Recently, IMF cut global growth forecasts. As US-Sino trade talks will give way to next trade wars, new tariff wars will not resolve US deficits but will further impair global economic prospects.

Ever since the US-Sino trade talks began almost four months ago, the United States has pushed for a broad commitment focusing on China’s economic practices, including participation of U.S. firms in certain industries and protection of U.S. intellectual property rights (IPRs).

In a recent CNBC interview, Treasury Secretary Steven Mnuchin claimed that the countries had “pretty much agreed” on an enforcement mechanism for a trade deal. After his meeting with the Chinese delegation last week, President Trump stated that negotiators may need four more weeks to package the deal.

But the enthusiasm may prove premature.

The state of US-Sino trade talks

As the last globalist in the Trump administration, Mnuchin’s views carry some weight, but he lacks clout to enforce those views. That’s been the case since Gary Cohn, Mnuchin’s former Goldman Sachs colleague, resigned from the White House ahead of the tariff wars. In turn, Commerce Secretary Wilbur Ross has proven too weak, reluctant and old (81 years) to press for compromise.

That’s why trade talks are led by Peter Navarro, Director of National Trade Council, and Robert Lighthizer, U.S. Trade Representative. The former is an advocate of trade mercantilism, who has a dark track record in China-bashing; the latter’s trade wars began against Japan in the Reagan administration.

In addition to enforcement mechanisms, the two are pressing for a pact that would allow US tariffs on Chinese goods to snap back in case of violations - but without permitting China to retaliate in response.

Understandably, Chinese negotiators consider such conditions unacceptable. Such conditionality has surprised even Craig Allen, President of US-China Business Council, who believes that Mnuchin may have been too optimistic about the deal, if it is burdened by a conditionality clause.

Indeed, US business groups tend to focus on commitments, including the proposed “enforcement offices.” They dislike negotiating tactics that needlessly prolong the talks and may undermine the progress achieved.

Chinese Vice-Premier Liu He has expressed greater caution by stressing that, by the end the proposed four weeks, the two countries may learn whether a trade deal could be reached. And even if a final deal is achieved, it will take another year or two to verify the structural changes associated with the pact.

Trade wars' next targets

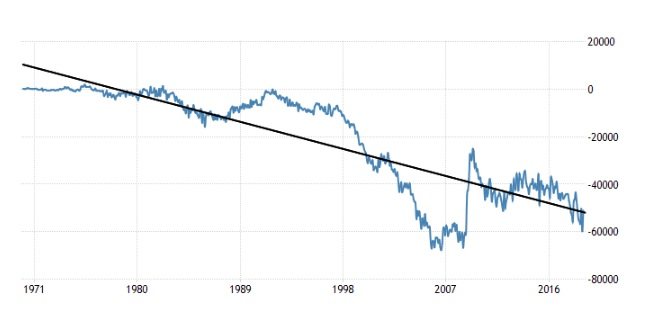

However, a US-China deal will not resolve US trade deficits, which have increased for half a century. The imbalances began in the postwar era after the recovery of the key EU economies - UK, Germany, France and Italy - and the subsequent rise of Japan. Toward the late 20th century, the deficits reflected the emergence of the four dragons; i.e., Taiwan, South Korea, Hong Kong and Singapore. China’s role in these deficits became prominent in the 2000s.

Today, the largest deficits prevail with China, US NAFTA partners (Mexico, Canada), key EU countries (Germany, Ireland, Italy), ASEAN (Vietnam, Malaysia) and India. China has been targeted first, but others will follow.

Last year, Mexico and Canada were pressured to a revised “US first” regional pact. Friction has been steadily rising with Japan and Germany. And Trump has pledged to extend the trade war to ASEAN - where the deficits are likely to climb if US companies begin to relocate.

Despite half a century of promises to bring an end to deficits, US dependency on trade deficits has only deepened as Washington has become increasingly dependent on foreign financing and sovereign debt (which now exceeds $22.2 trillion, or 106% of US GDP). The net effect is a falling trend line (Figure).

Figure U.S. trade deficits have deepened for half a century (US$ Million)

Why tariff wars won’t resolve US deficits

Do the US tariff wars make economic sense? No. Here are some reasons why:

US deficit issue is multilateral and regional, not bilateral and national. Trying to resolve it by forcing the bilateral trade deficit down is a bit like mimicking the fictional story of the little Dutch boy who discovered a leak in the dyke and stuck his finger in it to save his country. That’s Trump’s strategy.

Unfortunately, it ignores the dyke’s many other leaks and may thus make the flood more likely.

Second, Trump’s trade hawks presume that international trade is a competition between companies representing different countries. They ignore the fact that, for decades – and particularly since the 1980s – national industry leaders have built multinational value activities around the world. Consequently – as even the OECD has concluded - conventional data on bilateral trade deficits can be misleading, due to multinationals’ global supply chains.

Third, it is the overall size of the trade balance that matters, and that is largely a function of macroeconomic forces, such as domestic savings and investment. If the US domestic investment continues to exceed savings, it will have to continue to import capital and will have a large trade deficit.

Since late 2017, the Trump administration has made this challenge much worse, thanks to large tax cuts, which have caused US fiscal deficits to soar. That is likely to cause the trade deficit to increase, irrespective the outcome of the trade war. Of course, one way to avoid this is that the White House will lead the US into a recession, with incomes declining adequately for investment and imports to plummet – as with the aftermath of the 2008 crisis (see the Figure).

Why tariff wars will weaken global prospects

Unfortunately, that path would further penalize American middle-class and working people, but it would also have even more severe implications internationally. It has potential to further derail global economic prospects (which would harm the very same US multinationals Trump claims to support).

As US tariff wars undermined the global recovery momentum in early 2018, the IMF now predicts that global economic activity is notably slowing. Global growth is projected to slow to 3.3% in 2019.

In the absence of more positive signals, the international environment is faltering toward a darker path.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore).

The commentary is based on Dr. Steinbock’s recent presentation on the state of US tariff wars and global prospects

Difference Group provides multipolar advisory services globally. We serve as trusted advisor to multinational companies, financial institutions, government agencies and municipalities, marketers and international multilateral organizations.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.