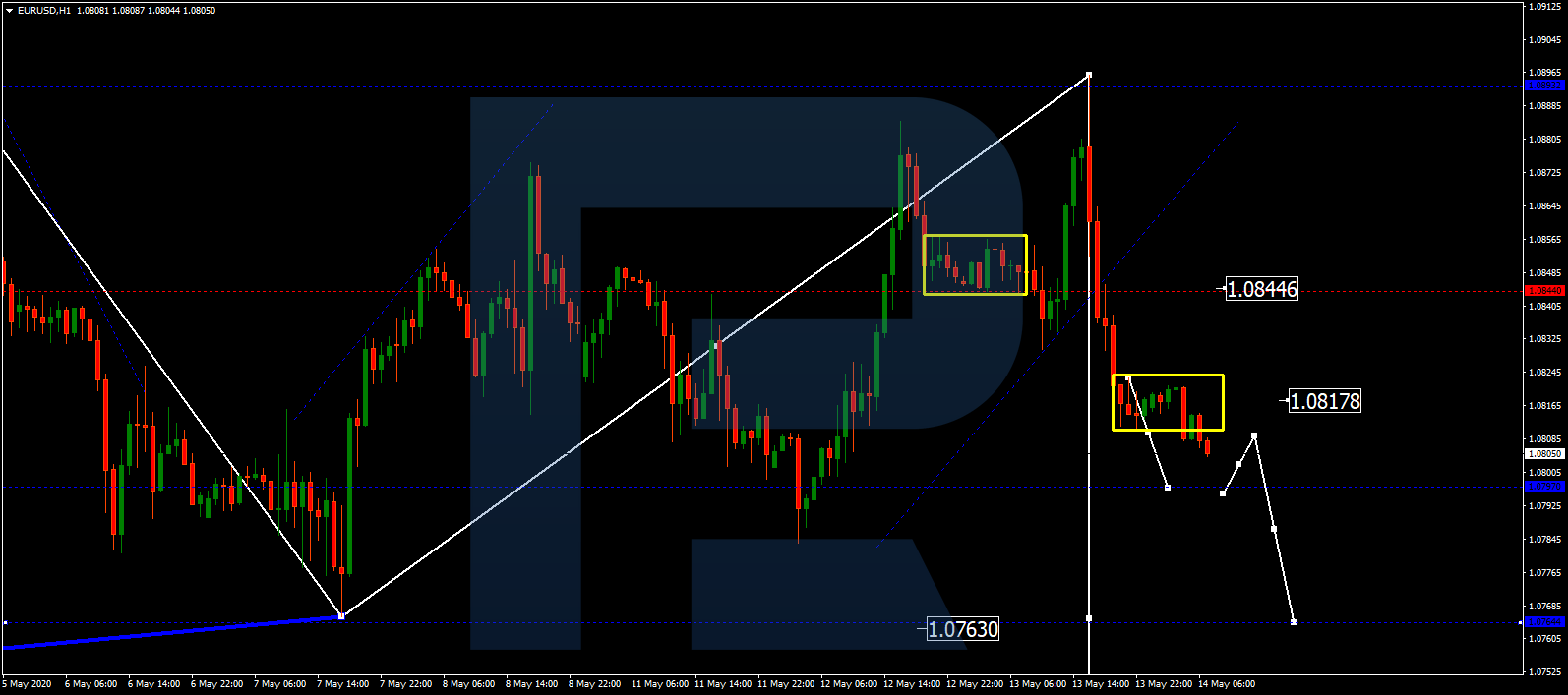

EUR/USD, “Euro vs US Dollar”

After finishing the correctional wave and then forming the consolidation range around 1.0817, EURUSD has broken it to the downside and may continue falling towards 1.0797. Possibly, the pair may test 1.0810 from below and then resume trading downwards with the target at 1.0770.

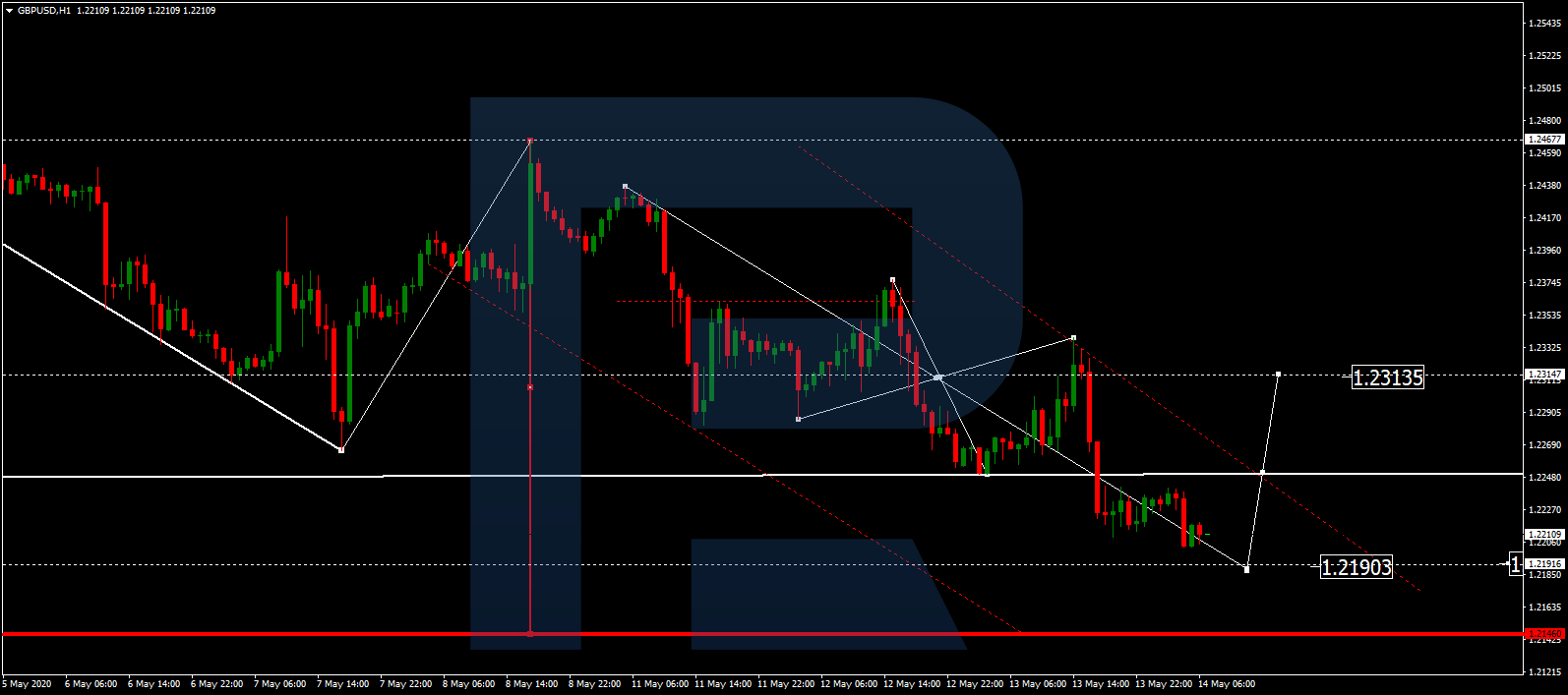

GBP/USD, “Great Britain Pound vs US Dollar”

GBPUSD has formed a downside continuation pattern Today, the pair may fall to reach 1.2190 and then correct towards 1.2240. After that, the instrument may resume trading inside the downtrend with the target at 1.2144.

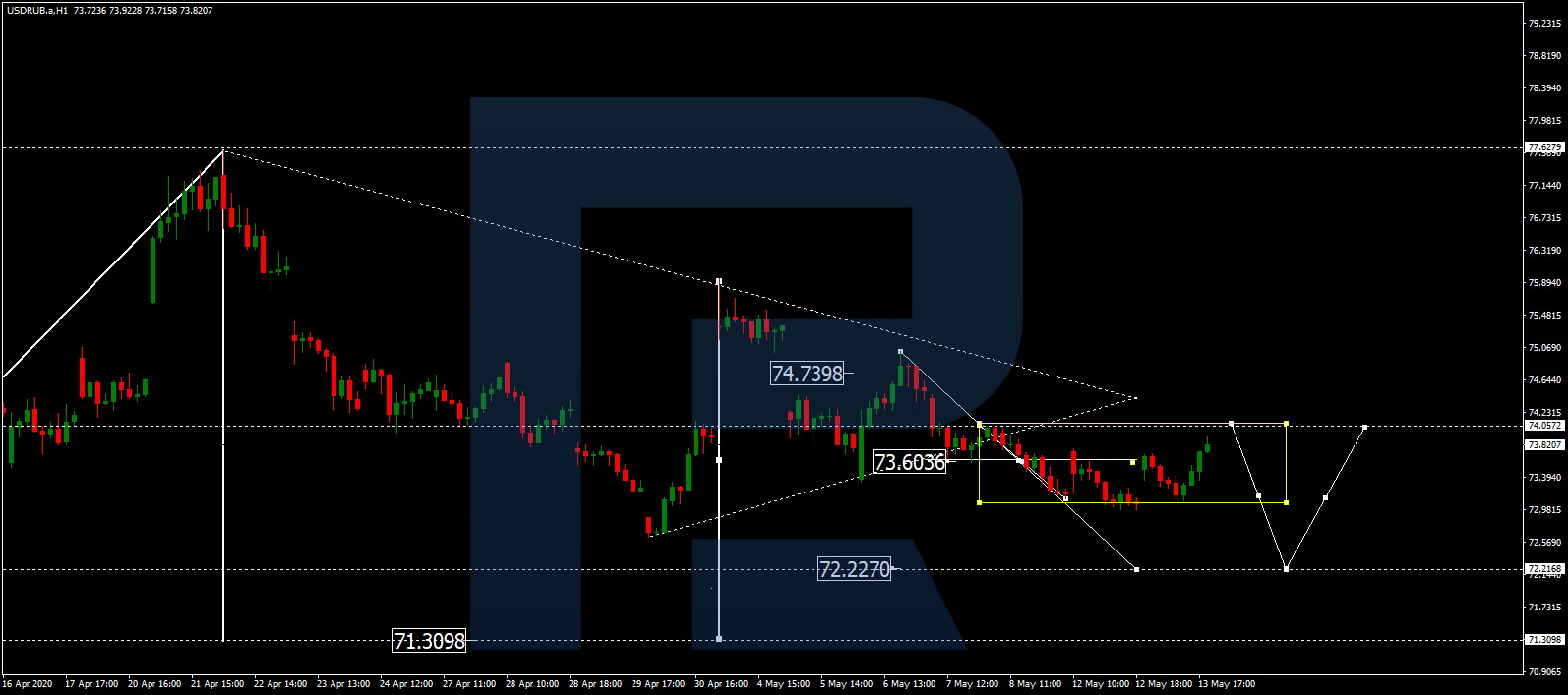

USD/RUB, “US Dollar vs Russian Ruble”

USDRUB is still consolidating around 73.60. Possibly, today the pair may correct to reach 74.05 and then form a new descending structure to break 72.90. Later, the market may continue trading inside the downtrend with the short-term target at 72.22.

USD/JPY, “US Dollar vs Japanese Yen”

USDJPY is falling. Possibly, today the pair may reach 106.72. After that, the instrument may correct towards 107.20 and then form a new descending structure with the target at 106.50.

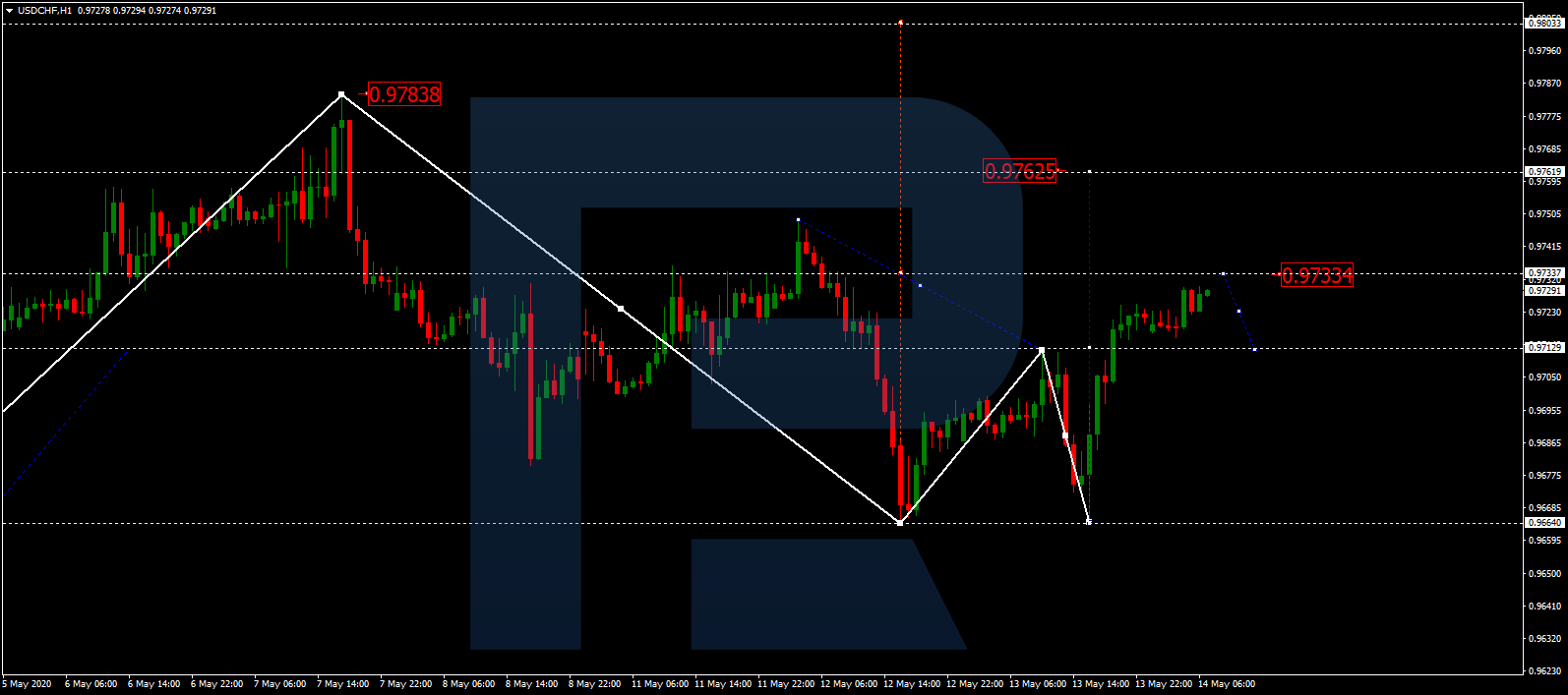

USD/CHF, “US Dollar vs Swiss Franc”

After breaking 0.9715, USDCHF is expected to continue growing with the target at 0.9763. Today, the pair may reach 0.9733 and then correct to return to 0.9725. Later, the market may start another growth towards the above-mentioned target.

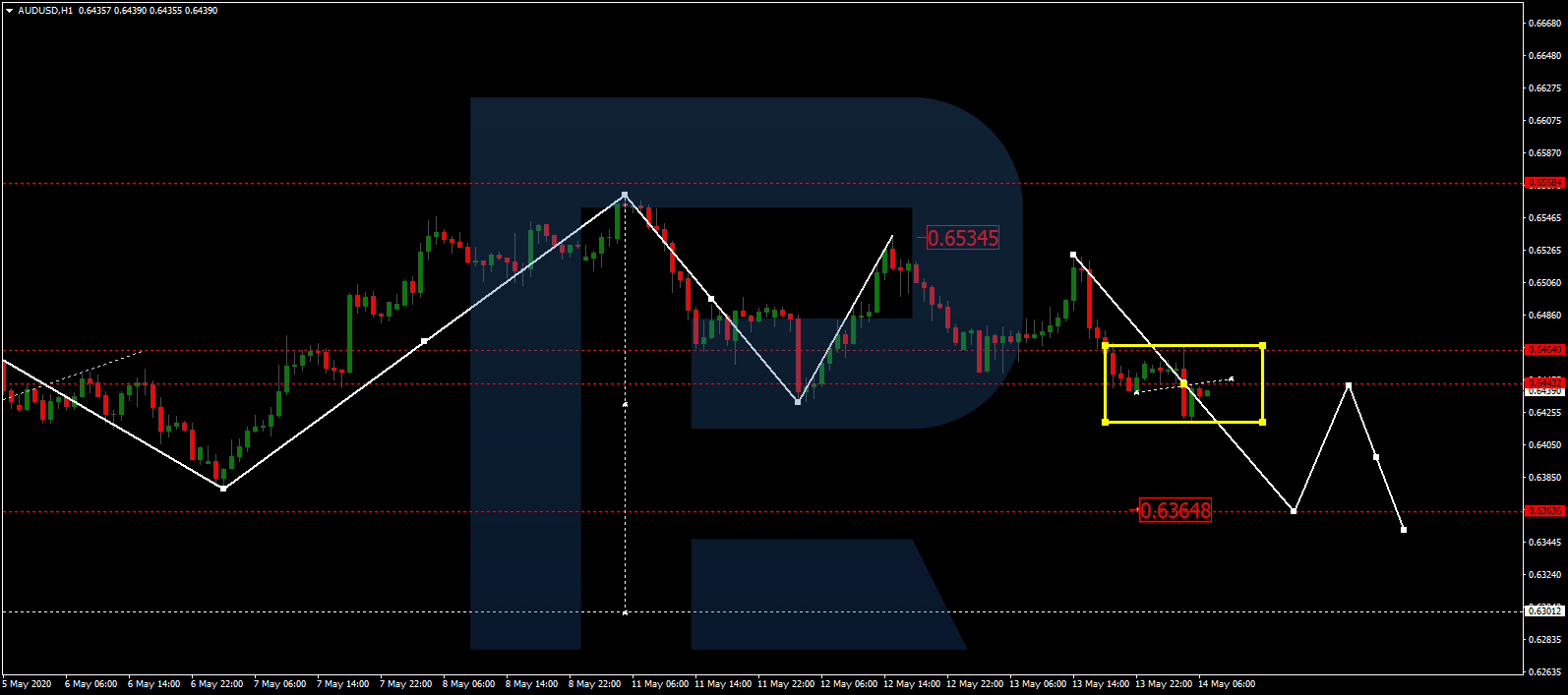

AUD/USD, “Australian Dollar vs US Dollar”

AUDUSD is consolidating around 0.6444. According to the main scenario, the price is expected to break this range to the downside and then start another decline with the short-term target at 0.6363. After that, the instrument may correct to return to 0.6440 and then resume trading inside the downtrend to reach 0.6310.

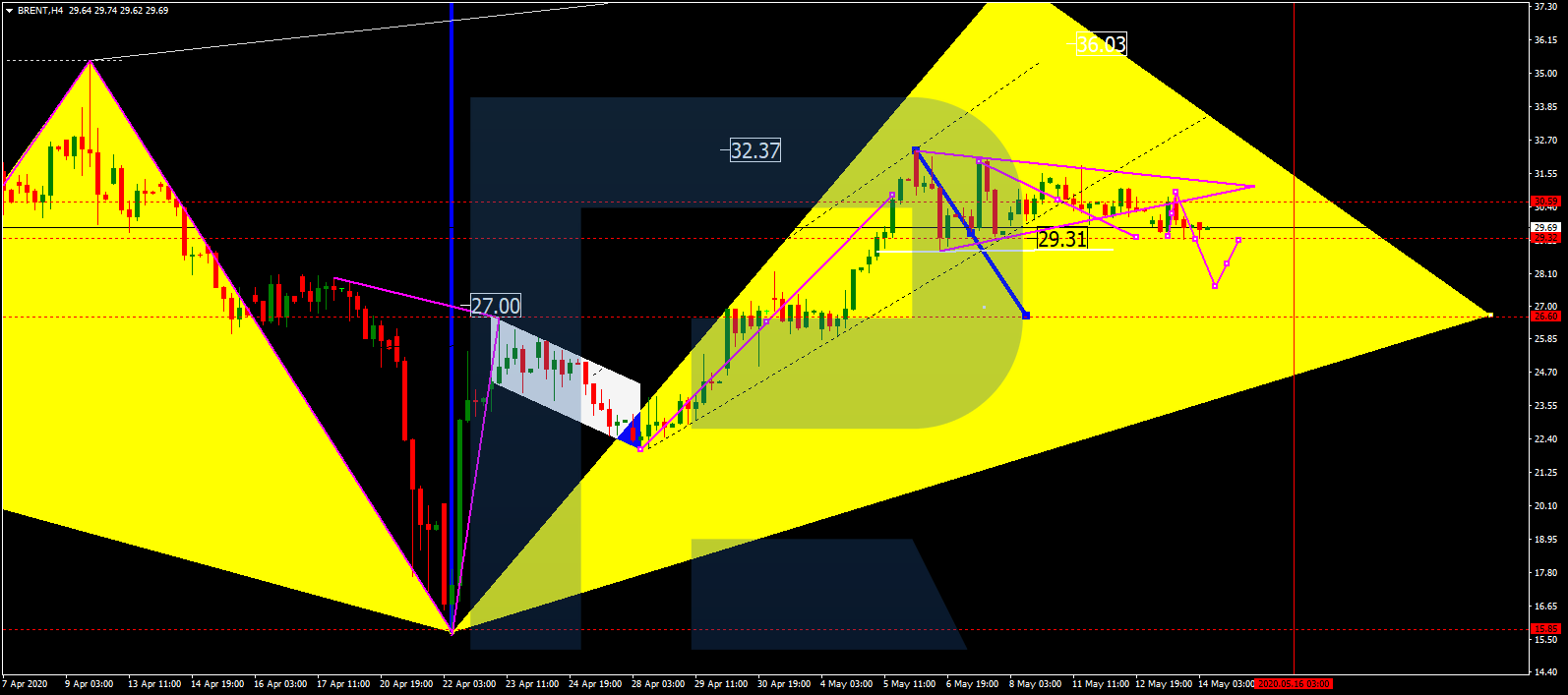

BRENT

Brent is still consolidating around 29.30. Possibly, the pair may break this level downwards and continue the correction to reach 27.70. After that, the instrument may form one more ascending structure to return to 29.30 and then start a new decline towards 27.00 to complete the correction. Later, the market may start another growth with the target at 38.20.

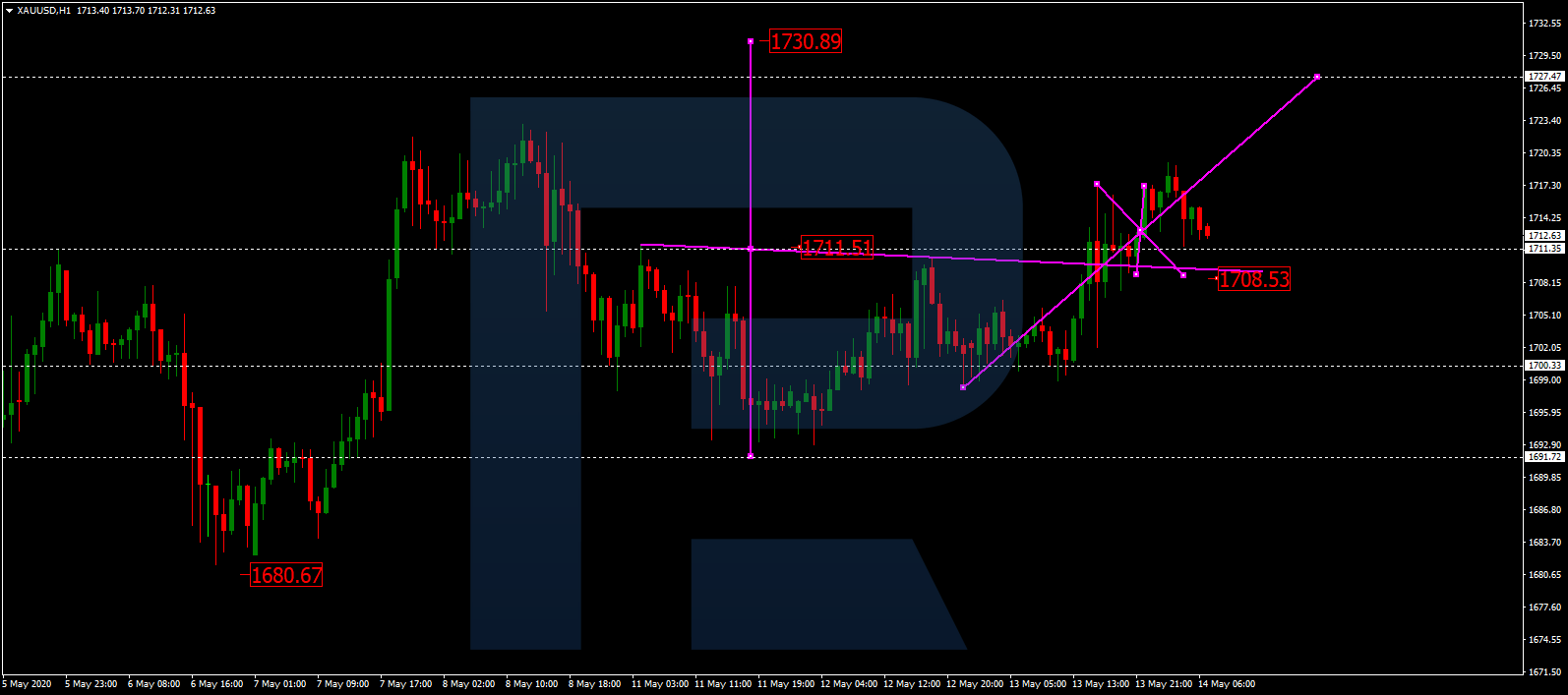

XAU/USD, “Gold vs US Dollar”

Gold has returned to 1711.35 to test it from above. The main scenario implies that the price may continue growing with the short-term target at 1727.47.

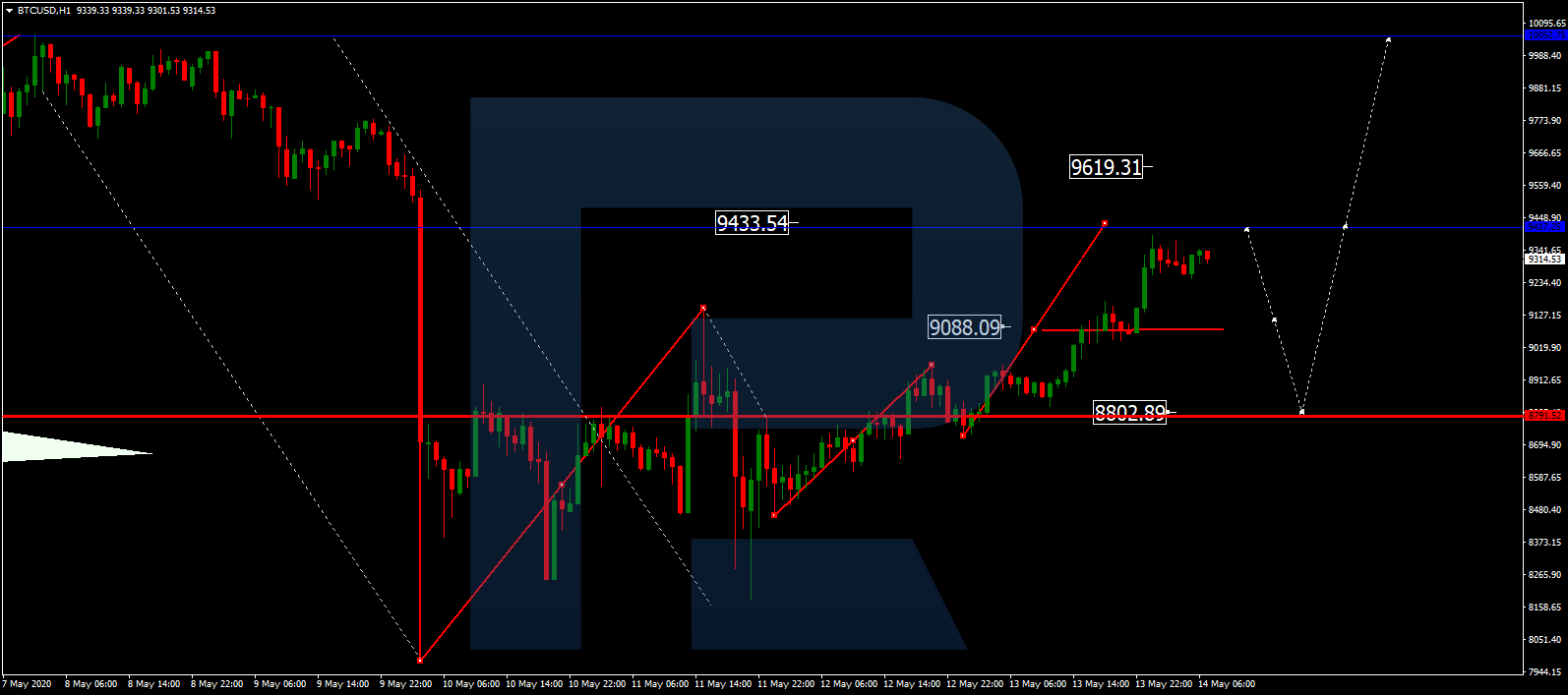

BTC/USD, “Bitcoin vs US Dollar”

BTCUSD continues growing with the short-term target at 9500.00. Possibly, today the pair may trade downwards to reach 9100.00 and then form one more ascending structure towards the above-mentioned target. After that, the instrument may start another correction to reach 8800.00 and then resume trading upwards with the target at 10000.00.

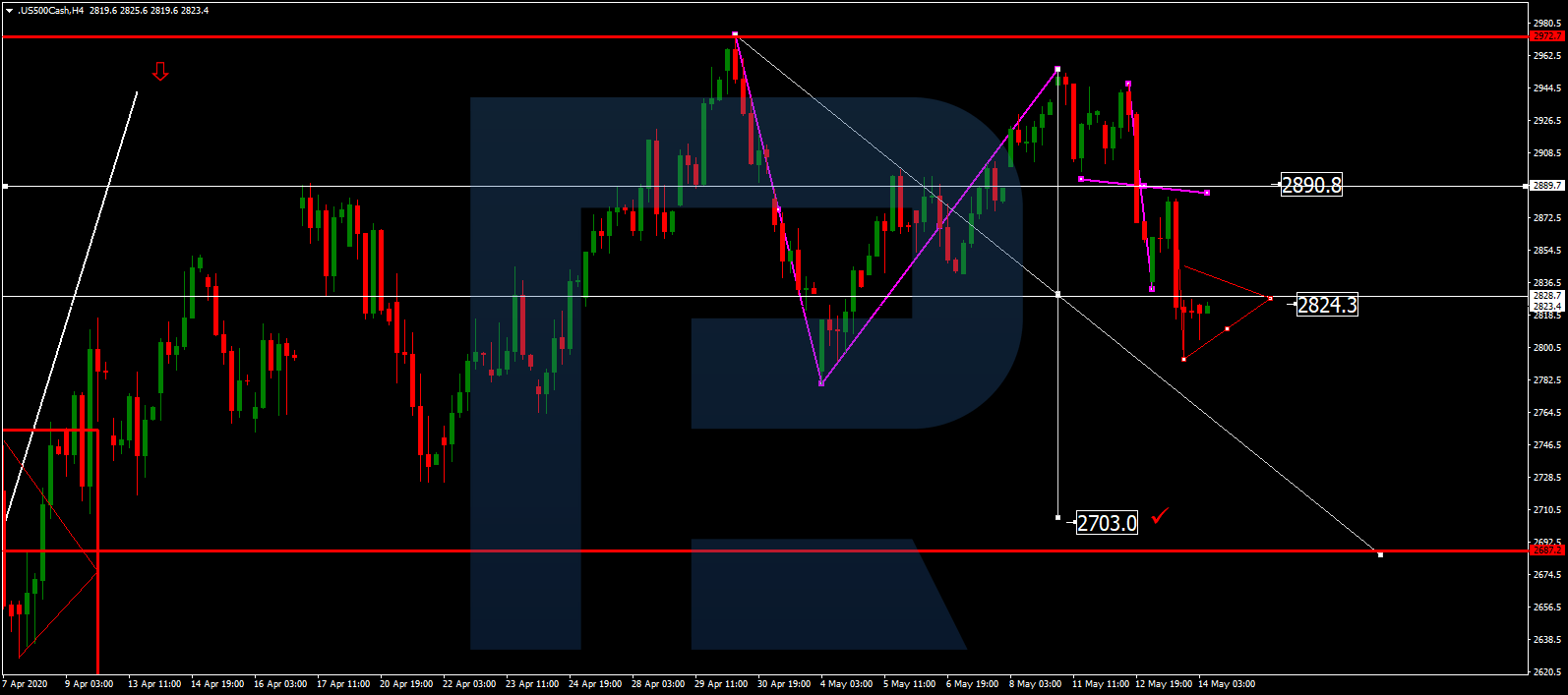

SP 500

After finishing the descending wave at 2824.4, the Index is consolidating around this level. If later the price breaks this range to the upside, the market may correct towards 2890.5; if to the downside – resume trading downwards with the short-term target at 2703.0.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.