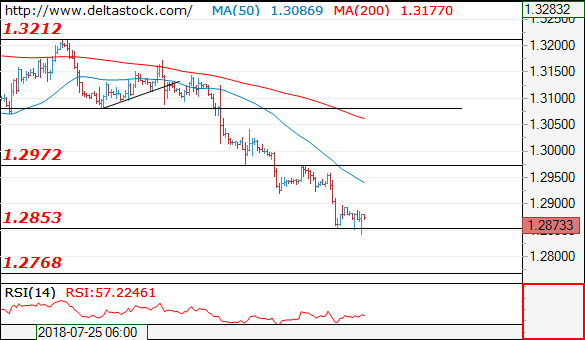

GBP/USD Current level - 1.2873

The general bias remains bearish, for a renewal of the downtrend towards 1.2770. Intraday there is a risk of another upswing to 1.2980 minor resistance.

|

|

||||||||||||||||

These analyses are for information purposes only. They DO NOT post a BUY or SELL recommendation for any of the financial instruments herein analyzed. The information is obtained from generally accessible data sources. The forecasts made are based on technical analysis. However, Deltastock’s Analyst Dept. also takes into consideration a number of fundamental and macroeconomic factors, which we believe impact the price moves of the observed instruments. Deltastock Inc. assumes no responsibility for errors, inaccuracies or omissions in these materials, nor shall it be liable for damages arising out of any person's reliance upon the information on this page. Deltastock Inc. shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation, losses or unrealized gains that may result. Any information is subject to change without notice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Deltastock AD is fully licensed and regulated under MiFID. The company is regulated and authorised by the Financial Supervision Commission (FSC), Bulgaria, Reg. No. RG-03-01

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.