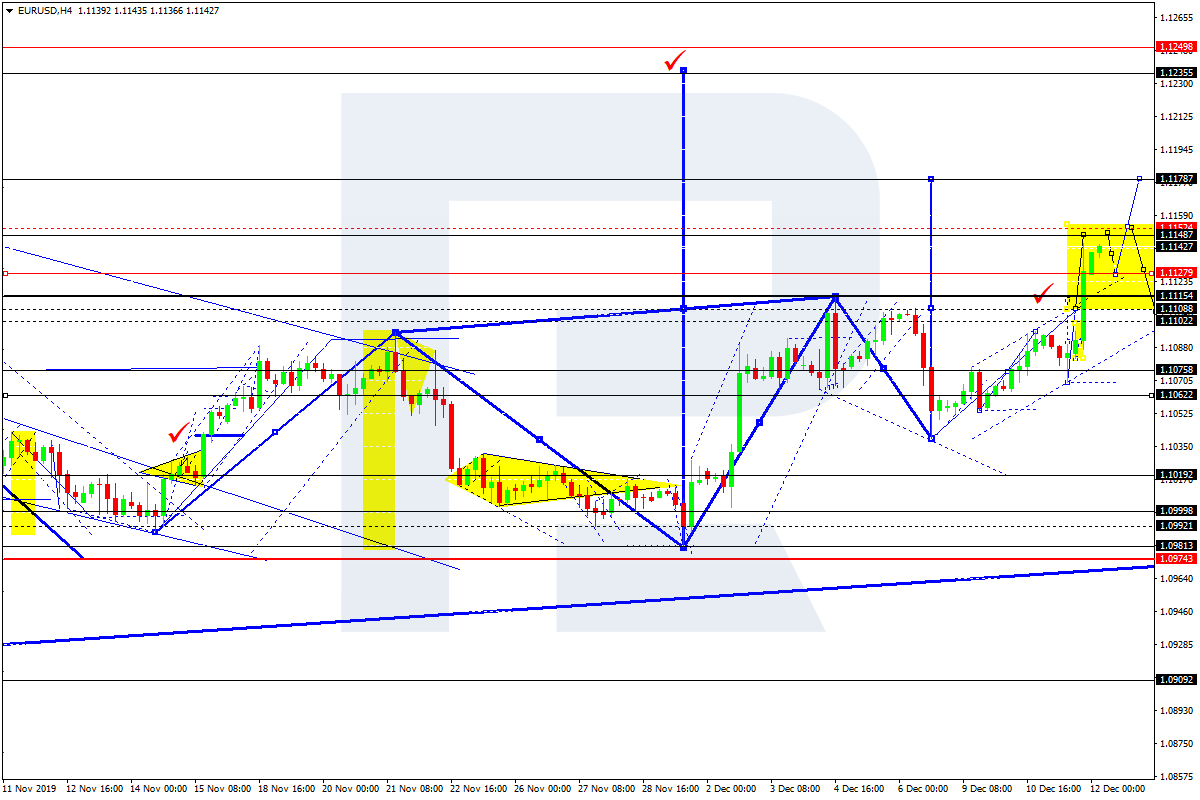

EUR/USD, “Euro vs US Dollar”

EUR/USD has chosen an alternative scenario to continue the ascending wave. Possibly, today the pair may grow towards 1.1150 and then start a new correction to reach 1.1111. Later, the market may continue moving upwards with the target at 1.1180.

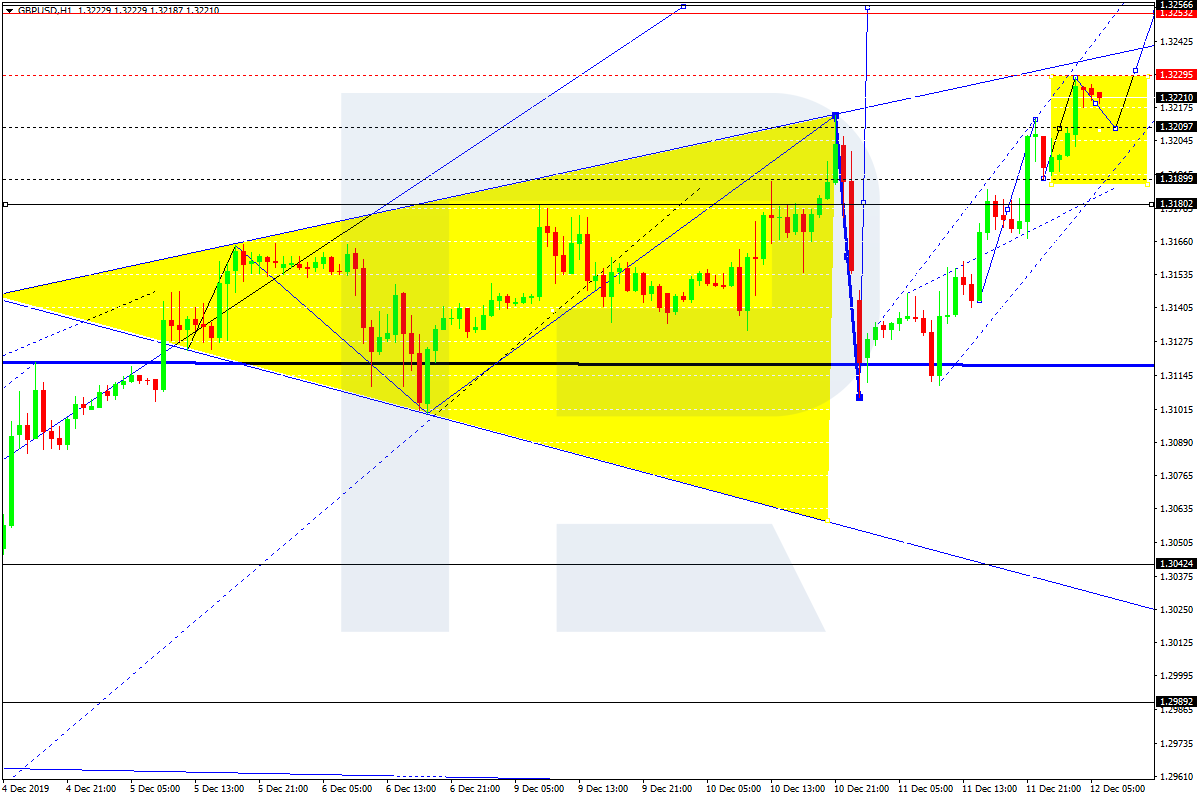

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD is moving upwards. Possibly, the pair may extend the wave towards 1.3252. Today, the price may fall to reach 1.3200 and then start a new growth with the target at 1.3252.

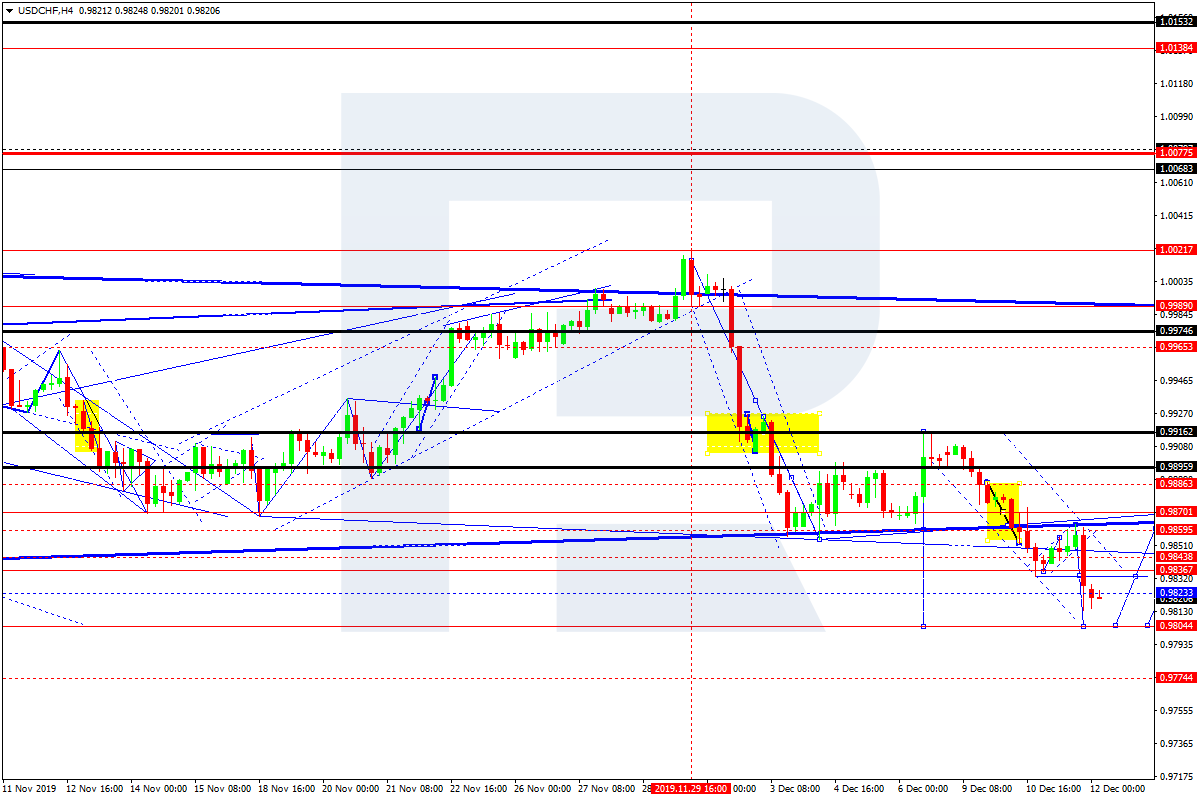

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has rebounded from 0.9861 to the downside; right now, it is still falling. Possibly, the pair may reach 0.9804 and then form one more ascending structure to return to 0.9860.

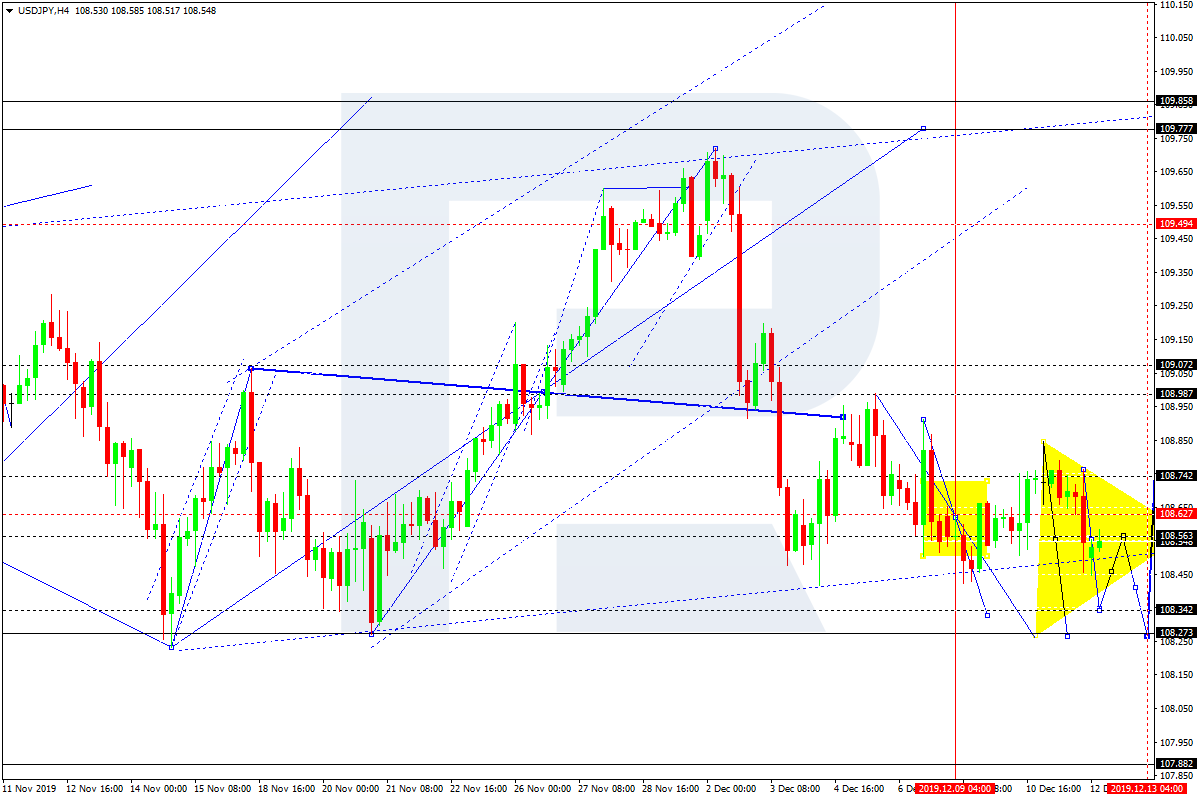

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY is forming another descending structure towards 108.27. Possibly, today the pair may reach 108.34 and then start another growth towards 108.57. After that, the instrument may continue moving downwards with the target at 108.27.

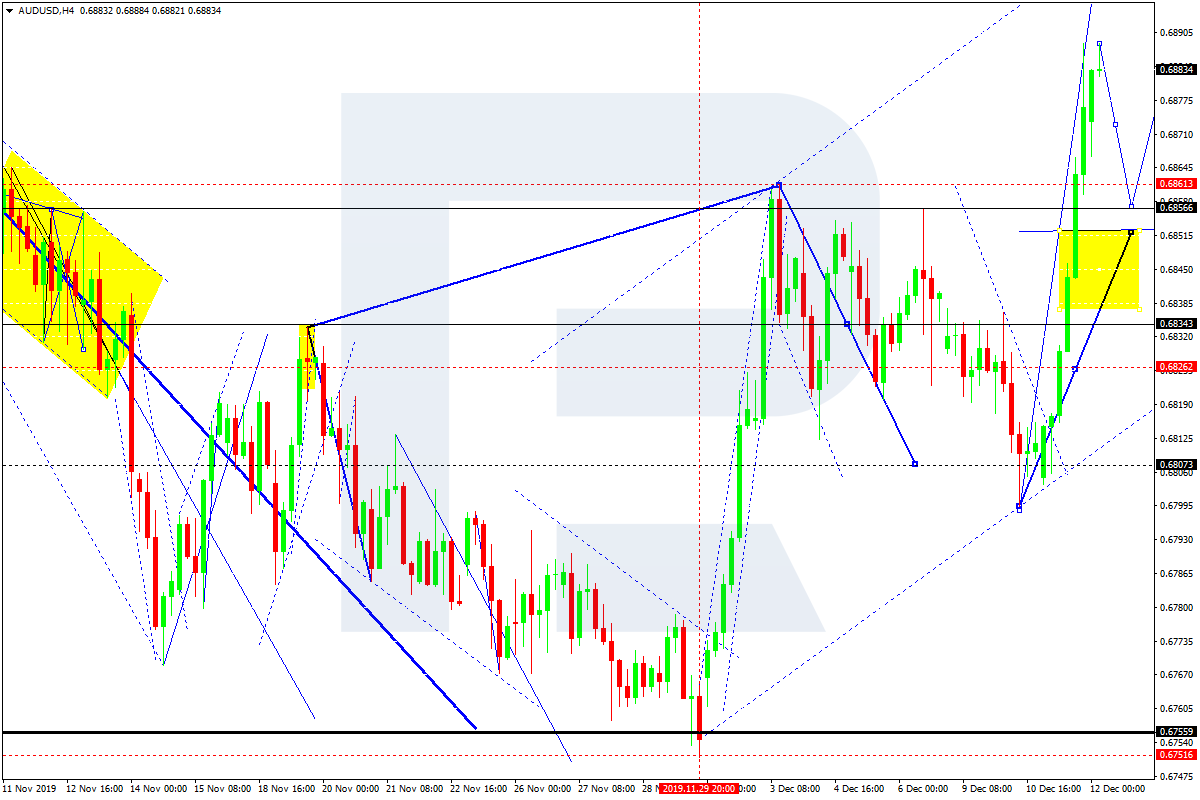

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has broken 0.6850; right now, it is still growing. Today, the pair may test 0.6868 from above and then resume trading inside the uptrend with the short-term target at 0.6906.

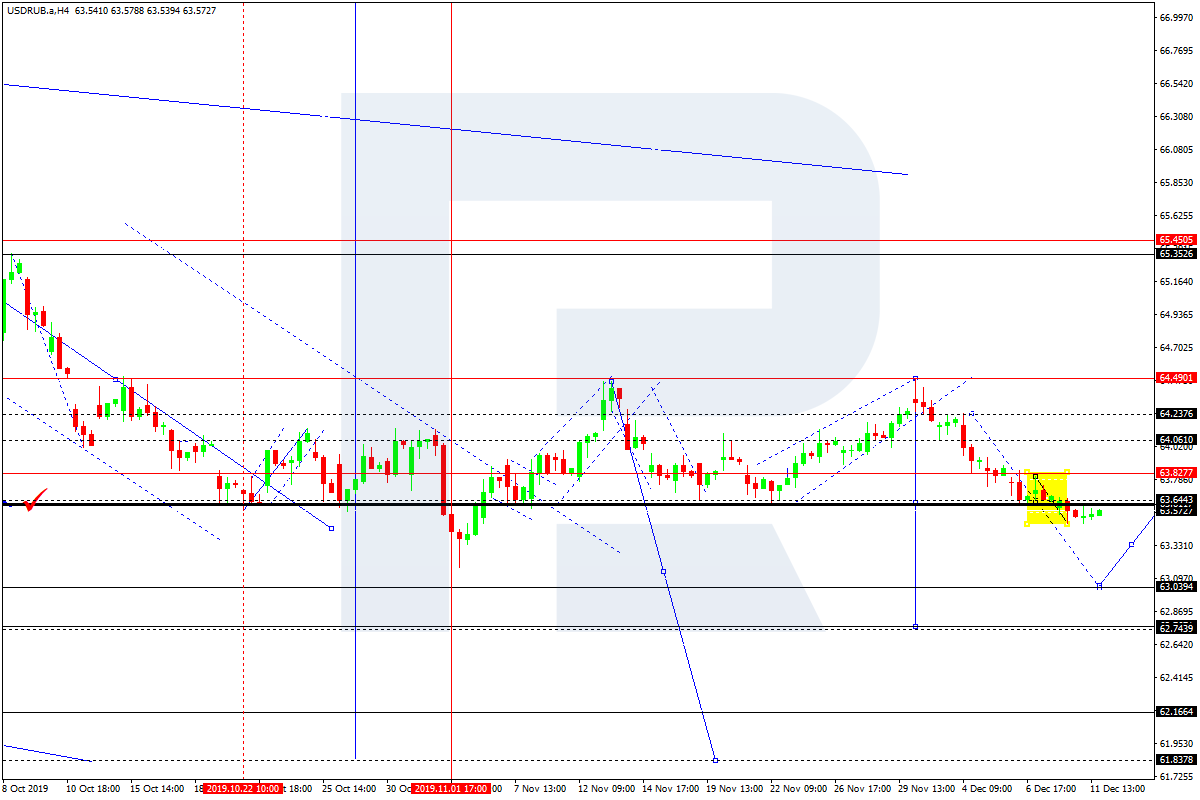

USD/RUB, “US Dollar vs Russian Ruble”

USD/RUB continues forming the downside continuation pattern around 63.60. Possibly, today the pair may fall to reach 63.06 and then start another correction to return to 63.60. Later, the market may form a new descending structure with the short-term target at 62.75.

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD is moving downwards to reach 1.3140. Later, the market may form one more ascending structure towards 1.3216, thus forming a new consolidation range between these levels. If later the price breaks this range to the downside, the market may resume trading downwards to reach 1.3108; if to the upside – continue the uptrend with the target at 1.3282.

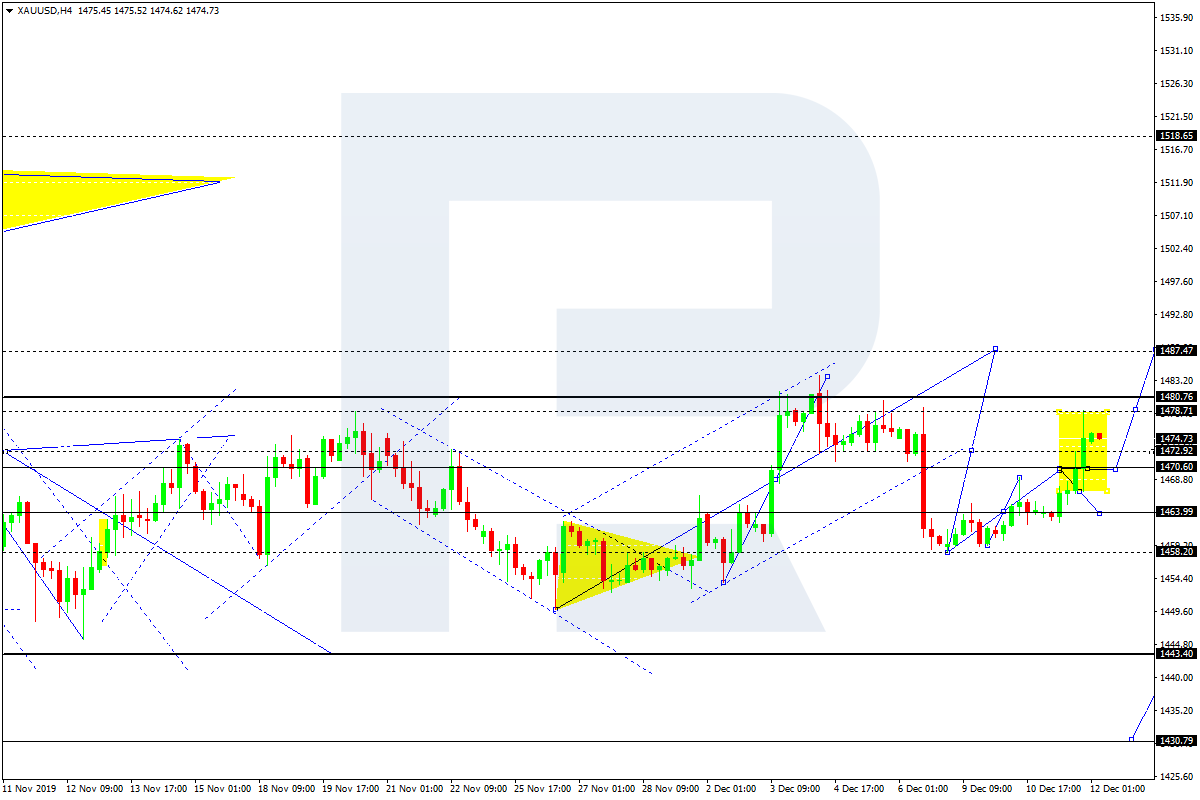

XAU/USD, “Gold vs US Dollar”

Gold has completed the ascending structure at 1470.60. Possibly, the pair may form an upside continuation pattern to start a new wave with the target at 1487.27. Today, the price may form a new descending structure to test 1470.60 from above and then and then resume moving upwards to reach the above-mentioned target.

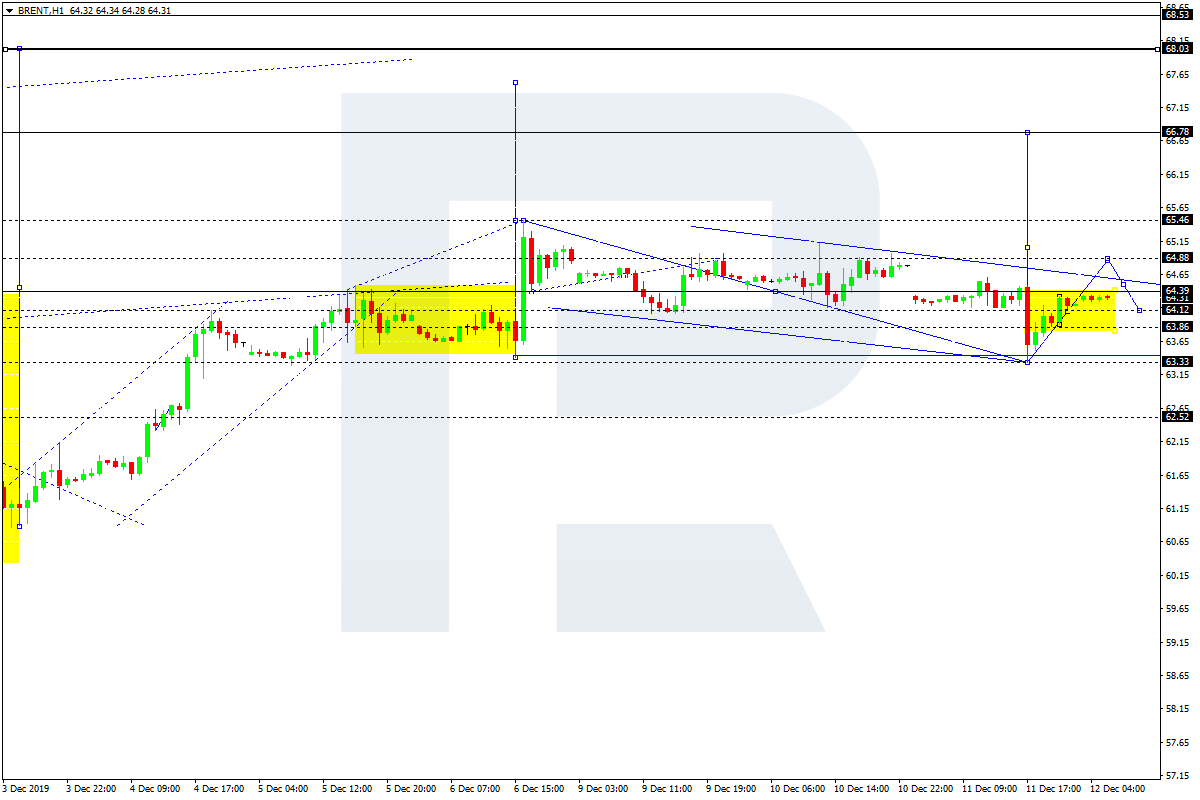

BRENT

Brent has completed Flag pattern; right now, it is growing towards 64.88. After that, the market may start a new decline towards 64.12 and then form one more ascending structure with the short-term target at 66.77.

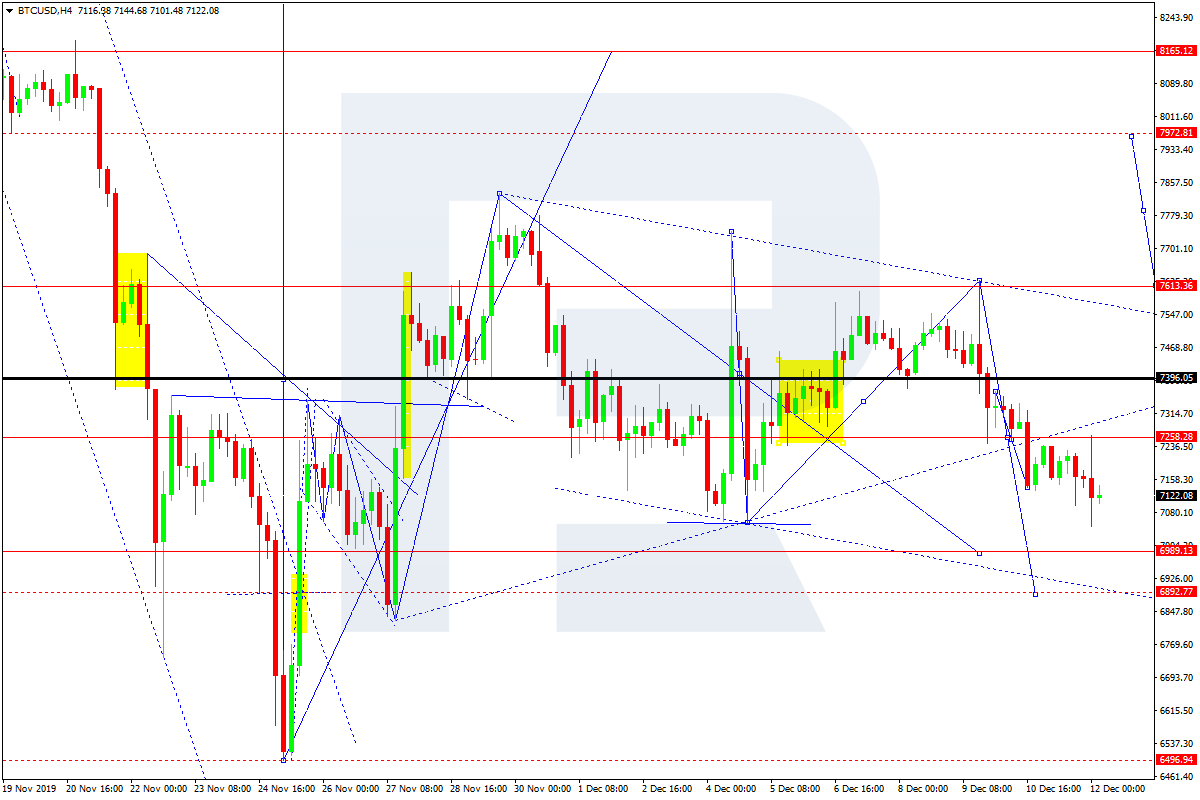

BTC/USD, “Bitcoin vs US Dollar”

BTC/USD is correcting towards 7000.00. Possibly, the pair may extend this structure down to 6900.00. After that, the instrument may resume moving upwards with the target at 8165.00.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.