EUR/USD, “Euro vs US Dollar”

is still consolidating around 1.1066. Possibly, today the pair may expand this range upwards and downwards, 1.1070 and 1.1062 respectively. If later the price breaks this range to the upside, the market may continue the correction towards 1.1087; if to the downside – fall to break 1.1050 and then continue trading inside the downtrend with the short-term target at 1.1026.

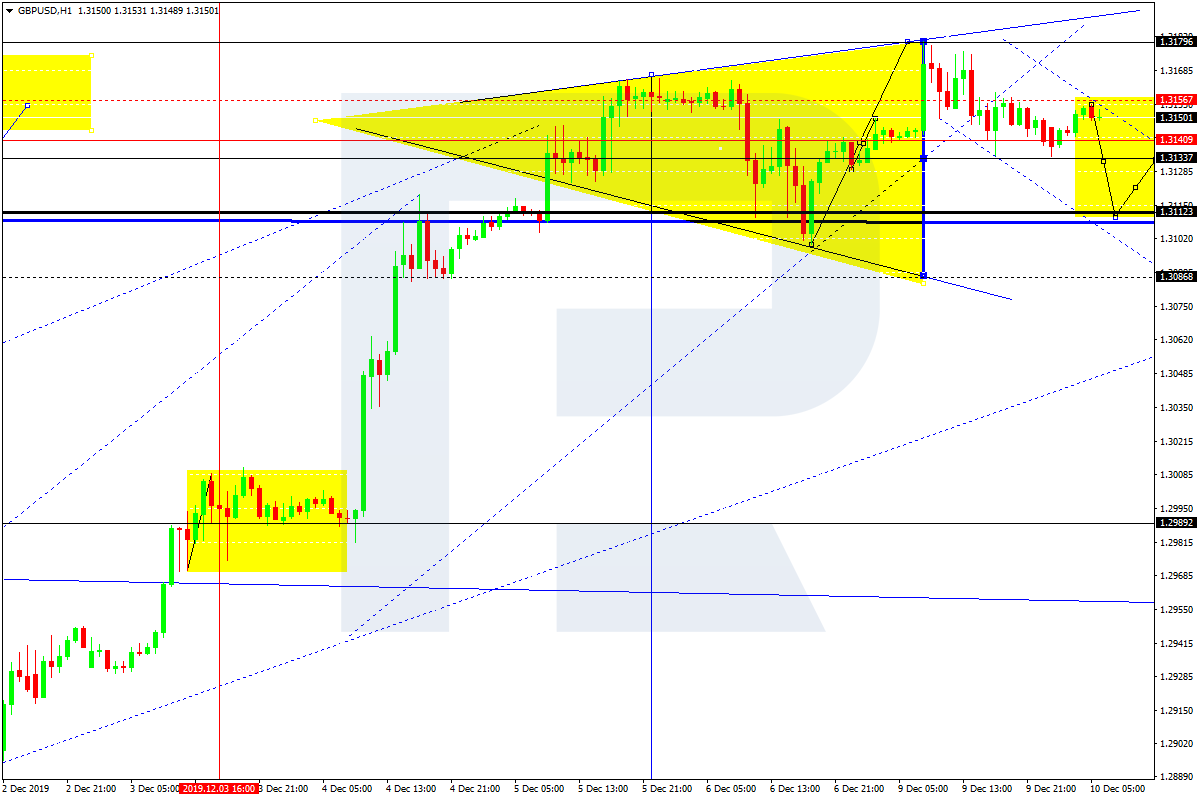

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD is still consolidating around 1.3133. Today, the pair may grow to reach 1.3156 and then fall to return to 1.3133. After that, the instrument may break this level and continue trading downwards to reach 1,3112. Later, the market may form one more ascending structure towards 1.3133 and then start a new decline with the first target at 1.3086.

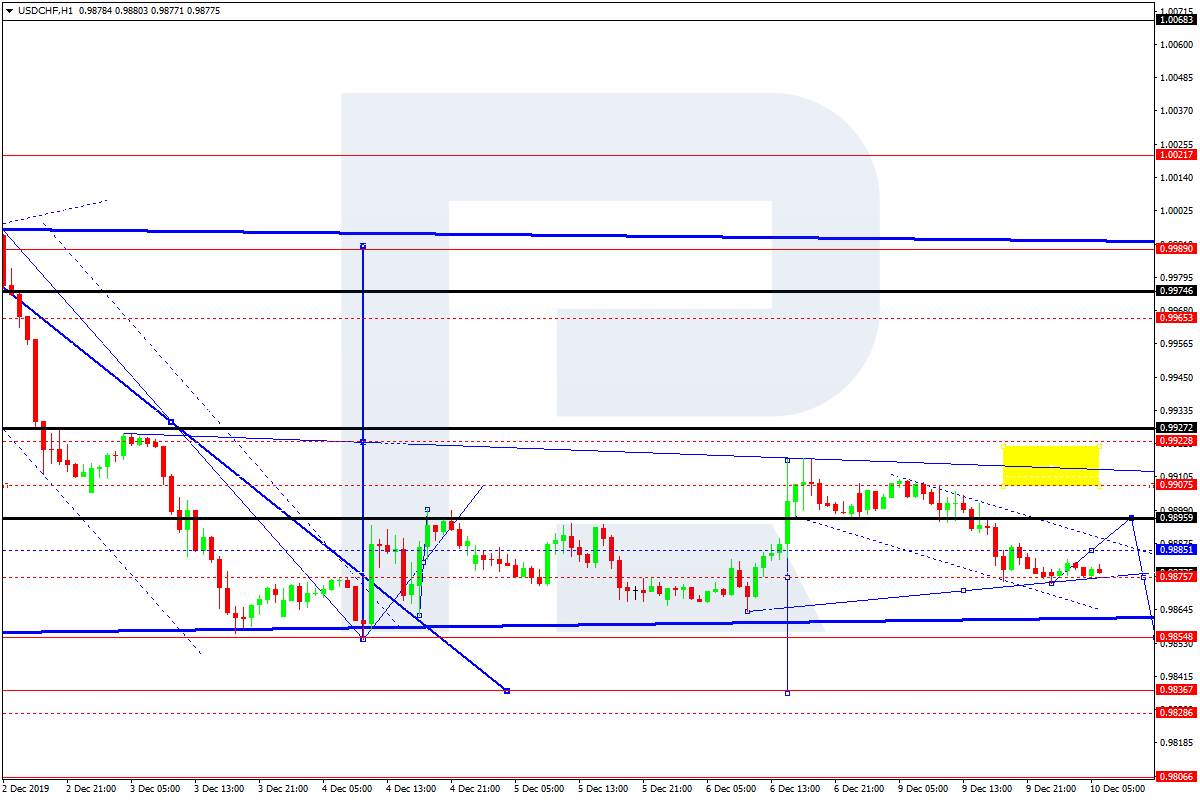

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF is consolidating around 0.9880. Possibly, today the pair may expand this range towards 0.9896 and then start a new decline to reach 0.9855. Later, the market may form one more ascending structure with the target at 0.9886.

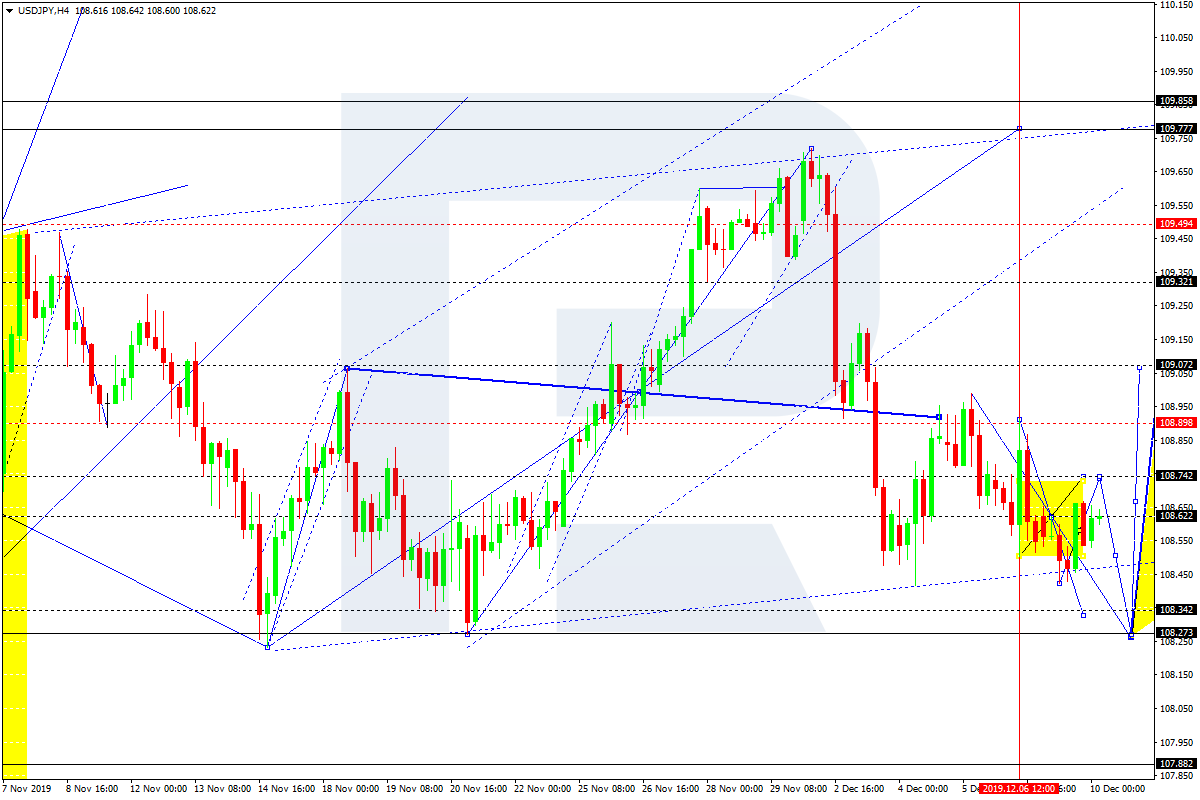

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY is still consolidating around 108.66 without any particular direction. Today, the pair may grow to reach 108.74 and then resume moving downwards with the target at 108.34. After that, the instrument may start a new correction to return to break 108.66.

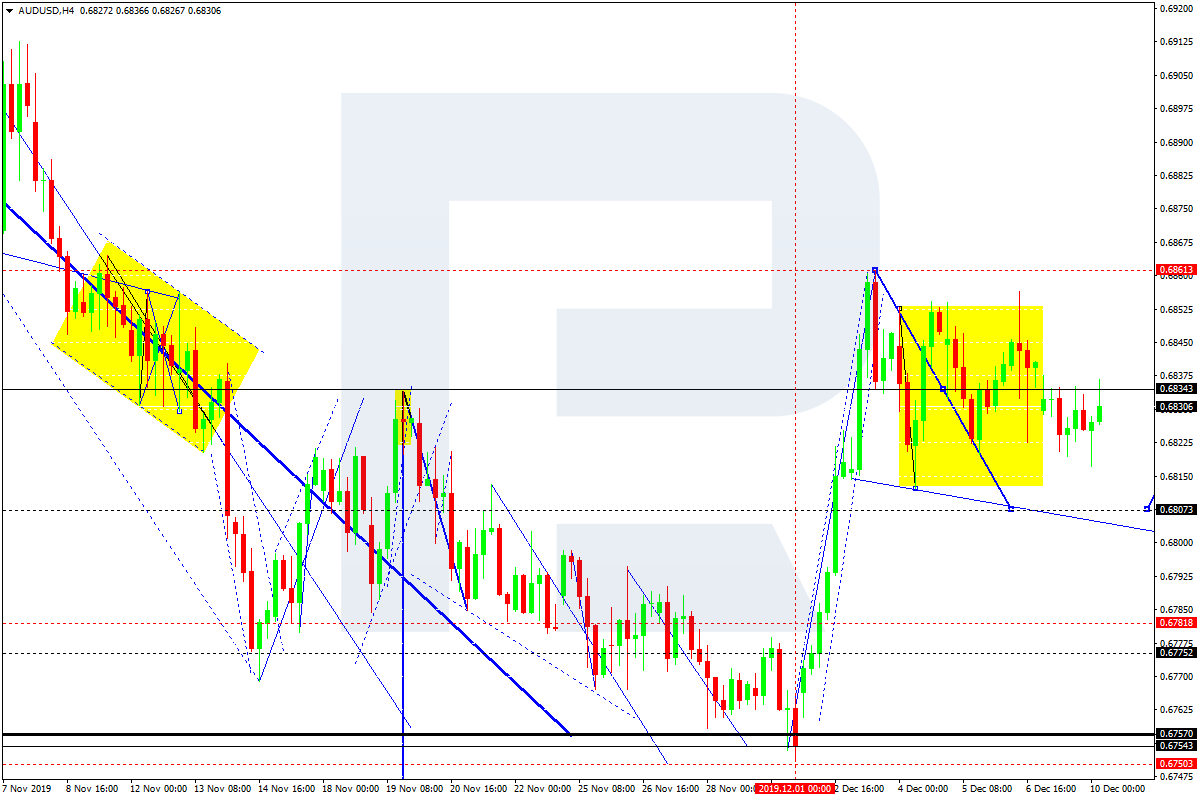

AUDUSD, “Australian Dollar vs US Dollar”

AUD/USD is correcting in the center of Flag pattern towards 0.6806. Possibly, today the pair may fall to reach this level and then start another growth towards 0.6834, thus forming a new consolidation range. If later the price breaks this range to the upside, the market may form one more ascending structure to reach 0.6860; if to the downside – resume trading inside the downtrend with the target at 0.6700.

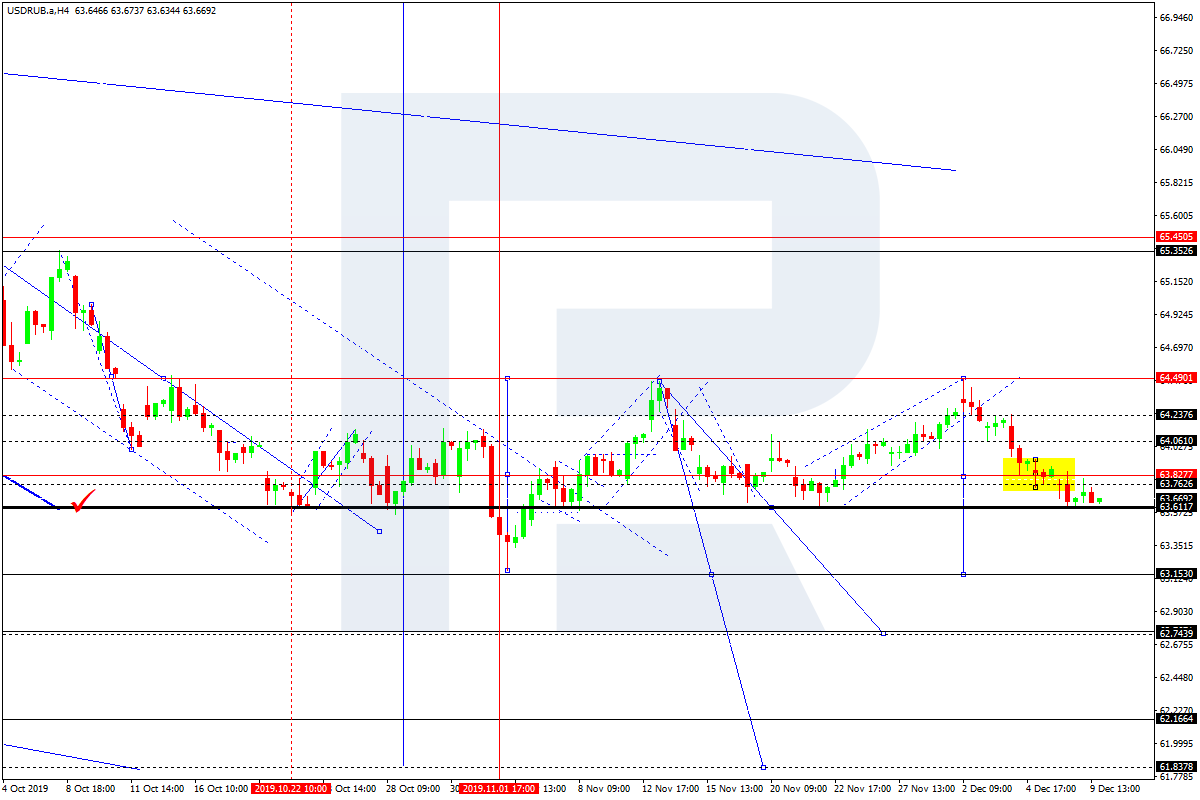

USD/RUB, “US Dollar vs Russian Ruble”

USD/RUB is consolidating above 63.61. Possibly, the pair may break this level to the downside and then continue falling with the short-term target at 63.15. After that, the instrument may grow to return to 63.61 and test it from below. Later, the market may continue trading inside the downtrend with the target at 62.74.

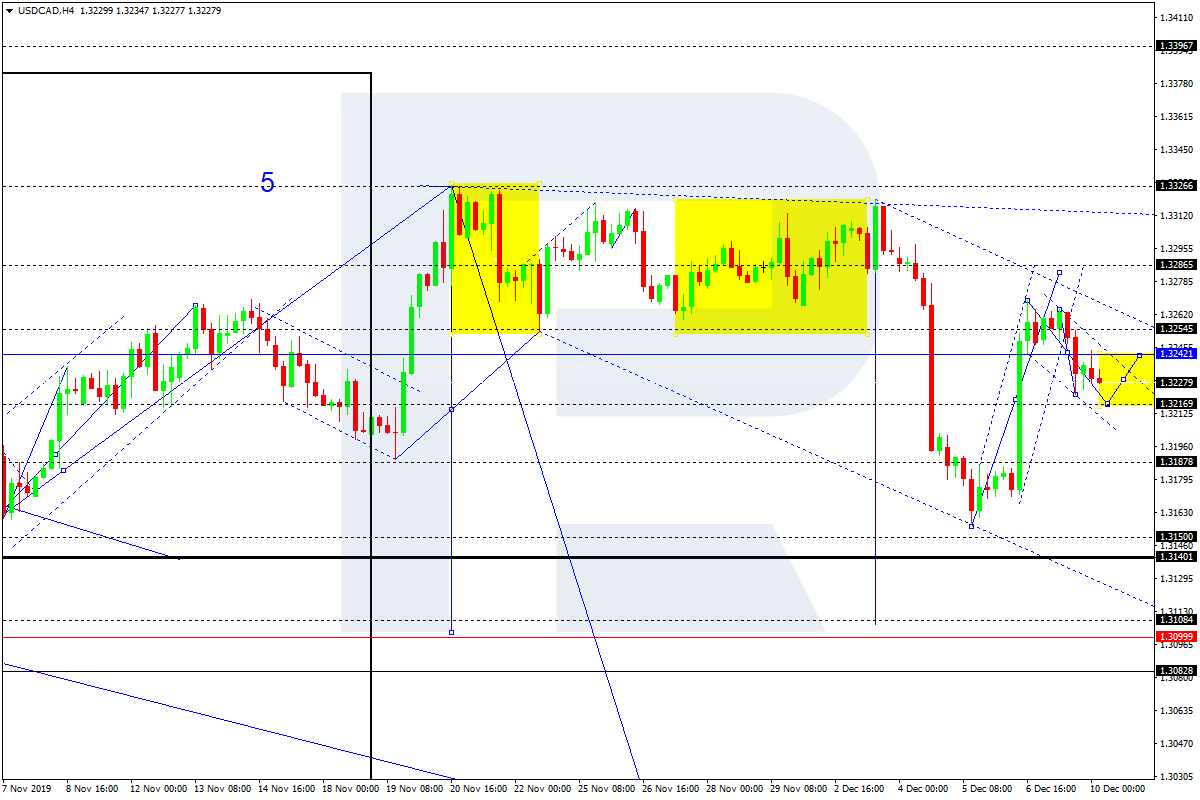

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD is moving downwards to reach 1.3217. Later, the market may form one more ascending structure towards 1.3274, thus forming a new consolidation range between these levels. If later the price breaks this range to the downside, the market may continue trading inside the downtrend towards 1.3108; if to the upside – continue the correction with the target at 1.3286.

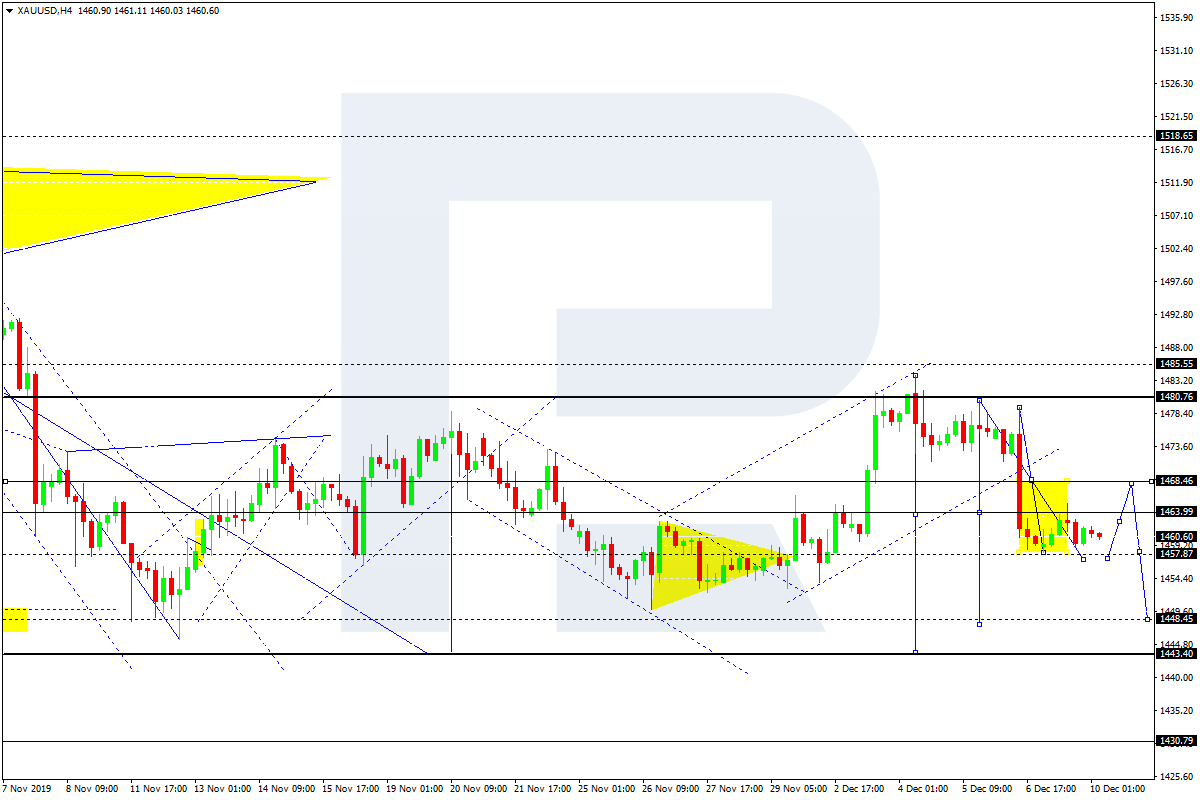

XAU/USD, “Gold vs US Dollar”

Gold is consolidating below 1464.00. Possibly, today the pair may expand the range towards 1468.46 and then form a new descending structure to reach 1457.21. Later, the market may start another correction to return to 1468.46 and then resume moving downwards with the target at 1444.00.

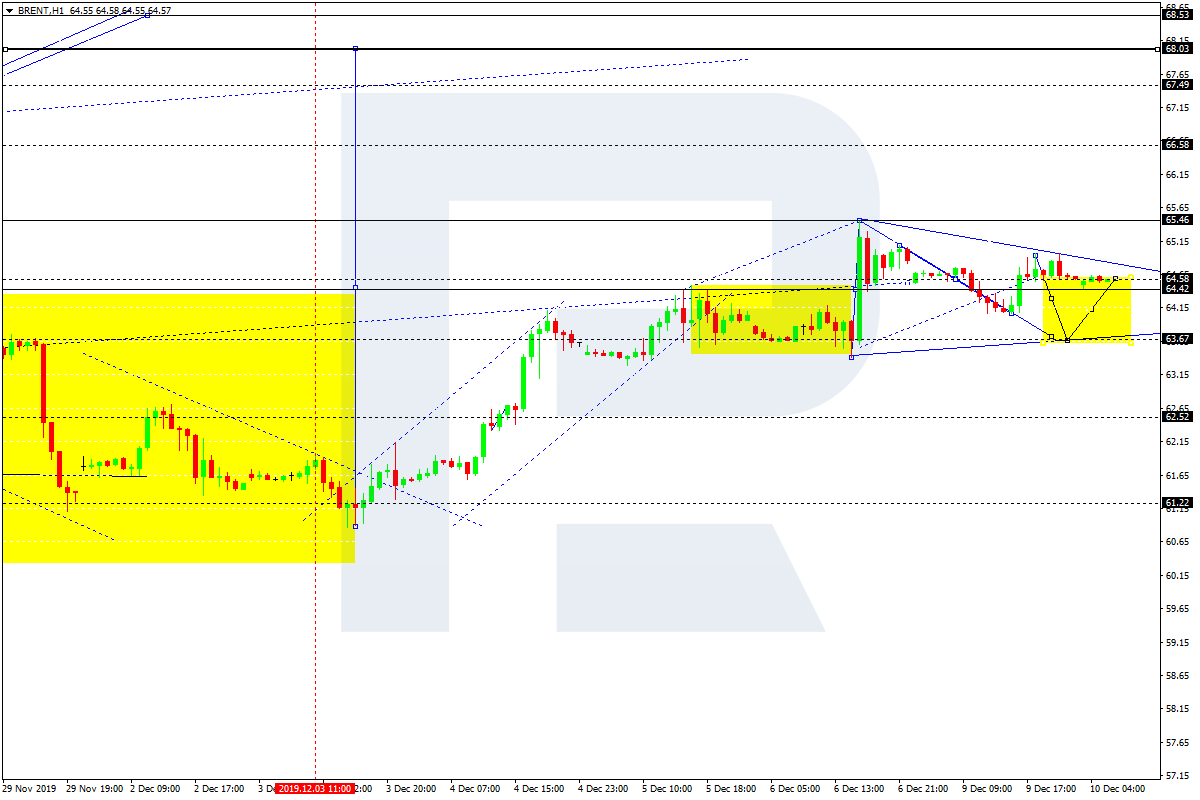

BRENT

Brent is consolidating around 64.60. Possibly, today the pair may fall towards 63.67 and then grow to reach 68.64. After that, the market may start a new decline towards 64.60. If later the price breaks this range to the upside, the market may form one more ascending structure with the short-term target at 68.00; if to the downside – start another correction to reach 62.55.

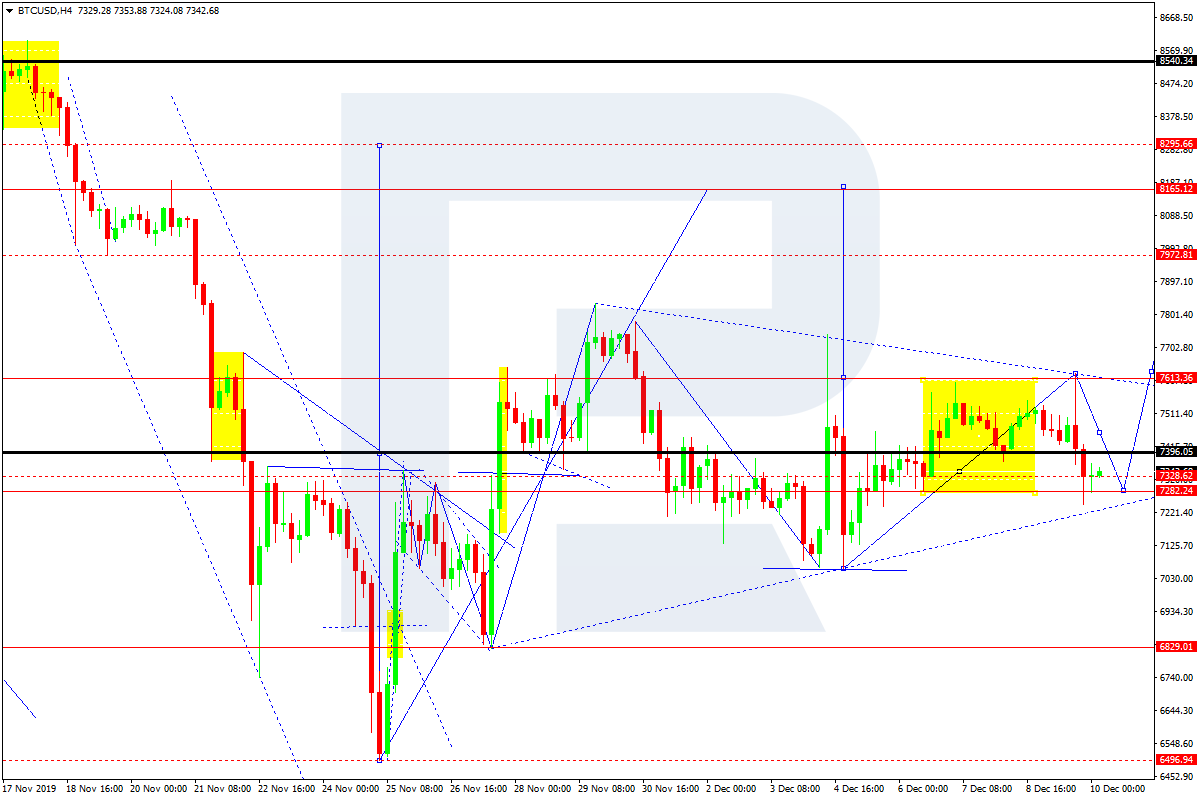

BTC/USD, “Bitcoin vs US Dollar”

BTC/USD is consolidating around 7340.00; right now, it is moving downwards. Possibly, the pair may expand the range towards 7028.00. Later, the market may resume moving upwards to break 7600.00 and then continue growing with the first target at 8165.00.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.