FX News Today

USD reversed its 5 day run as Yields stalled too. House vote tonight to impeach President Trump, (YouTube have banned him for 7 days), Pence will not initiate the 25th Amendment to remove him. The symbolism is significant, no President has ever been impeached twice. Equities flat too (UBER +7.24%,TSLA +4.72%, FB -2.24%, GooGL & NFLX -1.00%) Asian markets also flat. GBP rallied after Bailey pushed back on Negative Interest Rates. Oil rallied over 1% after surprise inventory drawdowns peaked at $53.90, AUD pegged by possible RBA “push back” to strong AUD. Gold recovered $1850.

China reported its largest daily new COVID-19 cases in 5 months.

USDIndex – Back under 90.00 from rejection of 90.50 yesterday. Trades at 89.95 just over S3 – PP 90.40 – S3 89.90, S2 90.07.

EUR – Recovered back over 1.2200 (R2) – Trades at 1.2215 now– PP – 1.2157. R3 1.2225.

JPY – Reverses under 104.000 – after rejection 104.50 on Monday. – Trades at 103.68 (200hr MA). – PP 103.90, S1 103.55.

GBP – Big rally – spurred by USD weakness and Governor Bailey pushing back on Negative Interest Rates. Breached 1.3600 after multiple attempts – rallied to 1.3690 – PP 1.3585, R1 1.3668, R2 1.3715.

AUD – Over 0.7700 yesterday to test 0.7770 (R2) now. R1 0.7748.

NZD – Over 0.7200 yesterday to test 0.7240 (R3) now. r2 0.7215.

CAD – back to test 1.2700 (S2) today as Oil rises – S1 1.2725, S3 1.2664 from Friday.

CHF – Trades back to 0.8850 (200hrMA) and under S3 (0.8865)- PP 0.8900.

BTC – Back to around $34,600. – PP today 34,500, r1 36,600, s1 32,800.

GOLD – Recovers over 1850 (PP) – Trades at 1860 (R1) – R2 1875, PP 1840.

USOil – New 11-mth high $53.90 (R2) after surprise drawdown in private inventories (EIA data later). R3 $54.70, r1 53.55.

USA500 – Closed up 1.5 (+0.04%) 3800 – USA500 FUTS now at 3808. 48 days north of 20SMA (3740).

Today – EZ industrial production, US CPI, ECB’s Lagarde, Fed’s Bullard, Brainard, Harker, Clarida.

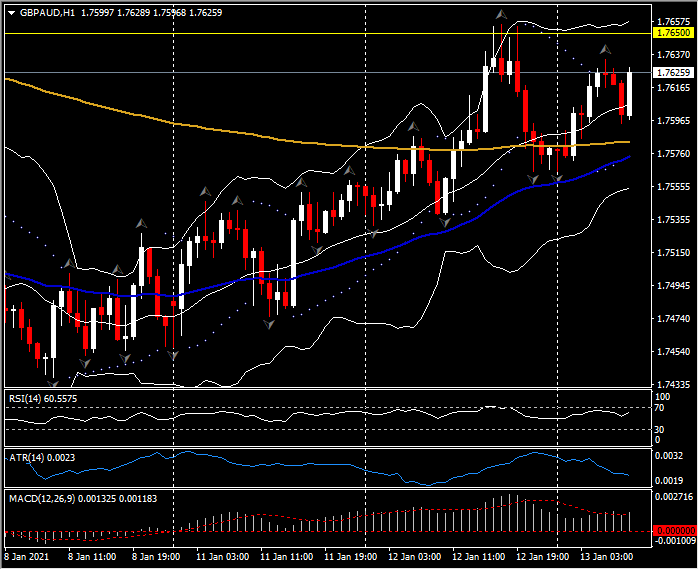

Biggest (FX) Mover @ (07:30 GMT) GBPAUD (+0.23%) 5th day higher – Bounced from 200MA on open, testing 1.7625 now, key resistance 1.7650. Fast MAs aligned and trending higher, RSI 59 and rising, MACD histogram & signal line aligned higher and north of 0 line from Monday open, Stochastics rising to OB. H1 ATR 0.023, Daily ATR 0.0125.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.