Introduction

The Peoples’ Bank of China set the weakest reference rate for the Yuan in five years, setting the level at 6.54693 compared 6.5716 anticipated. The currency markets for USD/CNY and USD/CNH, along with the rest of USD/Asia FX, moved higher on this news. However the buoyancy did not last long. USD was ultimately under some potentially short lived pressure during Asian trading despite stronger than expected new home sales data. The price of crude oil has hit a seven-month high at US$49.35 whilst the active copper futures contracts rose by over half a percent, aiding Antipodean currencies in their reversals from declines yesterday.

Asian Session

Goldman Sachs Group Inc. indicated that it expects JPY to move lower by 12% over the next twelve months. USD/JPY has traded within a 68-pip range overnight with the door balance amidst recent good data, a potential benchmark interest-rate hike, but also downplaying rhetoric from St. Louis Fed President James Bullard. Speaking on television, Bullard mentioned that a June move by the central bank in the states should not be pre-empted and thus priced in, and also that a press conference does not have to essentially accompany such a hike.

Australian construction work data came in lower than previously, whilst Kiwi trade balance data added buoyancy to that currency. AUD and NZD have gained close to 0.5% and 0.25% respectively during APAC trading, with the price of cooper aiding the mining industries in Australia and New Zealand.

Singaporean GDP data proved largely in line with expectation as the trade and industry ministry maintained its growth forecast for 2016. Both KRW and MYR strengthened, as with other nearby countries’ currencies, largely on the back of the recent greenback weakness.

The day ahead in Europe and NY

EUR/USD trades at 1.1152 as London begins trading, after finance ministers across the continent agreed to a fresh EUR 10.3bio in new loans directed towards the Greek economy. German consumer confidence data has already been released and proved a little better than expected, whilst business climate details will print out of Frankfurt at 09:00 BST.

Aside from the aforementioned, the Swiss ZEW Survey will be released at 10:00 BST today. ECB Vice-President Victor Constâncio speaks at The Bank of England on Threadneedle Street in London. The speech is scheduled for 11:30 BST.

Goods trade balance data a house price index will be shown to the market in North America at 12:30 BST and 13:00 BST respectively today, not before mortgage application info at midday BST. Crude oil stocks info. will be closely eyed by commodity and currency traders, whilst PMI figures print at 14:45 BST. Patrick T. Harker of The Philly Fed. speaks at 14:00 BST. The Bank of Canada will release an interest rate statement half an hour into NY equity trading, and is also expected to keep its benchmark interest-rate fixed at 0.5%.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1152 | 0.12 | 1.1158 | 1.1135 |

| USDJPY | 109.88 | 0.1 | 110.19 | 109.87 |

| GBPUSD | 1.461 | -0.17 | 1.4638 | 1.4603 |

| AUDUSD | 0.7211 | 0.41 | 0.7219 | 0.7174 |

| NZDUSD | 0.6754 | -0.25 | 0.6764 | 0.6734 |

| USDCHF | 0.9912 | 0.22 | 0.9936 | 0.9909 |

| EURGBP | 0.9635 | -0.29 | 0.7639 | 0.7612 |

| EURCHF | 1.1058 | 0.7 | 1.1073 | 1.1051 |

| USDCAD | 1.3105 | 0.15 | 1.3133 | 1.3086 |

| USDCNH | 6.5608 | 0.9 | 6.5694 | 6.5605 |

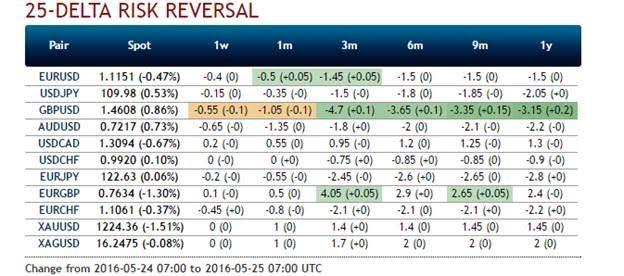

FXO

The small possibility of a June hike from The US Federal Reserve is giving support to one month volatilities in both the EUR/USD and USD/JPY spaces. The respective straddles trade at 8.8% and 11.15%. Citibank options analysts note that the potential for BoJ monetary policy action ads the extra volatility to the one month USD/JPY strikes, and indeed gamma in that apace.

The strongest bias notable within the currency options space at Saxo Bank A/S can be seen regarding XAG/USD, USD/CHF and USD/JPY options. In each case, over 80% of traders prefer downside strikes.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.