- A combination of factors assisted GBP/USD to regain positive traction on Tuesday.

- Hopes for a last-minute Brexit trade deal continued lending support to the pound.

- The risk-on mood weighed heavily on the safe-haven USD and remained supportive.

The GBP/USD pair had some good two-way price swings on Tuesday and finally settled in the green for the third consecutive session, albeit remained below twelve-week tops set in the previous day. In the absence of fresh Brexit updates, the lack of progress on three sticking points – the so-called level playing field, fisheries and state-aid rules – prompted some intraday selling around the major. However, investors remained optimistic about the possibility of a last-minute Brexit trade deal, which, in turn, continued extending some support to the British pound. Apart from this, the emergence of some fresh selling around the US dollar further contributed to the pair's overnight uptick.

The greenback remained depressed on the back of the prevalent risk-on environment amid the progress toward remedies for the highly contagious coronavirus disease. Meanwhile, the formal start of US president-elect Joe Biden's transition to the White House cleared the uncertainty on the US political front. This, along with reports that the former Fed Chair Janet Yellen could become the next US Treasury Secretary, provided an additional boost to the already upbeat market mood. The USD bulls failed to gain any respite from Tuesday's disappointing release of the Conference Board's Consumer Confidence Index, which dropped notably to 96.1 in November from 101.4 in the previous month.

Despite the supporting factors, the pair lacked any strong bullish conviction and the upside remained capped below the 1.3400 round-figure mark. The pair was seen hovering in a narrow trading band around mid-1.3300s through the Asian session on Wednesday. There isn't any major market-moving economic data due for release from the UK and British finance minister Rishi Sunak is due to deliver a one-year Spending Review to the parliament at around 1230 GMT. Apart from this, the incoming Brexit-related headlines will influence the sterling and produce some trading opportunities. Later during the US session, a slew of top-tier US macro data, followed by the FOMC meeting minutes will determine the next leg of a directional move for the greenback and provide some meaningful impetus.

Short-term technical outlook

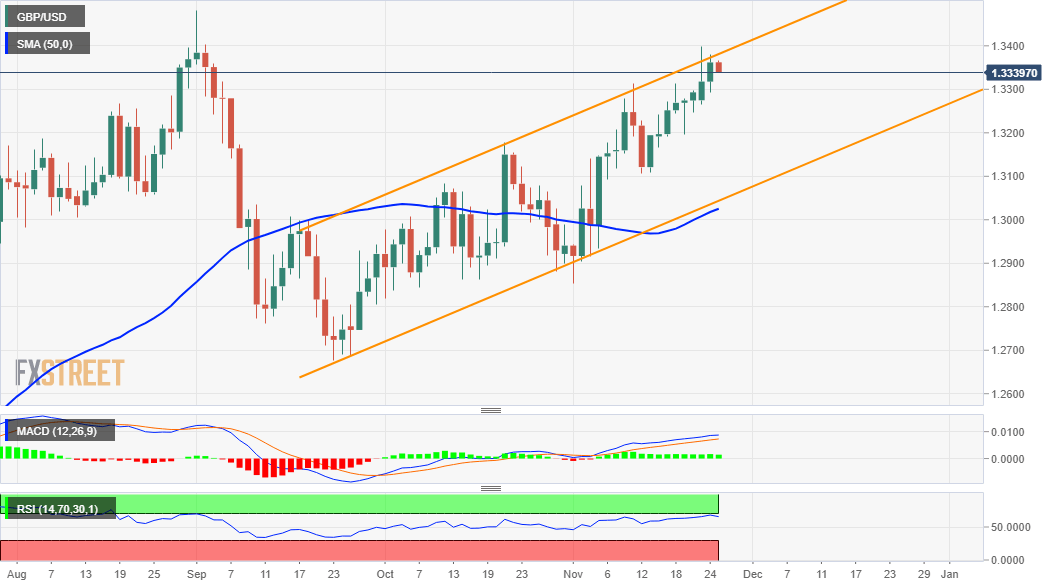

From a technical perspective, the pair has been struggling to make it through a resistance marked by the top end of a two-month-old ascending trend-channel. That said, the emergence of some dip-buying on Tuesday still favours bullish traders. However, it will be prudent to wait for some follow-through buying above the mentioned barrier, currently near the 1.3400 mark, before positioning for any further appreciating move. A sustained breakthrough will be seen as a fresh trigger for bullish traders and push the pair further towards September monthly swing highs, around the 1.3480 region, en-route the key 1.3500 psychological mark.

On the flip side, the 1.3300 round-figure mark might continue to act as immediate strong support. Any subsequent fall might still be seen as a buying opportunity and remain limited near the 1.3260 horizontal support. Failure to defend the mentioned support levels might prompt some technical selling and turn the pair vulnerable to slide back towards the 1.3200 round-figure mark. The corrective slide could further get extended to the 1.3160 region before the pair eventually drops to test the next major support near the 1.3110-05 zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.