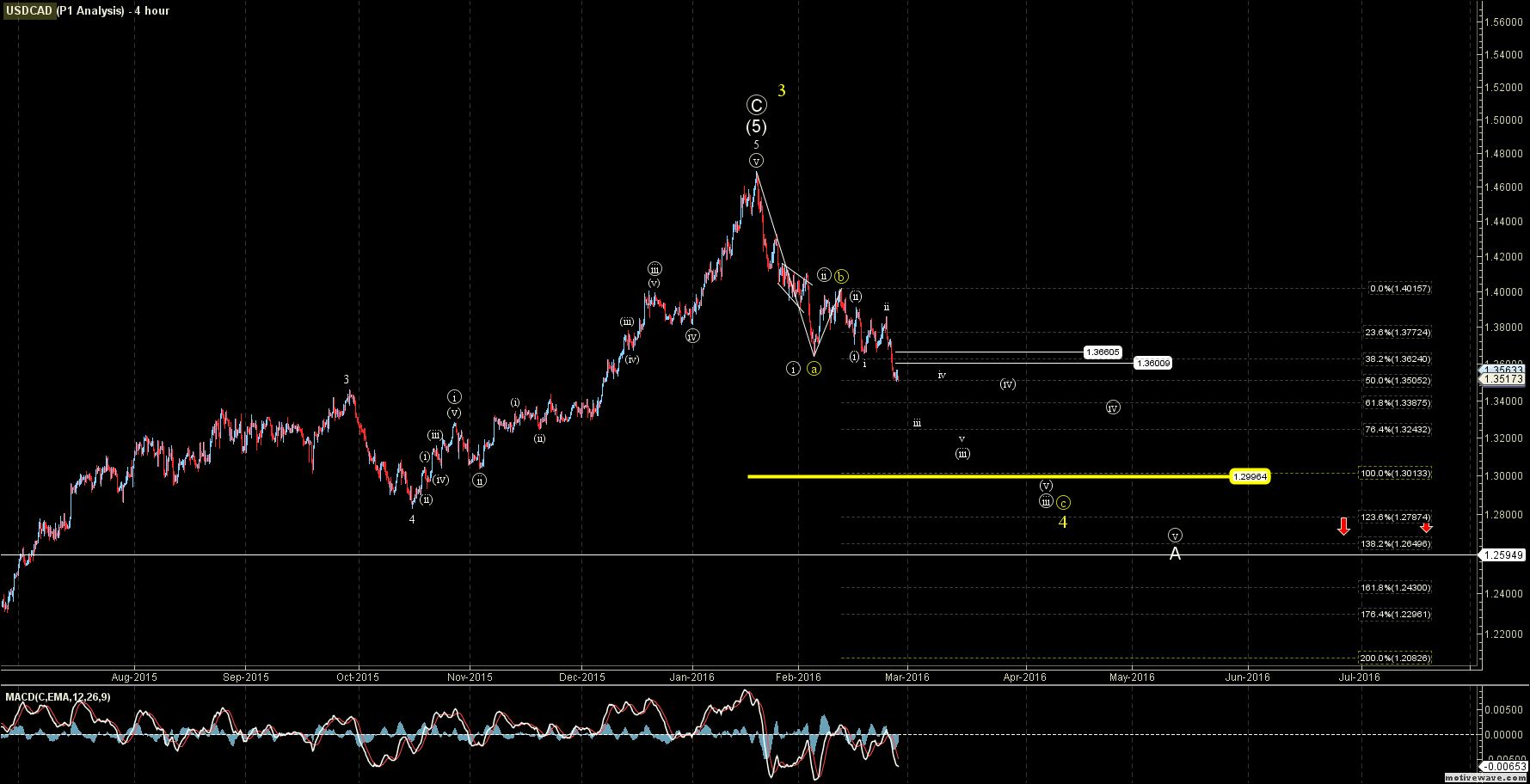

On the larger time-frames it is clear that the top that we saw in January at the 1.4696 level was a significant larger degree top. This high hit the 338.2 extension of the initial wave off of the 2011 low almost to the penny. While the 338.2 extension is a less common extension, the fact that it came so close to hitting that fib on such a large degree does make me take notice. This is a much more common Fibonacci extension level that we would expect to see during a third wave and not a C wave.

So while the entire move off of the 2011 low is still not entirely clear and could be counted as either a completed corrective pattern or still an impulsive pattern, the fact that we hit the 338.2 extension certainly has me leaning towards this still needing yet another move up over the January high prior to a much larger degree top being in place. Now with that being said, on the more intermediate time-frames over the next several months the trend is clearly down and as long as we remain under the 1.3603-1.3660 resistance levels I do expect to see lower levels.

Zooming into the 1 hour chart we can see that the action we saw on Friday was very typical of a minor degree fourth wave consolidation. In this case I am counting this consolidation as part of wave ((4)) of iii down with targets for wave iii coming in at the 1.3416 -1.3302 zone with resistance levels for this wave ((4)) again coming in at the 1.3603-1.3660 zone. A break back over this resistance zone would be the first indication that this move to the downside for wave C of 4 is not going to play out impulsively. Of course as the pattern is still very incomplete even if we do break back over these resistance levels it is still likely that we still will see lower levels in the form of an ending diagonal to the downside as the pattern is still quite incomplete.

It would really take a move over the February 24th high at the 1.3857 level to consider that we have a more significant bottom in place, and as long as we are trading under these levels the pressure over the intermediate time-frame is still very much to the downside on this pair.

The commentaries and analysis represent the opinions of the analyst nd should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret these opinions as constituting investment advice. Our analysts may have personal positions in the instruments mentioned.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.