The euro is the worst performer in the G10 today, and has fallen sharply on Tuesday, with EURUSD slumping 0.7% and slicing through some pretty critical support levels that opens the way to a potential longer-term decline back towards 1.0341 – the low from 3rd January. The single currency is defying the better-than-expected flash PMIs for Europe, with the composite figure rising to 56.0 from 54.4 in January. The biggest problem for the euro is politics, and it’s not going away any time soon.

French political risk premium starting to rise

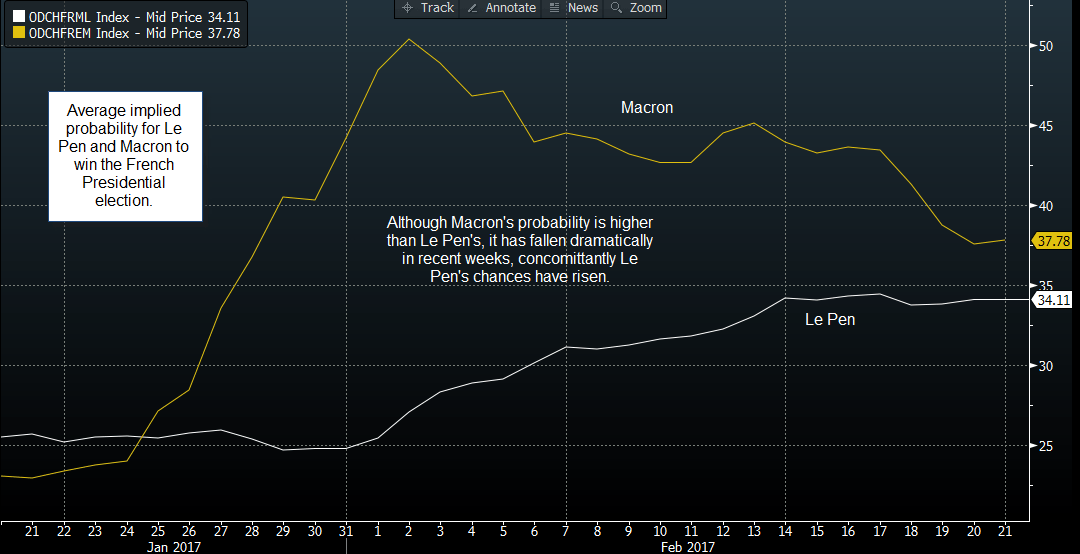

The bond and FX market have been spooked by a sharp rise in the spread between French and German bond yields. This has been driven by a rise in support for the National Front leader, Marine Le Pen. The odds of her winning have risen sharply in February. The chart below shows the average implied probability of Marine Le Pen (white line) and the current front-runner Emmanuel Macron’s (yellow line) chance of winning the upcoming French Presidential election. As you can see, Macron has seen his odds of winning the election slide, as Marine Le Pen has seen her chances rise. Although Macron has a near 38% chance of winning in May, Le Pen is not far behind at 34%, and momentum appears to be on her side.

This chart is important, and is something that we will be tracking in the coming weeks leading up to the election. While polls have proven to be inaccurate in recent elections in the UK and the US, odds can be a more reliable indicator when it comes to assessing political risks.

French bond yields: terrified of Le Pen?

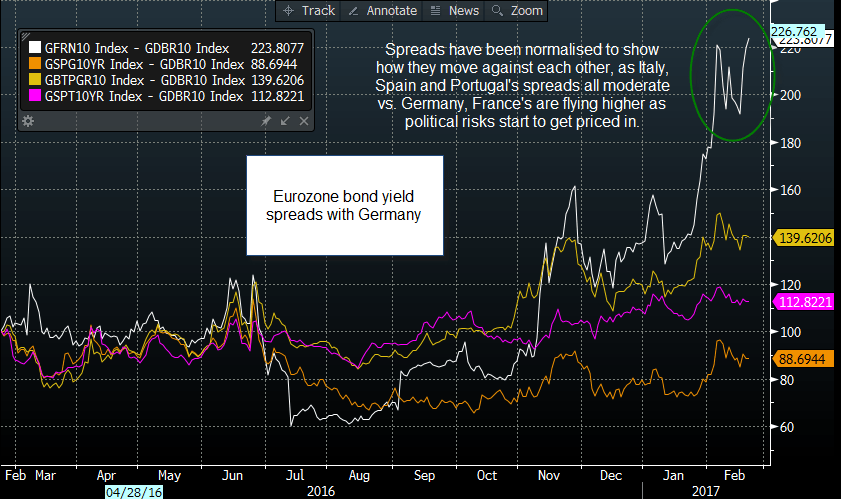

Politics appears to be weighing on the European bond market. Figure 2 shows the spread between French and German, Spanish and German, Italian and German, and Portuguese and German 10-year sovereign bond yields. This chart has been normalised to show how they move together. While the nominal level of the bond spread between France and Germany is the lowest compared to Spain, Italy and Portugal, the more enlightening information you can get from this chart is when it is normalised – so you can see how these spreads are moving relative to each other. As you can see, France’s 10-year spread with Germany has been rising at a much faster rate than other European bond spreads in Europe during February, which has coincided with Le Pen’s increasing chance of winning the Presidential election. This chart suggests that the there is some panic amongst bond investors, who are starting to worry (read, price in) the tide of momentum that seems to be with Le Pen’s candidacy.

If this continues then we could see French bond yields rise above levels seen in other countries like Spain, that don’t have election risks on the horizon. Already on Tuesday we have seen French bond yields briefly rise above Irish bond yields of a 10-year maturity.

Marine Le Pen: toxic for the euro

It is well known than Marine Le Pen is no fan of the euro, and we won’t go into the detail of her policies in this note. But it is worth remembering this, rising support for Le Pen is likely to keep upward pressure on French bond yields, and this political risk premium could weigh further on the euro. We will watch what EUR/USD does at 1.0500, there is some key support at this level. However, if it falls through 1.0500, then EUR/USD could find itself testing the 2017 lows so far at 1.0341.

Stocks are not immune to Le Pen risks

A weaker euro is helping European stocks on Tuesday, which have also been given some uplift by a continued strong performance from equities in the US. However, if Le Pen’s odds of winning the election continue to rise at a similar pace in March as they have done in February, then we think that risk aversion could spread from the bond and FX market to the European equity markets.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.